The Bitcoin price has stabilized around $92,000, which is a very positive sign and preserves the chances for continued growth. Ether also remains above $3,100, which keeps the prospects for a continuation of the uptrend and a return to $3,200.

Meanwhile, reports indicate that Donald Trump's company, World Liberty Financial, will begin issuing loans secured by crypto assets. This new trend, somewhat similar to classic DeFi, is becoming mainstream in 2026 and is already being implemented by the sitting US president. WLFI will use Dolomite's infrastructure for its new lending service, "WLFI Markets."

WLFI Markets is expected to operate relatively simply: users will be able to pledge their cryptocurrencies (Bitcoin, Ethereum, and other popular altcoins) as collateral and receive loans in US dollars. Interest rates and lending terms will depend on the market value of the pledged assets and the borrower's credit history. It is notable that Dolomite was chosen as the infrastructure solution, indicating WLFI's desire to secure operations. Dolomite is known for its advanced security mechanisms that protect against hacks and other cyber threats. Nevertheless, risks associated with sharp cryptocurrency price swings remain significant.

Regarding intraday strategy in the crypto market, I will continue to act on major pullbacks in Bitcoin and Ether, betting on the continuation of the long-term bullish market, which has not disappeared.

For short-term trading, the strategy and conditions are described below.

Bitcoin

Buy scenario

Scenario No. 1: I will buy Bitcoin today at an entry point around $92,300, aiming to rise to $93,200. Around $93,200, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Bitcoin can be bought from the lower boundary at $91,800 if there is no market reaction to its breakout in the opposite direction, targeting $92,300 and $93,200.

Sell scenario

Scenario No. 1: I will sell Bitcoin today at an entry point around $91,800 with a target to fall to $90,700. Around $90,700, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Bitcoin can be sold from the upper boundary at $92,300 if there is no market reaction to its breakout in the opposite direction, targeting $91,800 and $90,700.

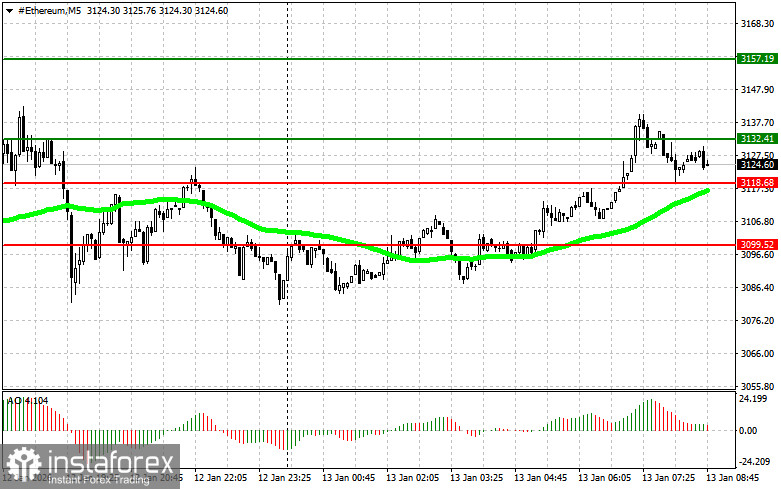

Ethereum

Buy scenario

Scenario No. 1: I will buy Ether today at an entry point around $3,132, with a target of $3,157. Around $3,157, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Ether can be bought from the lower boundary at $3,118 if there is no market reaction to its breakout in the opposite direction, targeting $3,132 and $3,157.

Sell scenario

Scenario No. 1: I will sell Ether today at an entry point around $3,118 with a target to fall to $3,099. Around $3,099, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Ether can be sold from the upper boundary at $3,132 if there is no market reaction to its breakout in the opposite direction, targeting $3,118 and $3,099.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română