The Bitcoin price reached $96,400, continuing the bull market observed since the beginning of this year. Ether also remains one step away from $3,400, which keeps the chances for a continuation of the uptrend.

Meanwhile, the crypto market is being fueled by investor and trader enthusiasm and belief in long-term bullish potential. Yesterday, it was announced that the Bank of Thailand included USDT in its monitoring program, citing it as a potential channel for gray money. According to the central bank, about 40% of transactions are conducted by foreigners who do not have the right to trade in the country. This step by the Thai central bank reflects growing global concern about the use of cryptocurrencies, especially stablecoins, for money laundering and tax evasion. The anonymity inherent in many crypto transactions makes them an attractive tool for those seeking to hide the sources of their funds or circumvent currency controls.

Tightening control over USDT by the Bank of Thailand will likely lead to stricter requirements for exchanges and other platforms that use this stablecoin. They may be required to implement more thorough customer identification (KYC) and transaction monitoring to detect suspicious activity. It is quite likely that we will see tougher regulation of the crypto industry in Thailand, with a particular focus on stablecoins, given their growing popularity and potential to destabilize financial markets.

Regarding intraday strategy in the crypto market, I will continue to act on major pullbacks in Bitcoin and Ether, betting on the continuation of the long-term bull market, which has not gone away.

For short-term trading, the strategy and conditions are described below.

Bitcoin

Buy scenarios

Scenario No. 1: I will buy Bitcoin today at an entry point around $95,200, aiming to rise to $96,200. Around $96,200, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Bitcoin can be bought from the lower boundary at $94,400 if there is no market reaction to its breakout in the opposite direction, targeting $95,200 and $96,200.

Sell scenarios

Scenario No. 1: I will sell Bitcoin today at an entry point around $94,400 with a target to fall to $93,300. Around $93,300, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Bitcoin can be sold from the upper boundary at $95,200 if there is no market reaction to its breakout in the opposite direction, targeting $94,400 and $93,300.

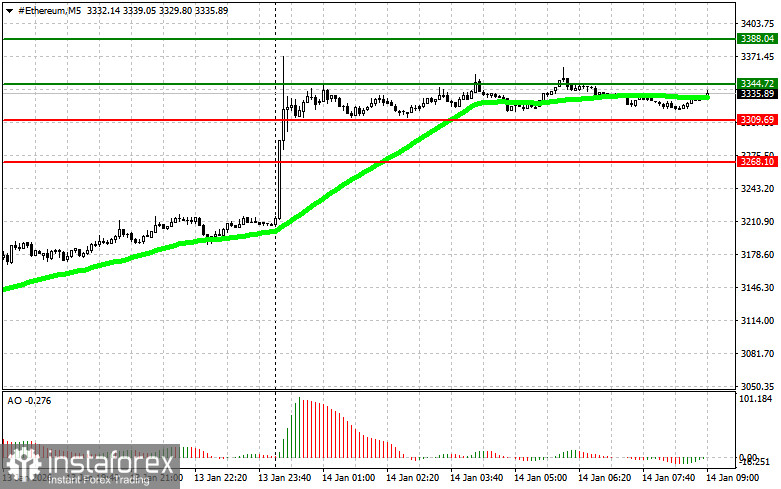

Ethereum

Buy scenarios

Scenario No. 1: I will buy Ether today at an entry point around $3,344, with a target of $3,388. Around $3,388, I will exit longs and sell immediately on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario No. 2: Ether can be bought from the lower boundary at $3,309 if there is no market reaction to its breakout in the opposite direction, targeting $3,344 and $3,388.

Sell scenarios

No. 1: I will sell Ether today at an entry point around $3,309 with a target to fall to $3,268. Around $3,268, I will exit shorts and buy immediately on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario No. 2: Ether can be sold from the upper boundary at $3,344 if there is no market reaction to its breakout in the opposite direction, targeting $3,309 and $3,268.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română