Trade analysis and trading tips for the British pound

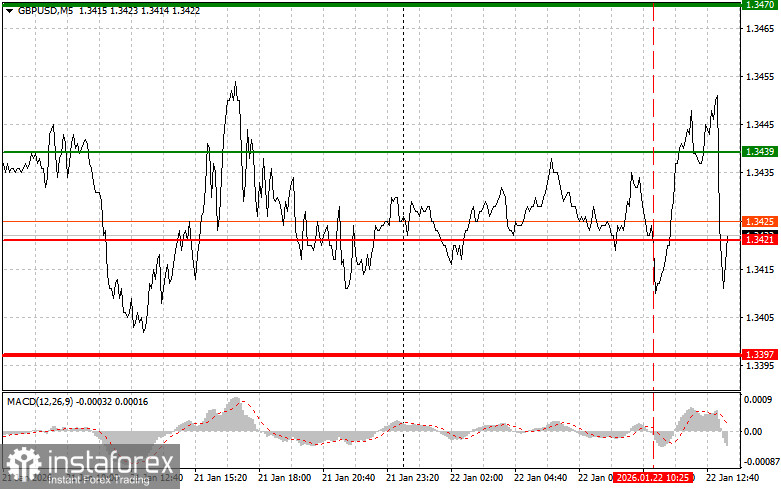

A test of the 1.3421 price level occurred at the moment when the MACD indicator was just starting to move downward from the zero line, which confirmed a correct entry point for selling the pound. As a result, the pair declined by only 10 points.

A reduction in net public sector borrowing put pressure on the pound, but it did not lead to any serious market changes. On the one hand, a decrease in the budget deficit would seem to be a positive signal, indicating a more sustainable fiscal position of the state. However, in the current situation, when economic prospects remain uncertain, such a reduction may indicate constraints on government investment, which could otherwise stimulate business activity and support employment.

In the second half of the day, the market will be influenced by data on the change in GDP for the third quarter of 2025, as well as inflation indicators from the core Personal Consumption Expenditures index. The publication of GDP data for the third quarter will be a key moment, as this will be the final assessment of the U.S. economy for this period. Market participants will pay particular attention to revised figures, seeking any signs of a slowdown in economic growth or, conversely, unexpected resilience. The Personal Consumption Expenditures index is the Federal Reserve's preferred inflation gauge. Any deviation from forecasts may trigger market volatility, as traders reassess the likelihood of changes in monetary policy. Data on personal income and spending will provide additional insight into consumer demand, which is an important driver of economic growth.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

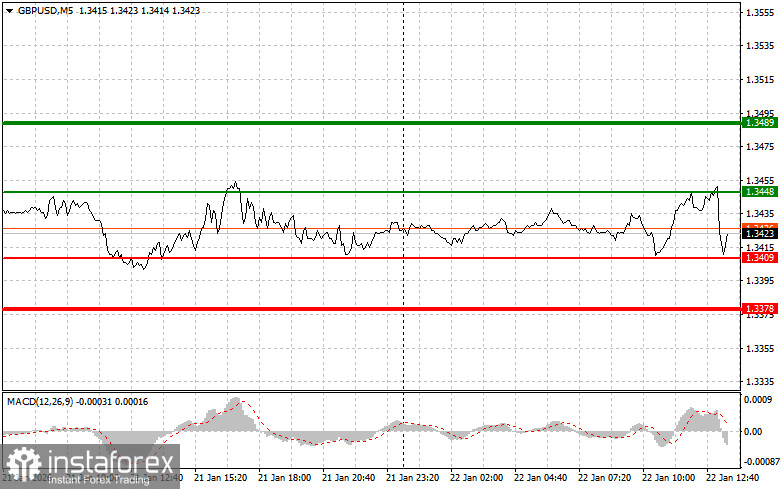

Scenario No. 1: Today, I plan to buy the pound when the price reaches the entry point around 1.3448 (green line on the chart), with a target move toward the 1.3489 level (the thicker green line on the chart). Around 1.3489, I will exit long positions and open short positions in the opposite direction (aiming for a move of 30–35 points from the level). Pound growth today can be expected only after weak economic data. Important! Before buying, make sure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3409 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.3448 and 1.3489 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after an update of the 1.3409 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 1.3378 level, where I plan to exit short positions and also immediately open long positions in the opposite direction (aiming for a move of 20–25 points from the level). Pressure on the pound will return today with strong economic data. Important! Before selling, make sure the MACD indicator is below the zero line and is just starting to fall from it.

Scenario No. 2: I also plan to sell the pound today in the event of two consecutive tests of the 1.3448 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.3409 and 1.3378 can be expected.

What's on the Chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price level where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price level where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should make market entry decisions very cautiously. Ahead of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română