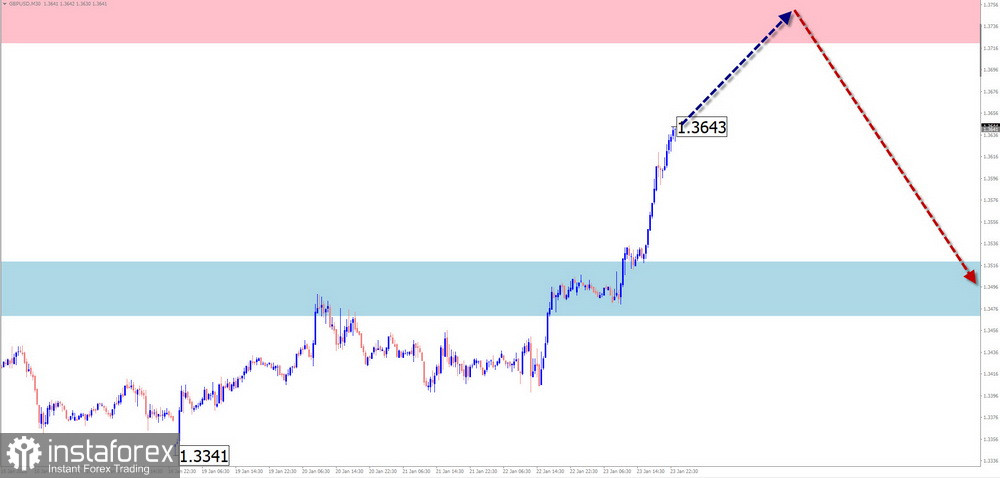

GBP/USD

Analysis:

On the British currency chart, the trend direction since the beginning of last year has been defined by an upward wave algorithm. The unfinished segment of the main trend has been counting from early November. As of now, its structure has not been completed. Price is approaching the lower boundary of a wide, large-scale potential reversal zone.

Forecast:

Over the coming days, a continuation of the upward price movement of the British pound is expected. After that, a sideways (flat) bias along the boundaries of the calculated resistance zone is likely. Closer to the weekend, a reversal and a return to a bearish trend can be expected. A decline is possible down to the support zone.

Potential Reversal Zones

Resistance:

- 1.3730 / 1.3780

Support:

- 1.3520 / 1.3470

Recommendations:

Buy: May be used for trading within individual sessions with a reduced volume size. Upward potential is limited.

Sell: Will become possible after confirmed signals from your trading systems appear near the resistance area.

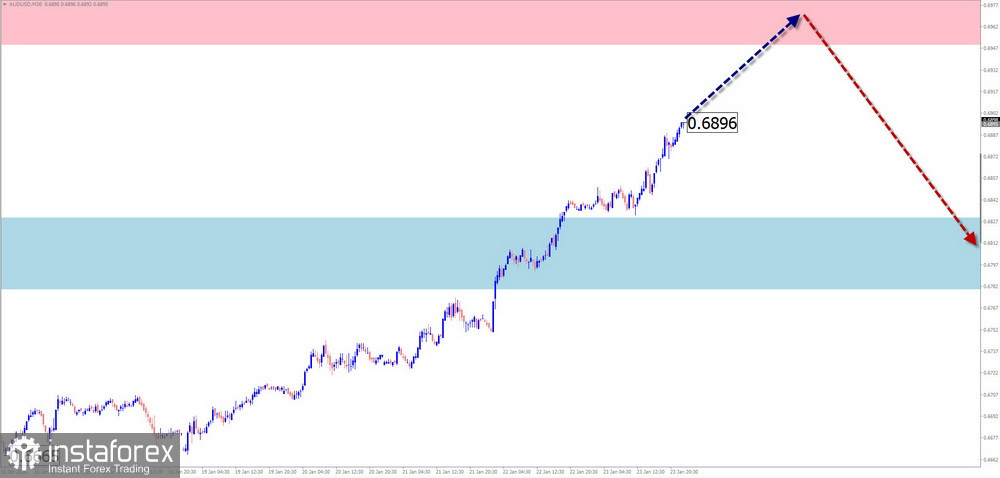

AUD/USD

Analysis:

Daily price fluctuations of the Australian dollar major pair since April of last year have been governed by an as-yet-unfinished bullish wave algorithm. Last week, quotes reached the boundaries of a strong potential reversal zone. The wave structure is not complete at the time of analysis.

Forecast:

In the coming days, continuation of the overall bullish price sentiment is expected in this pair. In the second half of the week, the probability of a pause and the formation of conditions for a reversal increases. If the direction changes, a short-term break above the upper resistance boundary cannot be ruled out.

Potential Reversal Zones

Resistance:

- 0.6950 / 0.7000

Support:

- 0.6830 / 0.6780

Recommendations:

Buy: Short-term, small-volume intraday trades are possible.

Sell: May be used only after confirmed reversal signals appear in the resistance zone.

USD/CHF

Analysis:

On the Swiss franc major pair chart, since the summer of last year, the direction of short-term price fluctuations has been defined by a bullish wave algorithm. A corrective segment (B) in the form of a shifting flat is developing within the structure. In recent weeks, quotes have reached the upper boundary of a strong potential reversal zone on a higher time frame.

Forecast:

During the upcoming week, completion of the decline and a transition of price fluctuations into a sideways range are expected. A change in direction and the start of an upward move are more likely in the second half of the week. The price channel is limited by the nearest opposing zones.

Potential Reversal Zones

Resistance:

- 0.7910 / 0.7960

Support:

- 0.7750 / 0.7700

Recommendations:

Sell: Have limited potential.

Buy: Will become relevant after appropriate reversal signals appear near the support area on your trading systems.

EUR/JPY

Analysis:

The dominant direction of the EUR/JPY pair since the end of February last year has been defined by an upward wave algorithm. Since October, the pair has been trading within the boundaries of a large time frame potential reversal zone. Over the past month, quotes have mostly formed a counter-corrective move in a horizontal direction. The structure of this wave is close to completion.

Forecast:

In the coming days, predominantly sideways, range-bound price behavior is expected. A downward vector is more likely, with quotes declining toward the support area. Closer to the weekend, increased volatility, a reversal, and a resumption of upward movement should be expected.

Potential Reversal Zones

Resistance:

- 187.50 / 188.00

Support:

- 183.10 / 182.60

Recommendations:

Buy: Will become possible after appropriate signals appear near the support area.

Sell: May be used with a reduced volume size. Downward potential is limited by support.

EUR/GBP

Brief Analysis:

The downward potential of the descending wave that began in April of last year on the EUR/GBP pair exceeds the correction level of the final segment of the previous trend, suggesting a full correction of the entire last wave of the dominant trend. The structure of this wave has formed a clearly defined expanded flat. Calculated support runs along the lower boundary of the higher time frame potential reversal zone.

Weekly Forecast:

In the upcoming week, there is a fairly high probability that the bearish price bias will be completed. After a possible rebound toward the resistance zone in the first days of the week, a resumption of the cross's decline can be expected, potentially down to contact with the calculated support boundaries.

Potential Reversal Zones

Resistance:

- 0.8730 / 0.8780

Support:

- 0.8620 / 0.8570

Recommendations:

Buy: Will become possible only after appropriate signals appear near the support area.

Sell: May be used with a fractional volume size within individual trading sessions.

Explanations:

In simplified wave analysis (SWA), all waves consist of three parts (A–B–C). In each time frame, the last unfinished wave is analyzed. Expected movements are shown with dashed lines.

Attention:

The wave algorithm does not take into account the duration of price movements over time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română