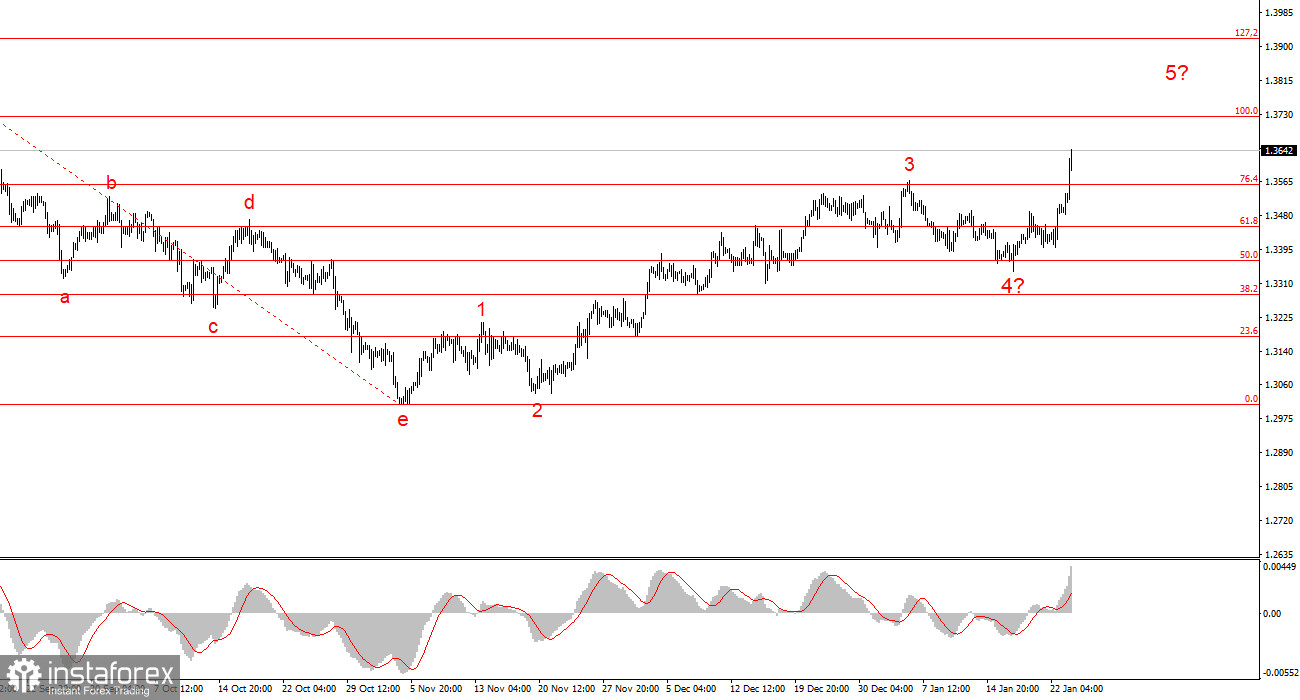

The British pound is in a similar situation to the euro. The GBP/USD instrument is also continuing to form an upward segment of the trend, but the latest wave structure is impulsive, rather than corrective, as is the case with the euro. However, on a larger scale, this is still an upward trend. If the first wave of the future global wave 5 takes on an impulsive form, it is likely that other sub-waves will form as well. I currently assume that the entire wave 5 will take on a quite extended form. If this assumption is correct, we can expect new prolonged strengthening of the British currency and a corresponding decline in the American dollar.

The British news background next week will have no impact on the currency market. There are no interesting reports or speeches from the Bank of England in the calendar. Therefore, my readers will again have to pay attention to Donald Trump, his actions, decisions, and statements. Given how Trump started 2026 (without long delays or procrastinations), there is no doubt that the flow of information will continue to pour from the White House.

In my view, virtually any message from Trump or his aides poses a potential threat to the U.S. dollar. This week, the market has shown that it is now viewing nearly every Trump decision with aggression; it is hardly reacting to positive news from the U.S. (such as strong GDP) and is venting its frustration on the American currency. In simple terms, the market is tired of President Trump's constantly shifting moods. The market wants stability, a clear political path for the U.S., independence of the Federal Reserve, and a final ruling from the Supreme Court on tariffs. None of this is currently available. As a result, market participants are anxious, worrying that tomorrow Trump might conduct a military intervention in Colombia or Cuba, consider Spain or Portugal as "territories of significant importance to U.S. security," or impose new tariffs.

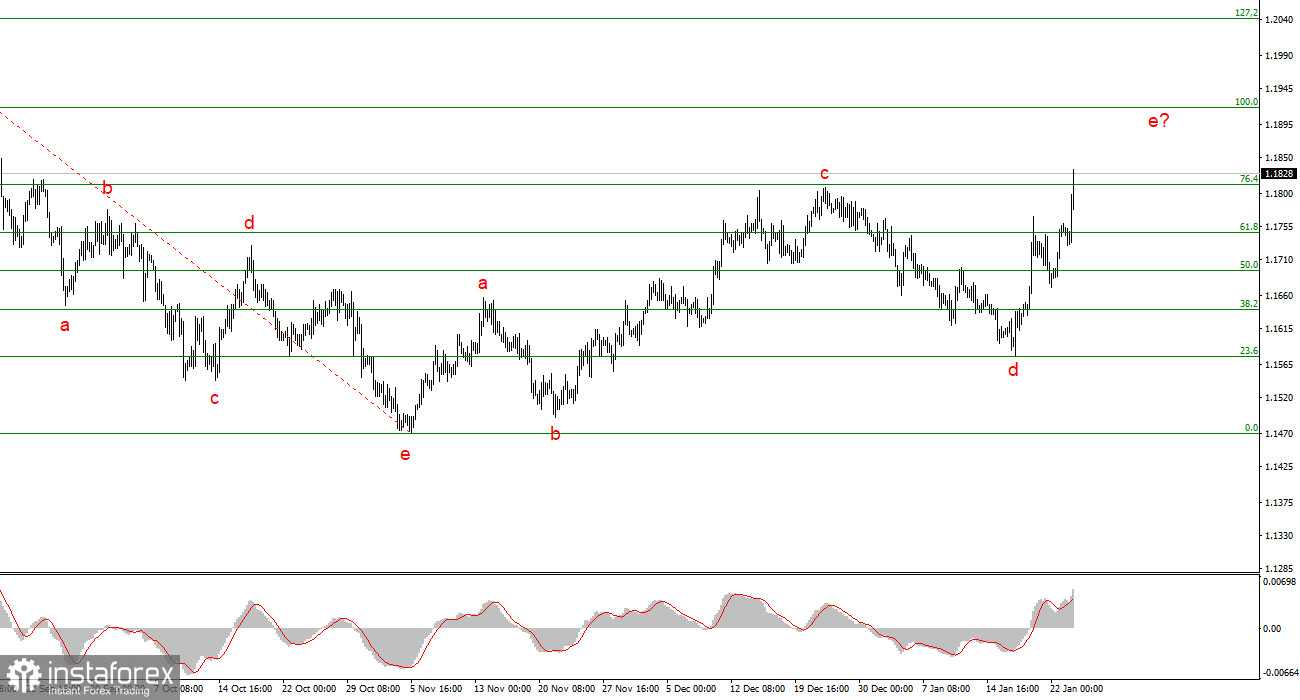

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Trump's policies and the Fed's monetary policy remain significant factors in the long-term decline of the American currency. The targets for the current trend segment may extend to the 25-figure mark. At this moment, I believe corrective wave 4 has completed its formation, so I expect further price increases, with the first target around 1.1918.

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has become clearer. The presumed wave 5 in 5 is currently being formed; however, the internal wave structure of the global wave 5 may take on a much more extended form. I believe the price rise will continue soon, with targets around 1.3721 and 1.3913, corresponding to the 100.0% and 127.2% Fibonacci. After completing the current five-wave pattern, the instrument may form three corrective waves. But for now, the upward segment is not yet complete, and after the correction, I expect a new impulsive wave segment in the direction of the 42 figure.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, and they often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% confidence in the direction of movement, and there never can be. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română