The AUD/JPY exchange rate has been declining from the 109.00 level observed in July 2024, which was reached again on Friday.

The Japanese yen sharply strengthened against all currencies following the Japanese Ministry of Finance's statement about the need to "consider a review of interest rates," which seemingly signals the government's preparation for possible currency intervention. The yen's appreciation triggered profit-taking after the cross rose about 375 pips over the past week.

The sharp yen strengthening is primarily news-driven and linked to the Japanese Ministry of Finance's call for a review of interest rates, which the market interpreted as a signal of possible preparations for currency intervention. This factor provoked an expanded reevaluation of short positions on the yen and led to a local correction in the AUD/JPY pair.

Meanwhile, the political backdrop in Japan does not allow the yen to fully develop a sustainable rally. The first female Prime Minister, Sanae Takaichi, dissolved Parliament and called for early elections on February 8, and the Liberal Democratic Party is expected to maintain a dominant majority in the lower house, paving the way for new fiscal stimulus measures.

Investors reacted cautiously to Takaichi's initiative for a temporary two-year reduction of the 8% consumption tax on food, which triggered a sell-off in government bonds. Pressure on the debt market partially offsets the effect of the Bank of Japan's more hawkish rhetoric and limits the potential for further strengthening of the yen, thus providing hidden support for the AUD/JPY cross and narrowing the space for deeper declines.

As expected, the Bank of Japan kept the short-term interest rate unchanged while also improving growth and inflation forecasts for the 2026 fiscal year. At the press conference, the head of the Bank of Japan, Kazuo Ueda, emphasized that core inflation is expected to continue rising moderately and confirmed readiness for further policy tightening if the fundamental economic scenario is realized.

The Australian dollar, in turn, remains a relatively strong player amid increasing expectations of a rate hike by the Reserve Bank of Australia as early as next month. A strong jobs report released on Thursday further supports the Australian dollar, which in turn warrants caution before confirming that the AUD/JPY pair has reached a peak and opening bearish positions.

From a technical perspective, the pair found good support at the level of 107.20, just before the round level of 107.00. If prices do not hold these levels, the next stop on the downside will be at the nine-day EMA around 106.70, on the way to the round level of 106.00.

To retest the round level of 109.00, the pair will need to overcome resistance at 108.35.

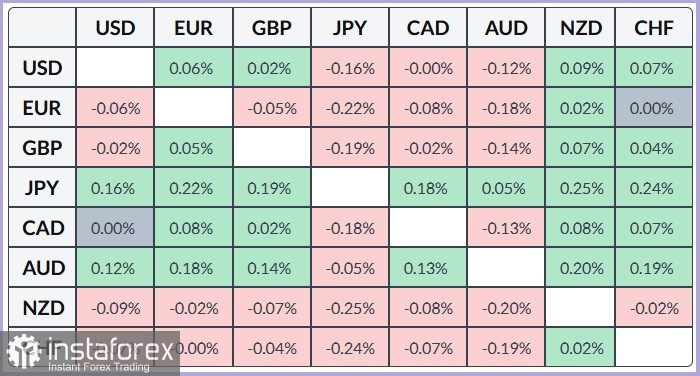

Nevertheless, oscillators on the daily chart are positive and have exited the overbought area, supporting the bulls. The table below reflects the dynamics of the Japanese yen against key global currencies for Friday: the maximum strengthening of the yen was recorded in the pair with the New Zealand dollar, where the yen demonstrated the largest daily gain.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română