Bitcoin has almost reached $89,000, and Ethereum has come close to the $3,000 mark, but that's about it. There are currently no serious bullish sentiments in the cryptocurrency market.

Yesterday, news broke that the hearing on amendments and voting for the large-scale cryptocurrency legislation, CLARITY, was postponed once again due to a snowstorm in Washington. The Senate Agriculture Committee was initially scheduled to meet on Tuesday, but the committee has now moved the meeting to Thursday.

It is noteworthy that the scheduled hearings will be the first time the Senate will begin discussing amendments and voting on cryptocurrency legislation, following setbacks in the parallel process in the Senate Banking Committee, which had to postpone its hearings. The Agriculture Committee has jurisdiction over the Commodity Futures Trading Commission (CFTC), while the Banking Committee oversees the Securities and Exchange Commission (SEC)—two agencies that play a central role in regulating cryptocurrencies.

Last week, the Senate Agriculture Committee, led by Republicans, published the text of its bill, but it did not receive support from Democrats. CLARITY remains the primary driver that could bring back bullish sentiment to the market, so we do not expect a strong recovery in the cryptocurrency market in the near future.

Regarding intraday trading strategies in the cryptocurrency market, I will continue to act based on any significant pullbacks in Bitcoin and Ethereum in anticipation of a continued development of a bullish market in the long term, which has not disappeared.

As for short-term trading, the strategy and conditions are described below.

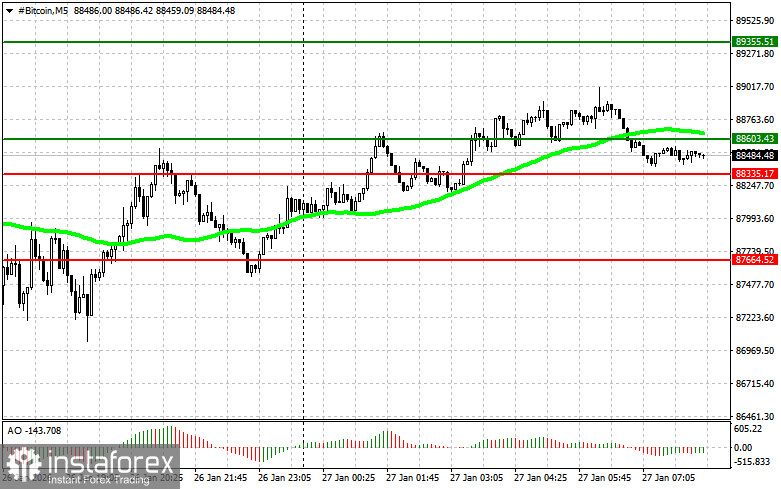

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching the entry point around $88,600, targeting a move to $89,300. Around $89,300, I will exit my purchases and sell immediately on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin can be considered from the lower boundary of $88,300 if there is no market reaction to its breakout in the opposite direction towards the levels of $88,600 and $89,300.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching the entry point around $88,300, targeting a drop to $87,600. Around $87,600, I will exit my sales and buy immediately on a bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin can be considered from the upper boundary of $88,600 if there is no market reaction to its breakout in the opposite direction towards the levels of $88,300 and $87,600.

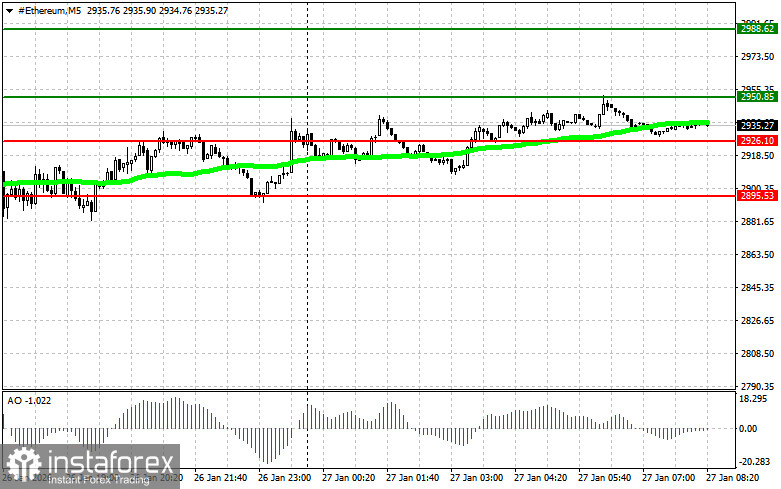

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching the entry point around $2,950, targeting a move to $2,988. Around $2,988, I will exit my purchases and sell immediately on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum can be considered from the lower boundary of $2,926 if there is no market reaction to its breakout in the opposite direction towards the levels of $2,950 and $2,988.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching the entry point around $2,926, targeting a drop to $2,895. Around $2,895, I will exit my sales and buy immediately on a bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum can be considered from the upper boundary of $2,950 if there is no market reaction to its breakout in the opposite direction towards the levels of $2,926 and $2,895.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română