Bitcoin has successfully recovered and is currently trading at $89,300, while Ethereum has surpassed the $3,000 mark and is trying to hold that level.

Bitcoin's recent rise is driven by increasing pressure on the US dollar, which is currently facing challenging times. Yesterday, the dollar index fell to its lowest level since 2022, and it seems that no one is planning to address this situation, at least for now. This has given buyers of risk assets, including Bitcoin, confidence.

Meanwhile, various forecasts suggest that Ethereum may recover to $3,300 in the near future. The market shows signs of stabilization based on options market data and on-chain metrics. Key drivers of this potential growth include increased activity on Layer 2 (L2) blockchains and rising trading volumes in the Ethereum DEX ecosystem. Growing interest in Layer 2 solutions such as Arbitrum, Optimism, and zk-Rollups indicates users' desire for faster and cheaper transactions. The decline in gas fees in these networks attracts new participants and stimulates the development of innovative DeFi applications, which, in turn, increases demand for Ethereum tokens. The rise in Total Value Locked (TVL) in L2 protocols is a compelling indicator of this trend.

However, it is essential to remember the potential risks, such as smart contract hacks and overall market volatility. Nevertheless, the current dynamics suggest that innovations in L2 solutions and DEX platforms could become key catalysts for further development and growth of the Ethereum ecosystem in the near future.

Regarding intraday strategies in the cryptocurrency market, I will continue to focus on significant pullbacks in Bitcoin and Ethereum, anticipating the ongoing development of a long-term bullish market, which has not disappeared.

As for short-term trading, the strategy and conditions are described below.

Bitcoin

Buy Scenario

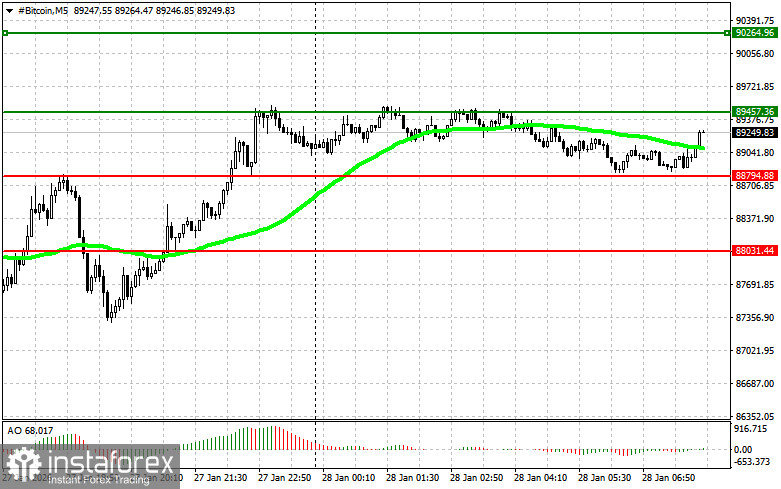

Scenario #1: I plan to buy Bitcoin today when it reaches the entry point around $89,500, targeting a rise to $90,200. At around $90,200, I'll exit my purchases and immediately sell on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin can be considered from the lower boundary of $88,800 if there is no market reaction to its breakout in the opposite direction toward levels $89,500 and $90,200.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today upon reaching the entry point around $88,800, targeting a drop to $88,000. At around $88,000, I'll exit my sales and immediately buy on a bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin can also be considered from the upper boundary of $89,500 if there is no market reaction to its breakout in the opposite direction toward levels $88,800 and $88,000.

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today when it reaches the entry point around $3,016, targeting a rise to $3,058. At around $3,058, I'll exit my purchases and immediately sell on a bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum can be considered from the lower boundary of $2,985 if there is no market reaction to its breakout in the opposite direction toward levels $3,016 and $3,058.

Sell Scenario

Scenario #1: I plan to sell Ethereum today upon reaching the entry point around $2,985, targeting a drop to $2,938. At around $2,938, I'll exit my sales and immediately buy on a bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum can also be considered from the upper boundary of $3,016 if there is no market reaction to its breakout in the opposite direction toward levels $2,985 and $2,938.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română