Monday's Trade Analysis:

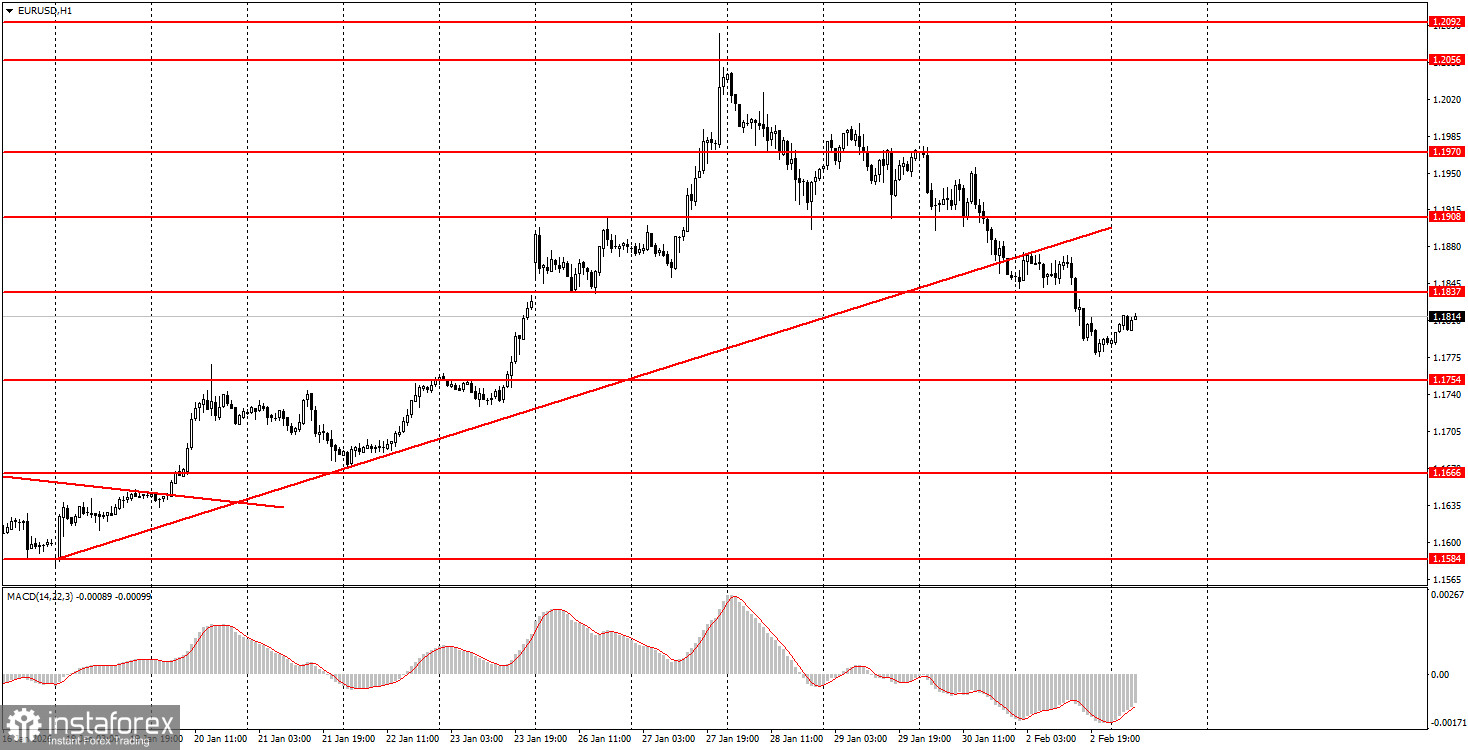

1H Chart of the EUR/USD Pair.

The EUR/USD currency pair continued its downward movement throughout Monday. We discussed the key report of the day: the ISM Manufacturing Index for the US. This index indeed triggered a new strengthening of the American currency. The index unexpectedly rose from 47.9 to 52.6, which could not go unnoticed. This is not merely about exceeding forecasts; it's about nearly 5 points of growth and moving out of the negative zone. However, it should also be acknowledged that the dollar began to rise before the index was published, with the opening of the American trading session. Technically, the pair has consolidated below the ascending trend line, indicating the short-term trend has shifted to the downside. We still believe that there is currently a downward correction within a new upward trend. Therefore, we expect the upward trend to resume. However, this week will be filled with many news events, so theoretically, the dollar's growth is also possible.

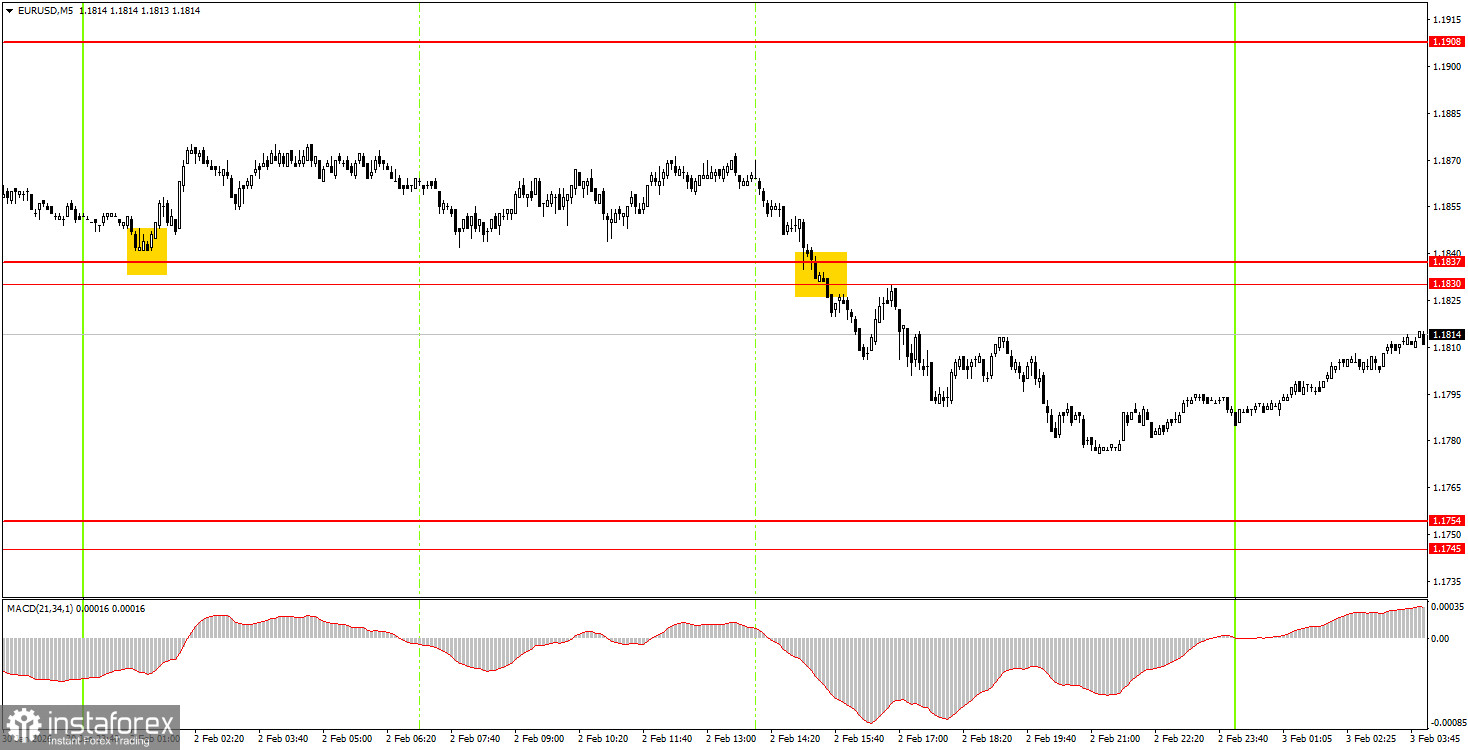

5M Chart of the EUR/USD Pair

On the 5-minute timeframe, one trading signal was formed on Monday. The price broke through the area of 1.1830-1.1837 during the American session, allowing traders to open short positions. The target area of 1.1745-1.1754 was not reached, so the trade could have only been profitable if it had been manually closed.

How to Trade on Tuesday:

The correction continues on the hourly timeframe. However, we should note that the flat movement lasting 7 months can be considered complete. If so, then the long-term upward trend has recovered, and we expect the dollar to decline in 2026. The fundamental background remains very challenging for the US currency; thus, we fully support further movement to the north.

On Tuesday, beginner traders can open new short positions if there is a rebound from the 1.1830-1.1837 area, targeting 1.1745-1.1754. A price consolidation above the 1.1830-1.1837 area will allow opening long positions with a target at 1.1908.

On the 5-minute timeframe, the following levels should be considered: 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527-1.1531, 1.1550, 1.1584-1.1591, 1.1655-1.1666, 1.1745-1.1754, 1.1830-1.1837, 1.1908, 1.1970-1.1988, 1.2044-1.2056, 1.2092-1.2104. Today, there are no important reports scheduled in Germany and the Eurozone, while in the US, the JOLTS report on job vacancies will be released. This report cannot be labeled significant, but it is part of the US labor market reports.

Main Rules of the Trading System:

- The strength of the signal is determined by the time it took to form the signal (rebound or breaking through the level). The shorter the time, the stronger the signal.

- If two or more trades were opened around a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or no signals at all. In any case, it is best to stop trading at the first signs of a flat.

- Trades are opened during the time period between the start of the European session and until the middle of the American session, after which all trades should be manually closed.

- On the hourly timeframe, signals from the MACD indicator should ideally be traded only when there is good volatility and a trend confirmed by a trend line or channel.

- If two levels are too close to each other (ranging from 5 to 20 pips), they should be considered as a support or resistance area.

- After moving 15 pips in the correct direction, it is advisable to set the Stop Loss to break-even.

What's on the Charts:

- Support and resistance levels are targets for opening buy or sell trades. Take Profit levels can be placed around them.

- Red lines indicate channels or trend lines that reflect the current trend and indicate the preferred direction for trading now.

- The MACD indicator (14,22,3) – the histogram and signal line – serves as a supplementary indicator that can also be used as a source of signals.

- Important speeches and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, trading should be conducted with maximum caution, or it is advised to exit the market to avoid a sharp price reversal against the preceding movement.

- Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and practicing sound money management are the keys to long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română