Analysis of Macroeconomic Reports:

A significant number of macroeconomic reports are scheduled for Wednesday, and some may influence the movements of the euro, pound, and dollar. We begin with the second estimates of the services sector activity indices for Germany, the UK, and the EU. These reports are secondary since the market always pays more attention to the preliminary estimates. Following that, an inflation report for January will be released in the Eurozone, which is interesting as it may show a decline to 1.7% year-on-year. If this happens, the European Central Bank will have to reconsider lowering rates, which would not be pleasant news for the euro.

In the US, the ADP report on private-sector employment changes and the ISM services activity index will be published. These are also quite important reports, especially considering that the Nonfarm Payrolls and unemployment figures may not be published on Friday. Yesterday, the JOLTs report was not released due to the "shutdown."

Analysis of Fundamental Events:

Among the key events on Wednesday is a speech by Federal Reserve representative Lisa Cook. However, we believe that this event will have no impact on the currency market. The Fed meeting took place last week, and the ECB and Bank of England meetings will occur tomorrow. All necessary and important information has either already been provided to traders or will be available shortly. The market is confident that the Fed is unlikely to pursue further monetary policy easing in the first half of this year, but much will depend on the state of the labor market. If Jerome Powell's assessments hold and the labor market continues to recover, additional easing will not be required in the near future. It is also worth noting that at any moment, Trump could order a strike on Iran, which is unlikely to go unnoticed by traders.

General Conclusions:

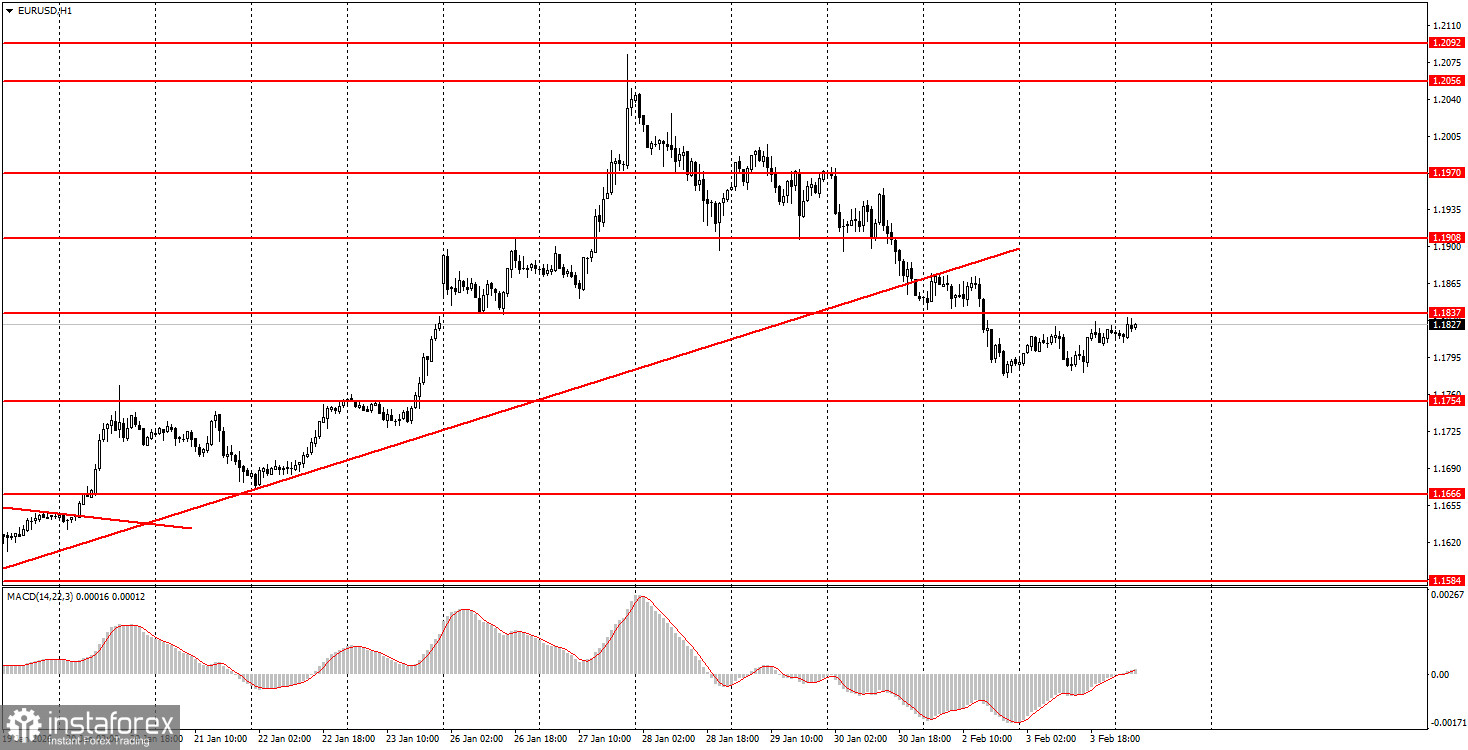

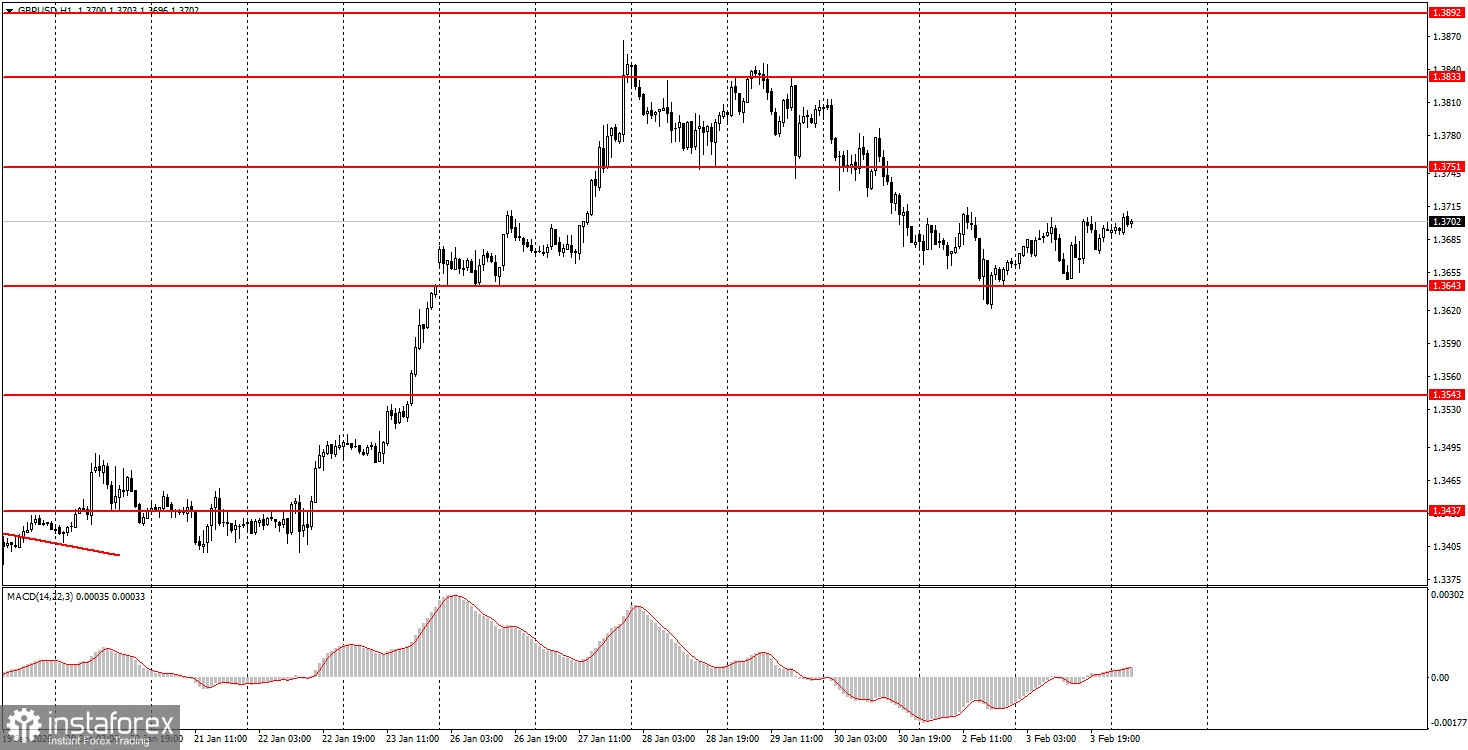

On the third trading day of the week, both currency pairs may be quite volatile due to important events scheduled for today. The euro can be traded today in the range of 1.1830-1.1837, while the British pound can be traded in the range of 1.3741-1.3751. Fundamental events could send the dollar into another knockout at any moment.

Main Rules of the Trading System:

- The strength of the signal is determined by the time it took to form the signal (rebound or breaking through the level). The shorter the time, the stronger the signal.

- If two or more trades were opened around a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or no signals at all. In any case, it is best to stop trading at the first signs of a flat.

- Trades are opened during the time period between the start of the European session and until the middle of the American session, after which all trades should be manually closed.

- On the hourly timeframe, signals from the MACD indicator should ideally be traded only when there is good volatility and a trend confirmed by a trend line or channel.

- If two levels are too close to each other (ranging from 5 to 20 pips), they should be considered as a support or resistance area.

- After moving 15-20 pips in the correct direction, it is advisable to set the Stop Loss to break-even.

What's on the Charts:

- Support and resistance levels are targets for opening buy or sell trades. Take Profit levels can be placed around them.

- Red lines indicate channels or trend lines that reflect the current trend and indicate the preferred direction for trading now.

- The MACD indicator (14,22,3) – the histogram and signal line – serves as a supplementary indicator that can also be used as a source of signals.

- Important speeches and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, trading should be conducted with maximum caution, or it is advised to exit the market to avoid a sharp price reversal against the preceding movement.

- Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and practicing sound money management are the keys to long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română