Bitcoin has plunged to around $70,000, and interestingly, no one seems to want it even at that price. Major players show no interest in the market, further pressuring the market. Ethereum has also stalled just a step away from $2,000.

In just one day, the crypto market lost $200 billion in market capitalization. Clearly, panic has gripped even the most seasoned veterans of the industry. The reasons for this plunge are multifaceted and are currently being discussed everywhere. Among the main factors is undoubtedly the increasing pressure from spot ETFs, a lack of clarity regarding regulatory risks, and the crowd effect. Many large players are starting to offload assets at a loss, which only fuels the sell-off and panic in the market. In turn, this triggers a cascading liquidation of highly leveraged positions, further exacerbating the situation.

However, despite such a significant correction, it is unlikely that we should speak of a complete collapse of the crypto market. In the long term, the potential of blockchain technology and decentralized finance remains immense. The current situation is more of a typical painful occurrence that happens every 2-3 years in the market, one that requires a reboot. It is important to remember that the crypto market has always been characterized by high volatility, and such declines are an integral part of its development. Investors should maintain composure and assess the situation on fundamental grounds rather than succumb to panic.

Regarding the intraday strategy for the cryptocurrency market, I will continue to rely on significant dips in Bitcoin and Ethereum, anticipating the ongoing development of a long-term bullish market, which is still very much alive.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

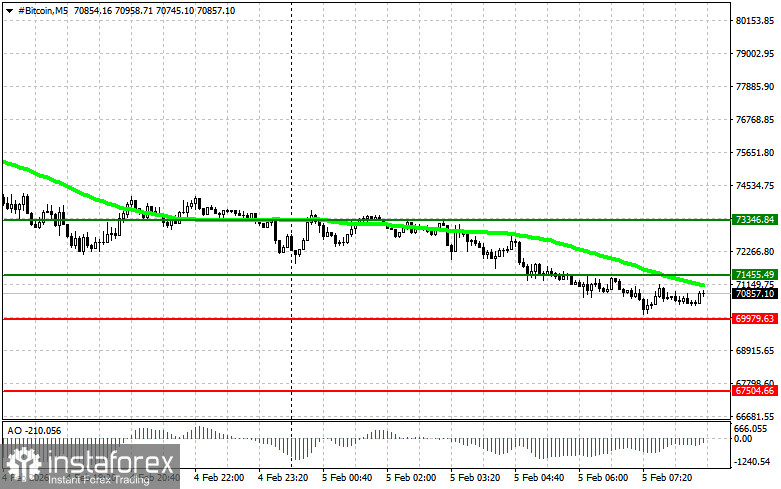

Scenario #1: I plan to buy Bitcoin today when it reaches an entry point around $71,400, with a target price of $73,300. At around $73,300, I will exit the purchases and sell immediately on the bounce. Before buying on the breakout, ensure that the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: Buying Bitcoin can also be considered at the lower boundary of $70,000, provided there is no market reaction to its breakout back towards $71,400 and $73,300.

Sell Scenario

Scenario #1: I plan to sell Bitcoin today when it reaches an entry point around $70,000, with a target drop to $67,500. At around $67,500, I will exit the sales and immediately buy on the bounce. Before selling on the breakout, ensure that the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: Selling Bitcoin can also occur at the upper boundary of $71,500 if there is no market reaction to its breakout back towards $70,000 and $67,500.

Ethereum

Buy Scenario

Scenario #1: I plan to buy Ethereum today when it reaches an entry point around $2,110, with a target price of $2,181. At around $2,181, I will exit the purchases and sell immediately on the bounce. Before buying on the breakout, ensure that the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: Buying Ethereum can also be considered from the lower boundary at $2,066, provided there is no market reaction to its breakout back towards $2,110 and $2,181.

Sell Scenario

Scenario #1: I plan to sell Ethereum today when it reaches an entry point around $2,066, with a target drop to $2,010. At around $2,010, I will exit the sales and immediately buy on the bounce. Before selling on the breakout, ensure that the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: Selling Ethereum can also occur from the upper boundary at $2,110 if there is no market reaction to its breakout back towards $2,066 and $2,010.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română