Trade Analysis and Tips for Trading the European Currency

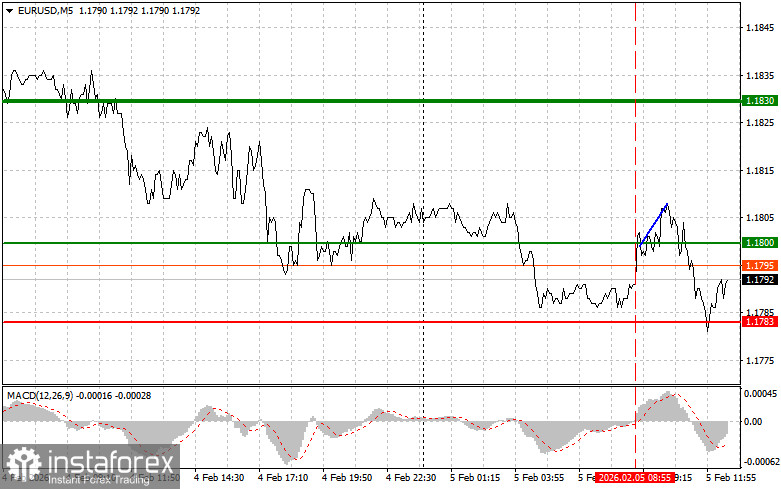

The test of the 1.1800 price level occurred at a moment when the MACD indicator was just beginning to move upward from the zero line, which confirmed a correct entry point for buying the euro. As a result, the pair rose by only 10 points.

The sharp increase in industrial orders in Germany was offset by weak data on changes in Italy's retail sales volume, which left the balance of power in the EUR/USD pair unchanged. Against the backdrop of this macroeconomic dissonance, the market continues to analyze signals coming from various sectors of the eurozone economy, attempting to forecast the European Central Bank's next steps. Expectations regarding the ECB's commitment to a stable monetary policy following today's meeting remain the key factor determining the euro's steady exchange rate.

In the second half of the day, special attention should be paid to the weekly report on initial jobless claims, as well as a speech by Raphael Bostic, a representative of the FOMC. Despite their apparent insignificance, these events may have a noticeable impact on market sentiment. The initial jobless claims report will reflect the current state of the U.S. labor market. A reading above expectations could lead to a strengthening of the dollar. Equally important is the speech by Raphael Bostic, an FOMC member. His comments on economic prospects and future Federal Reserve monetary policy may clarify the future path of interest rates. The market will closely watch for any hints of a potentially longer pause in the rate-cutting cycle, which would support the dollar.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible upon reaching the price level around 1.1806 (green line on the chart), with a growth target at the 1.1840 level. At 1.1840, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. A strong rise in the euro should be expected only after weak economic data.Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1779 price level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Growth toward the opposite levels of 1.1806 and 1.1840 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after reaching the 1.1779 level (red line on the chart). The target will be the 1.1744 level, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20–25 point move in the opposite direction from the level). Pressure on the pair will return in the event of strong economic data.Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1806 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1779 and 1.1744 can be expected.

What's on the Chart

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price at which Take Profit can be set or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price at which Take Profit can be set or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română