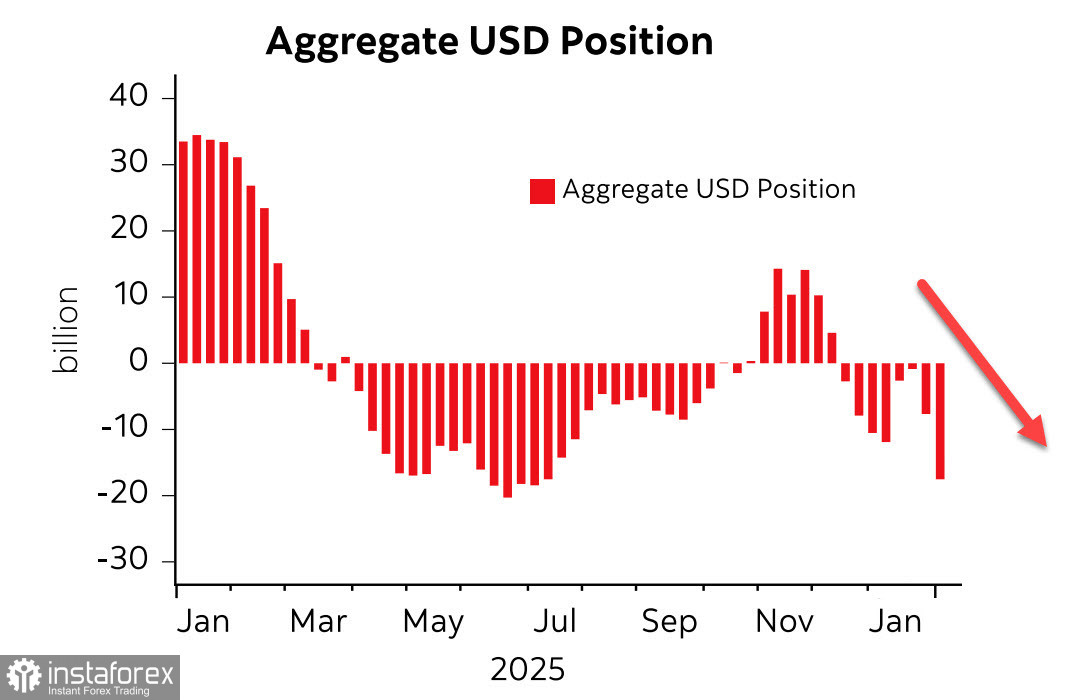

The latest CFTC report delivered an unpleasant surprise for the US dollar: the net short position on the dollar rose by $9.3 billion in the reporting week, reaching its highest level since July last year. All major currencies improved their positioning versus the dollar, led again by the euro, which gained $4.4 billion, while commodity currencies also showed solid inflows.

Speculative positioning in the dollar has turned openly bearish, and the key question now is whether we are simply witnessing another cyclical wave of market preference that will be followed by the usual rebound — or whether we are at the start of a fundamental weakening of the US dollar, signaling the end of its era of total dominance.

Kevin Warsh, the newly nominated Fed chair, may not be the Trump loyalist as some analysts assume. One of his notable quotes from November last year was: "...the Federal Reserve should reassess its serious mistakes that led to massive inflation. It should abandon the dogma that inflation arises when the economy grows too fast and workers are paid too much. Inflation arises when government spends too much and prints too much money."

In that sense, Warsh supports the reforms Trump is pursuing: the slogan "Make America Great Again" implies earning more, not creating wealth out of thin air that is then extracted from future generations.

That suggests the logic of future actions — the Fed will likely stop purchasing government bonds in the volumes previously seen. The government will attempt to cover the budget deficit by both trying to increase revenues through pro?business policies (hence Trump's pressure on the Fed to cut interest rates — to make money cheaper — and tariffs as a barrier to cheap imports to stimulate domestic production) and by cutting spending. Tightening belts is politically unspoken, but its implementation is inevitable.

The January employment report was postponed to Wednesday, February 11, and it will be the week's key event. If the labor market shows signs of recovery, the dollar may hold its current levels. But a number of other indicators point to continued deterioration in employment conditions.

The ADP report showed only 22,000 private?sector jobs created in January — well below long?term averages. ISM manufacturing employment for January was 48.1, better than December but still in contraction territory, not expansion, despite months of Trump's efforts to revive manufacturing. ISM services employment barely stayed in expansion at 50.3, worse than in December and below forecasts.

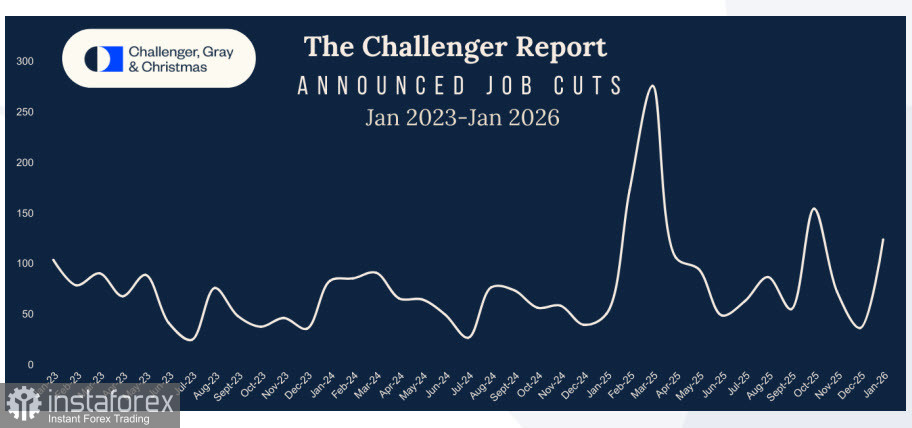

Challenger layoffs jumped sharply in January from 35,553 to 108,435, weekly initial jobless claims exceeded forecasts, and JOLTS job openings in December fell markedly instead of rising as expected.

Across every metric that reflects labor market health, the trend is degradation rather than recovery. That implies stagnation — possibly recession — and the Trump administration has so far failed to reverse the trend despite aggressive measures.

This morning's call from China for its banks to limit use of US Treasuries because of market risks adds another layer of concern and points toward further deterioration. China believes rising US budget deficits cannot be sustainably financed, which increases the risk of a sovereign stress event.

Taken together, we see no basis for the US dollar to resume a sustained rally. January's Non?Farm Payrolls could push the dollar considerably lower if they miss expectations — which is quite possible. If, improbably, NFPs surprise strongly to the upside, the market would likely respond with a wave of critical commentary accusing authorities of data manipulation — an outcome that would further undermine trust in the dollar.

Tough times lie ahead for the dollar, and the downtrend shows no signs of ending.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română