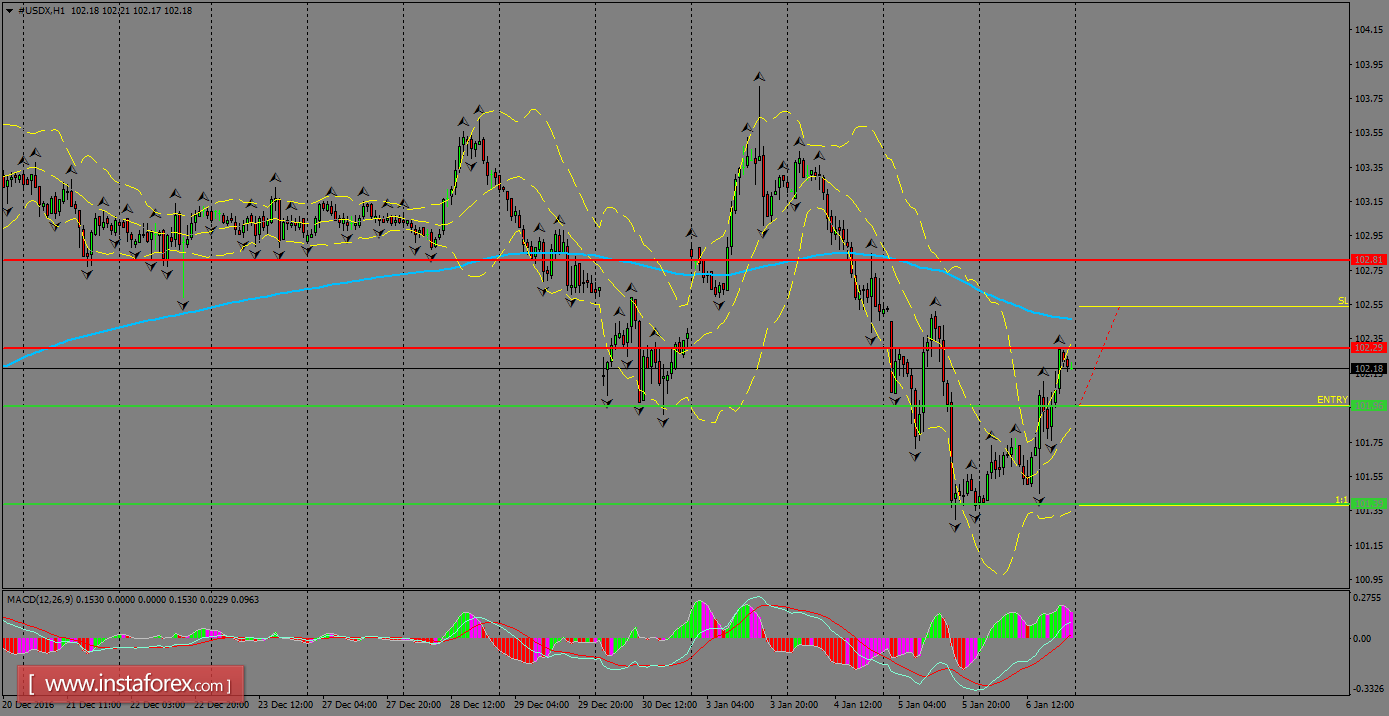

USDX recovered some lost ground during Friday's session, as the NFP numbers helped to lift the greenback, despite its below-than-expected number of jobs added in December. Currently, the index is challenging the resistance level of 102.29, which is very close to the 200 SMA zone at H1 chart and it could help to restart the overall bearish bias. If that happens, then we can expect another decline toward 101.39.

H1 chart's resistance levels: 102.29 / 102.81

H1 chart's support levels: 101.96 / 101.39

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 101.96, take profit is at 101.39 and stop loss is at 102.54.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română