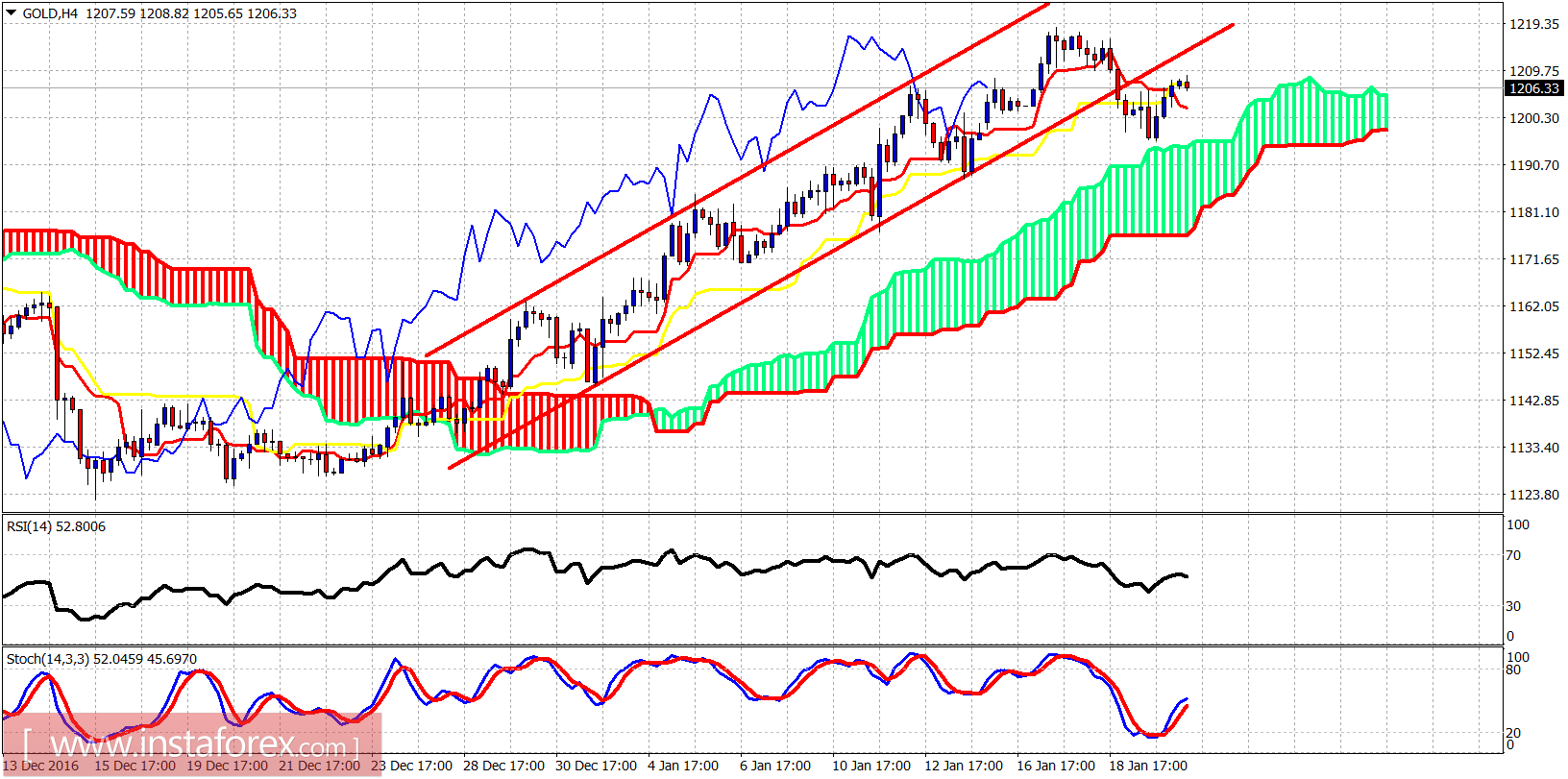

Gold price so far has made a shallow correction as low as $1,194 where prices reached the 4-hour Ichimoku cloud support and bounced back above $1,200. Gold price could see $1,210-15 today but bulls need to be very cautious as a break below $1,194 will open the way for a push towards $1,180-70.

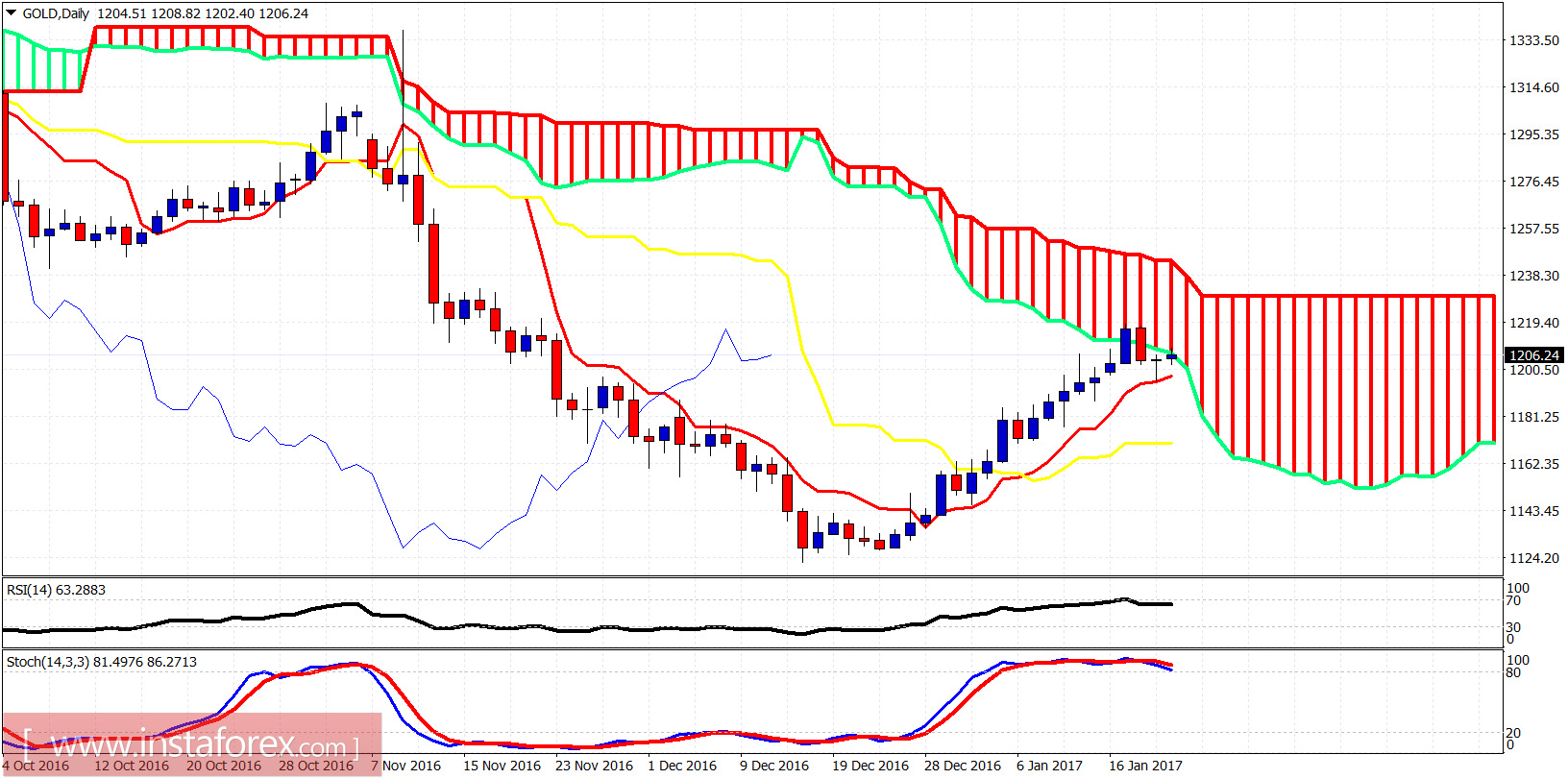

Gold price has broken out and below the bullish channel implying that Gold is in a corrective phase. This correction could push Gold price even towards $1,160 and still hold our bullish long-term scenario valid. Cloud support is at $1,194. If broken Gold price should move towards $1,180. Resistance is at $1,220.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română