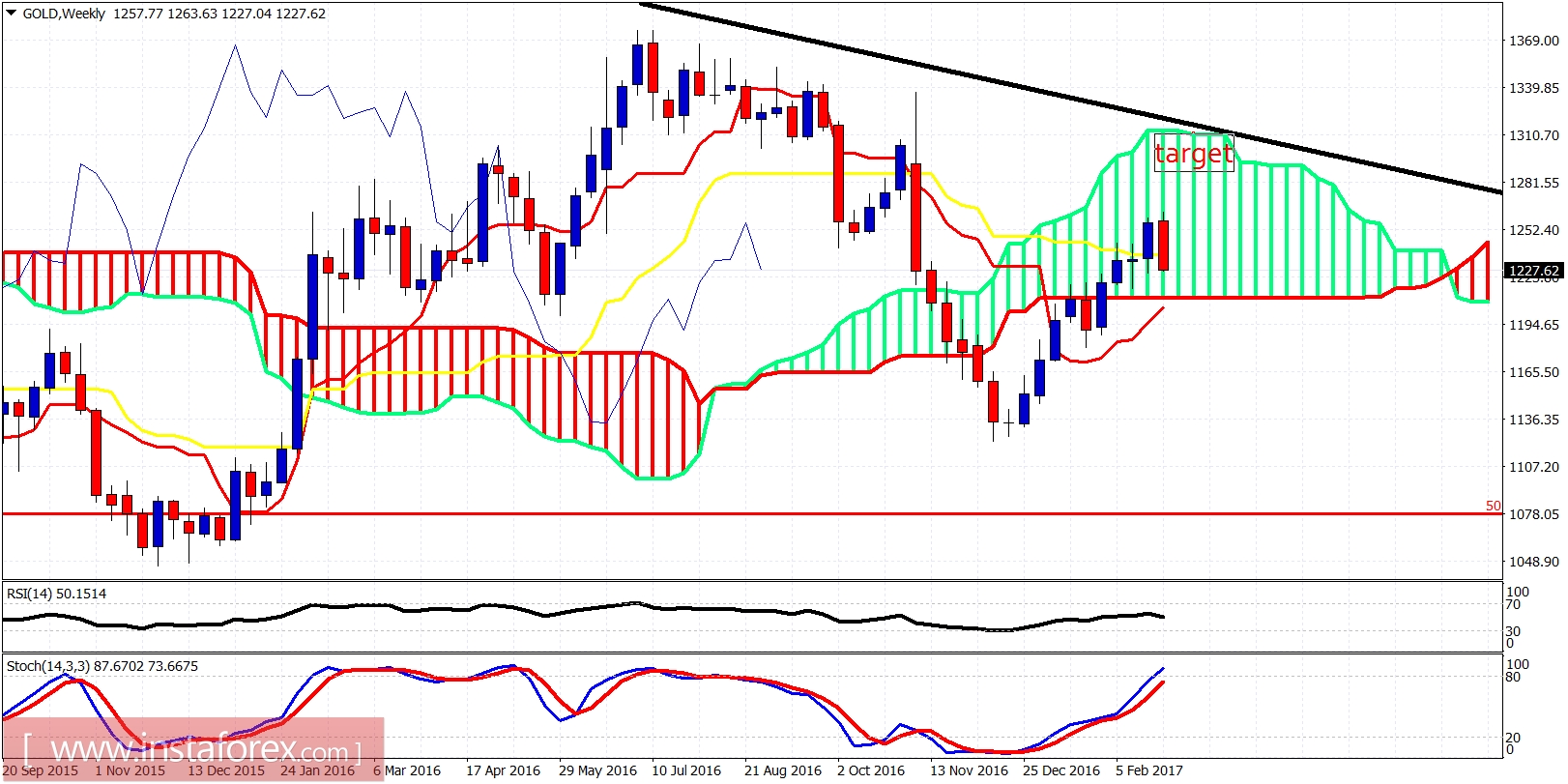

Gold weakness continues below our comfort zone and the bullish scenario is now in danger. The price should and must reverse soon to the upside. Otherwise the bullish scenario for $1,280-$1,320 will be canceled. Gold is in a bearish short-term trend and needs to retake $1,250 to change trend.

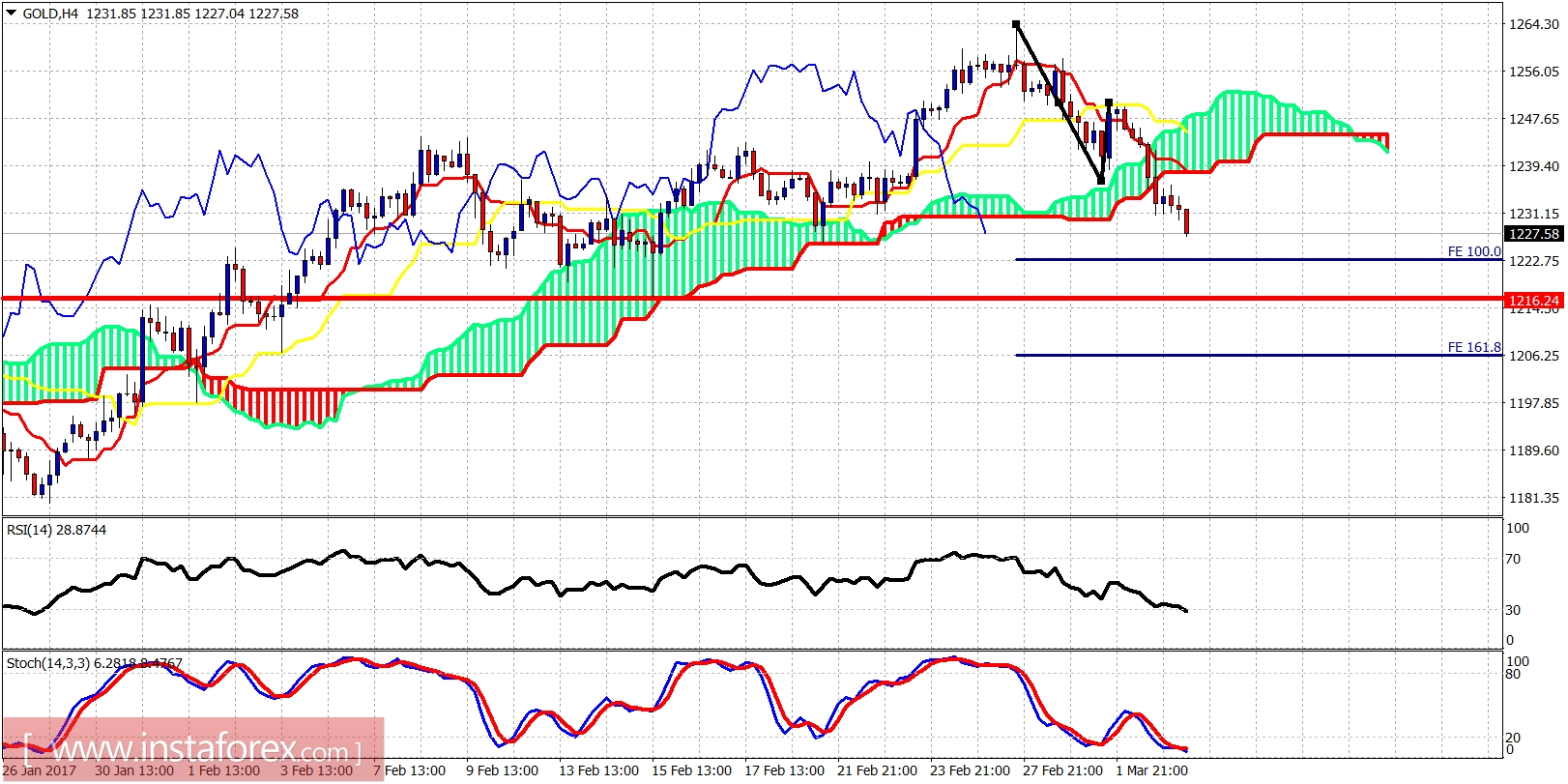

Black line - price extension targets

The price has broken below the Ichimoku cloud. Short-term trend is confirmed to be bearish. This might put in danger our medium-term bullish view for a move towards $1,280-$1,320. Gold is approaching the $1,220 target where the 2nd leg down will be equal to the first. Critical support for our bullish view is at $1,216. This level should not break. Stochastic is diverging at oversold levels. The RSI has entered oversold levels as well.

The weekly chart for Gold is implying a reversal. Although the oscillators imply more upside, the weekly candle has broken below the kijun-sen (yellow line indicator). The week is not over yet, so the bulls will need to step up today. Otherwise the bullish scenario will be in danger.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română