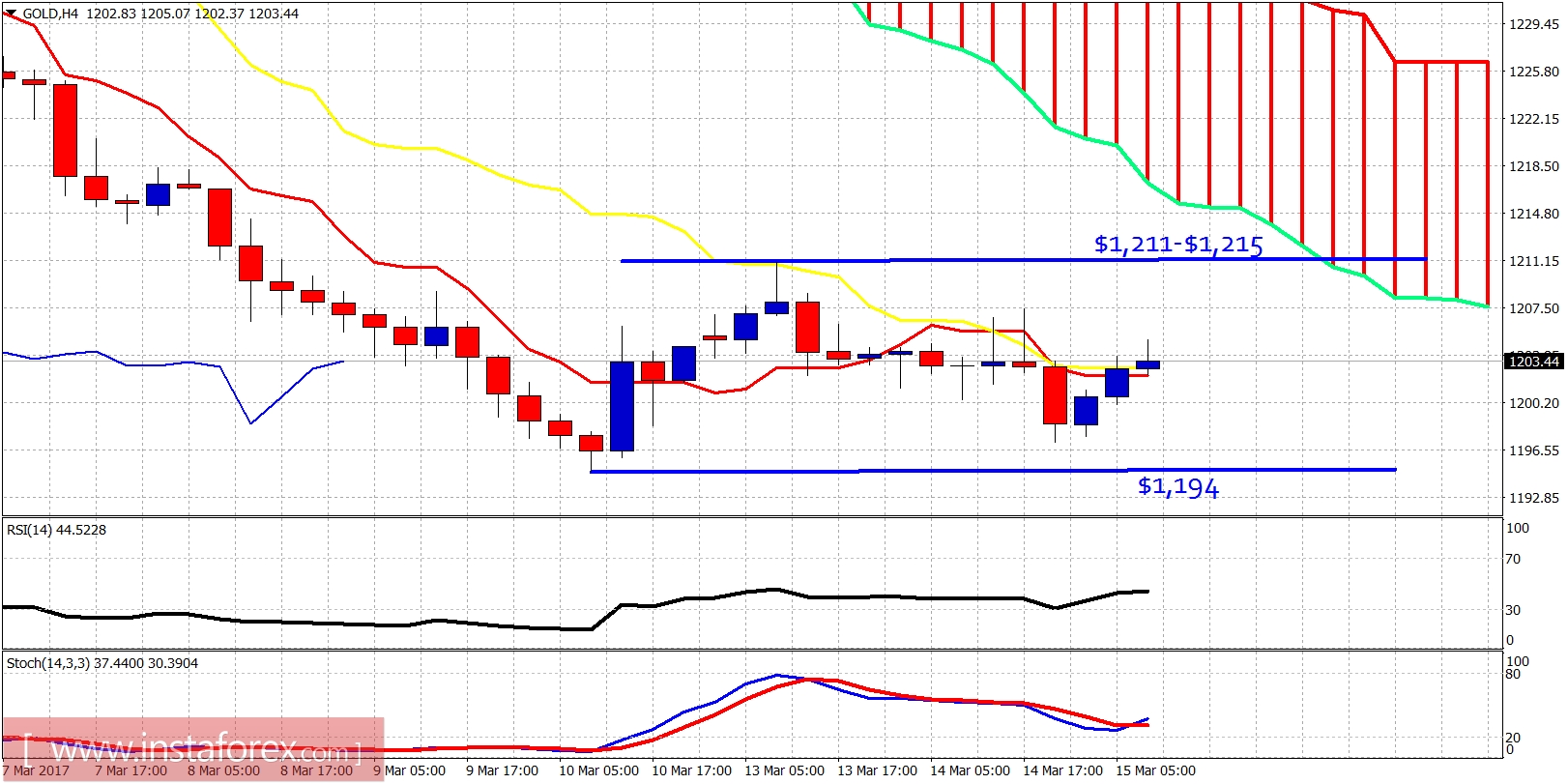

Gold is trading sideways between $1,211 and $1,194. Price has exited the bearish channel but has not made any meaningful progress to the upside. Price is expected to have increased volatility today after the conclusion of the FOMC.

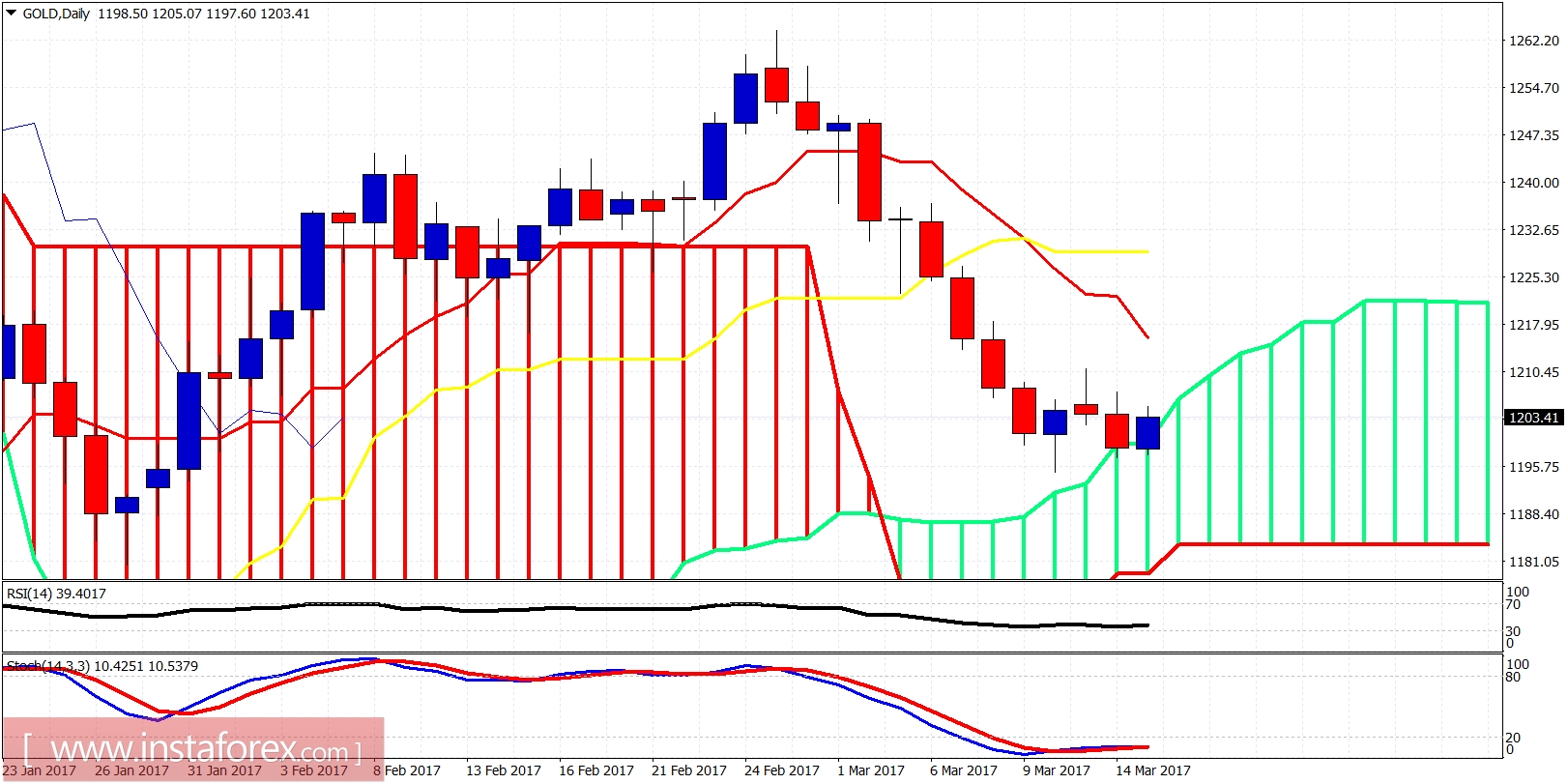

Gold price continues to trade below the Ichimoku cloud. In Ichimoku terms, trend remains bearish. However, Gold price has reached the $1,200 after rising to $1,263, and this correction could very well be over. Gold is now just waiting for the FOMC meeting tonight as a catalyst for a spike higher and reversal its short-term trend. Bulls need to break above $1,230-40 for a trend change. Bears need to break below $1,190 and remain below it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română