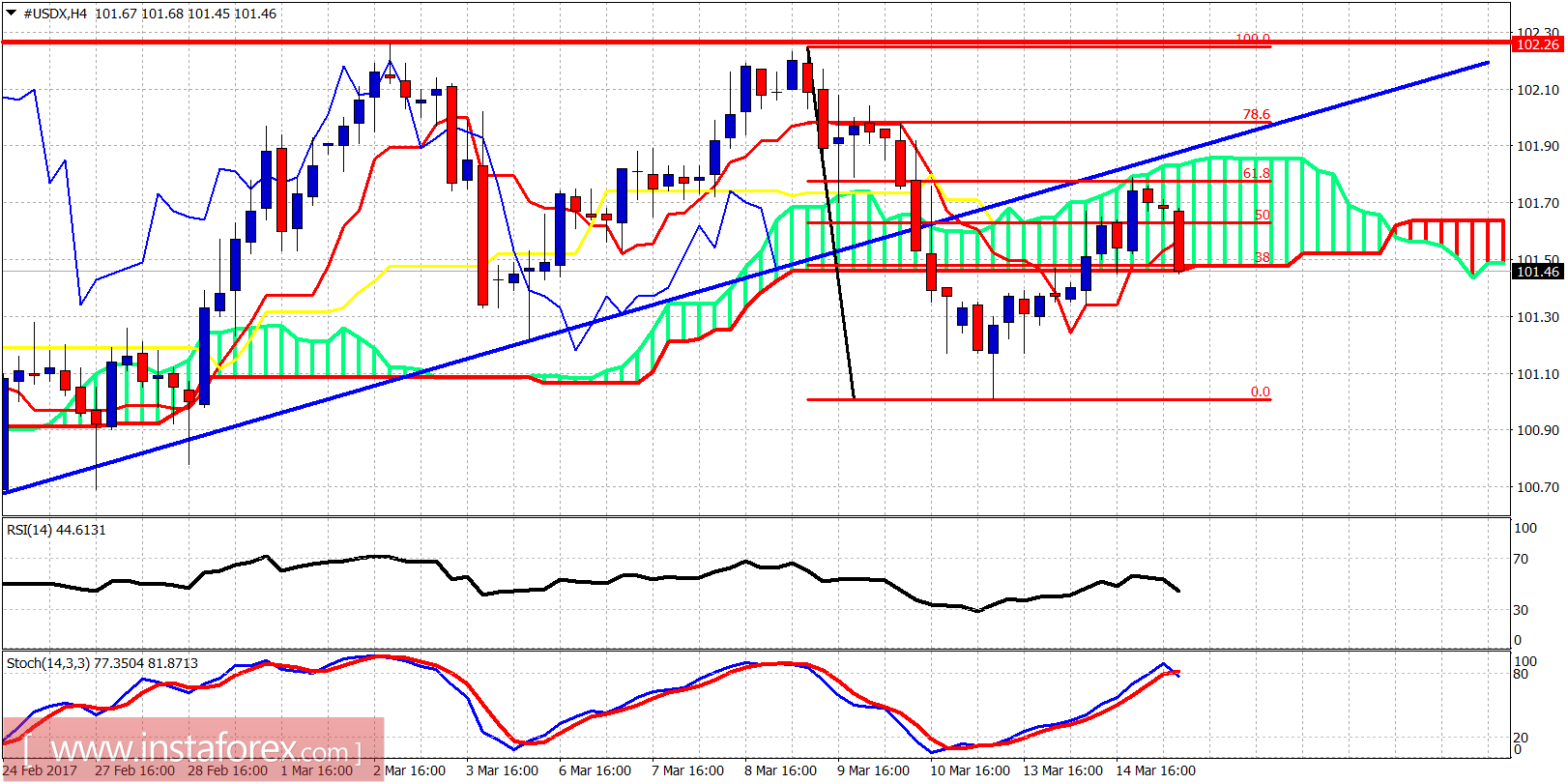

The Dollar index as expected made the back test yesterday and reversed after being rejected at 101.80. Short-term trend is bearish and volatility is expected to rise today after the FOMC announcement.

Blue line - support (broken)

The Dollar index back tested the broken blue trend line as expected and got rejected at the 61.8% Fibonacci retracement level. Price is now trying to break below the 4-hour Ichimoku cloud. The Dollar index has made a lower high yesterday relative to the recent highs at 102.30. A new low below 101 will be a bearish sign for more selling pressures to come over the coming weeks.

Red line - resistance

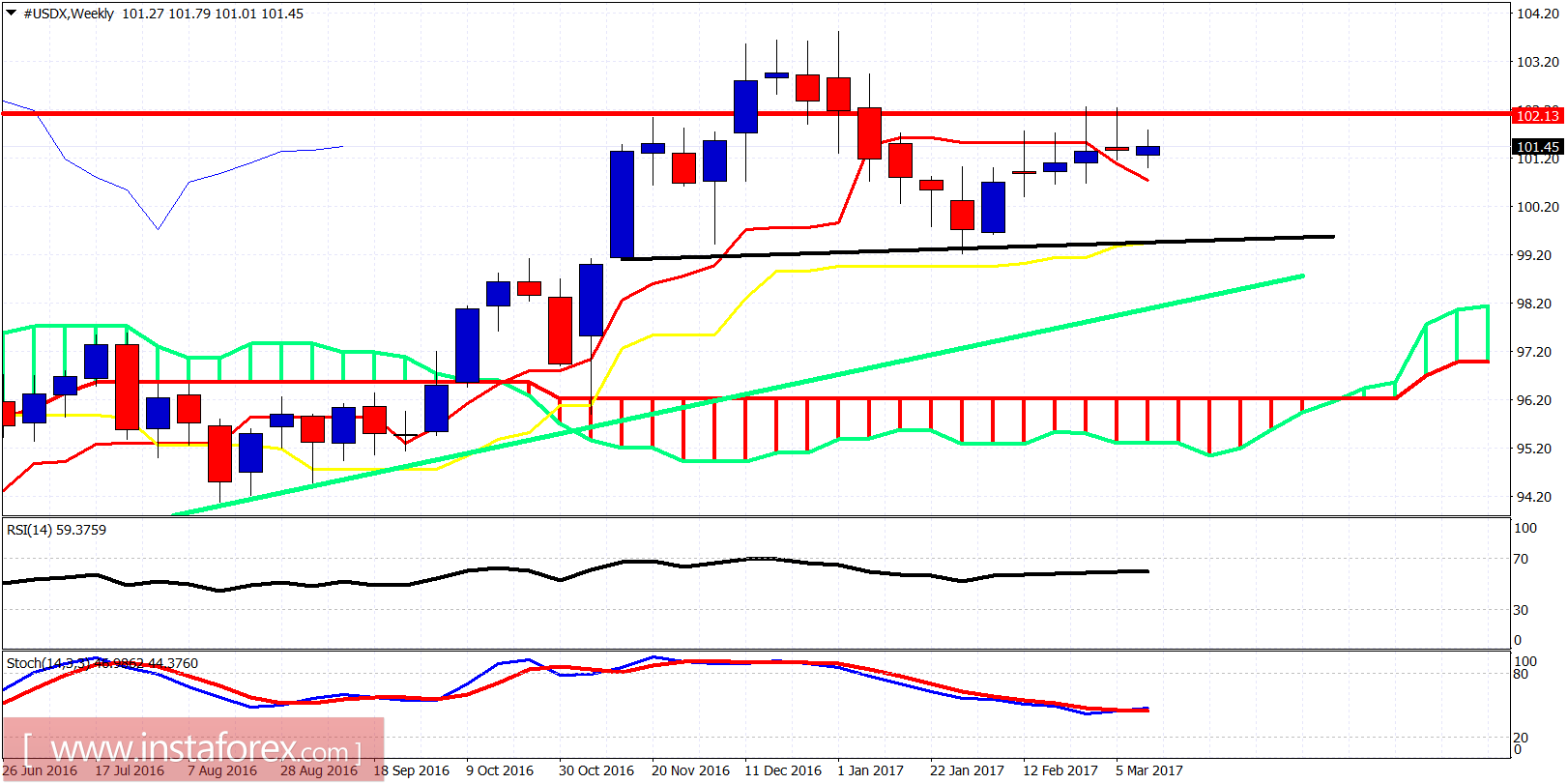

Black line - neckline support

Green line - long-term trend line support

The Dollar index remains below important resistance of 102.30 but no new lows on a weekly basis. Important weekly support is at 100.60, so a weekly close below it will open the way for a push lower towards 99 or even lower. Bulls need to break above 102.30 for the new highs scenario to remain valid.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română