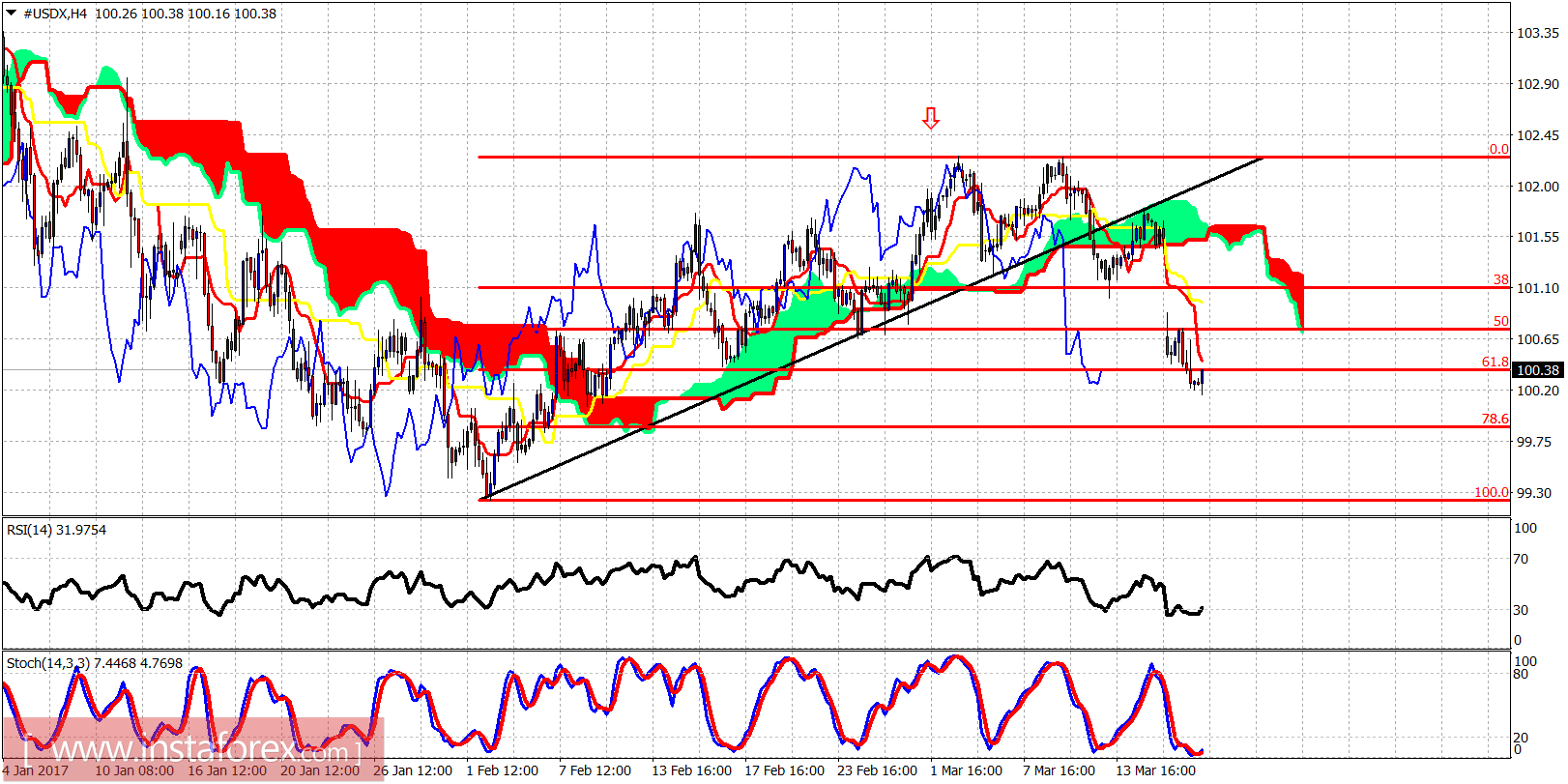

The Dollar index has broken through the 61.8% Fibonacci retracement support but it shows reversal signs. Short-term trend is bearish. Medium-term trend is neutral. Long-term trend remains bullish.

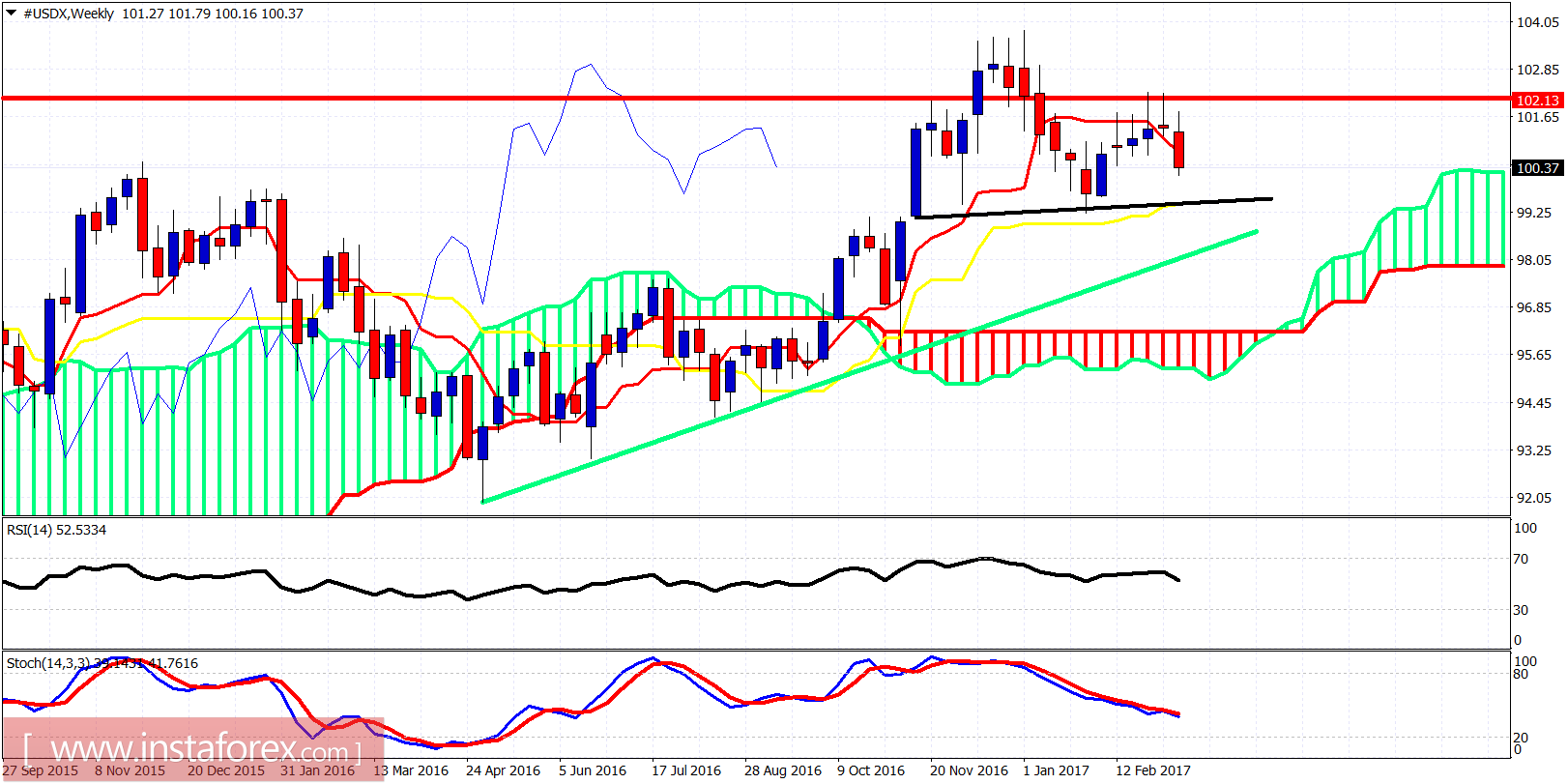

Black line - neckline support

Green line - long-term trend line support

The Dollar index is most probably forming a right hand shoulder in a bearish Head and Shoulders pattern that has a neckline support (black line) at 99.25. The Dollar index has broken below the weekly tenkan-sen (Red line indicator) and is heading towards the kijun-sen support (yellow line indicator). Important weekly resistance is at 101.80 and at 102.30. Bears are in control. Bulls need to show more constructive price action above at least 101.80 in order to regain control.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română