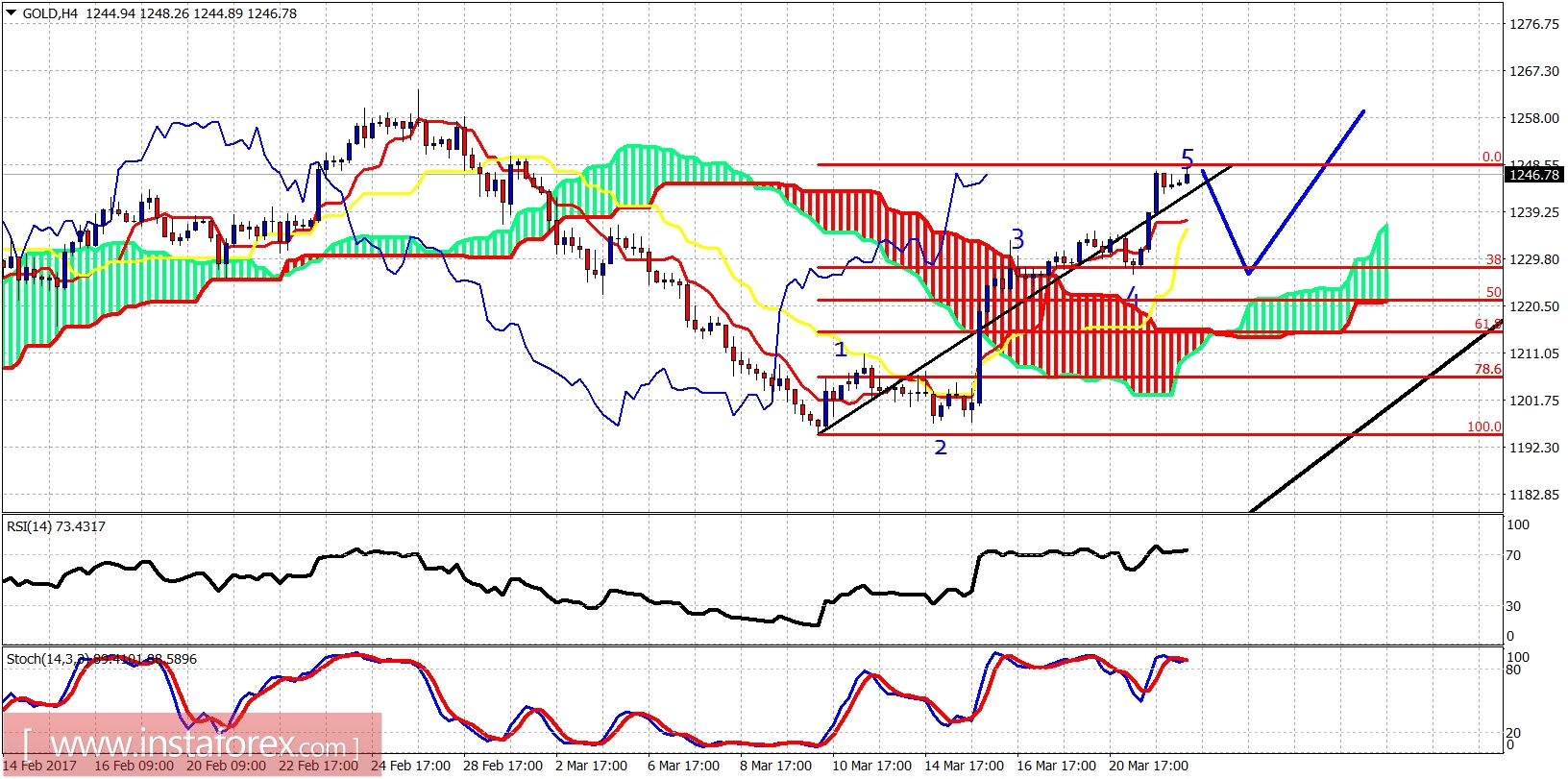

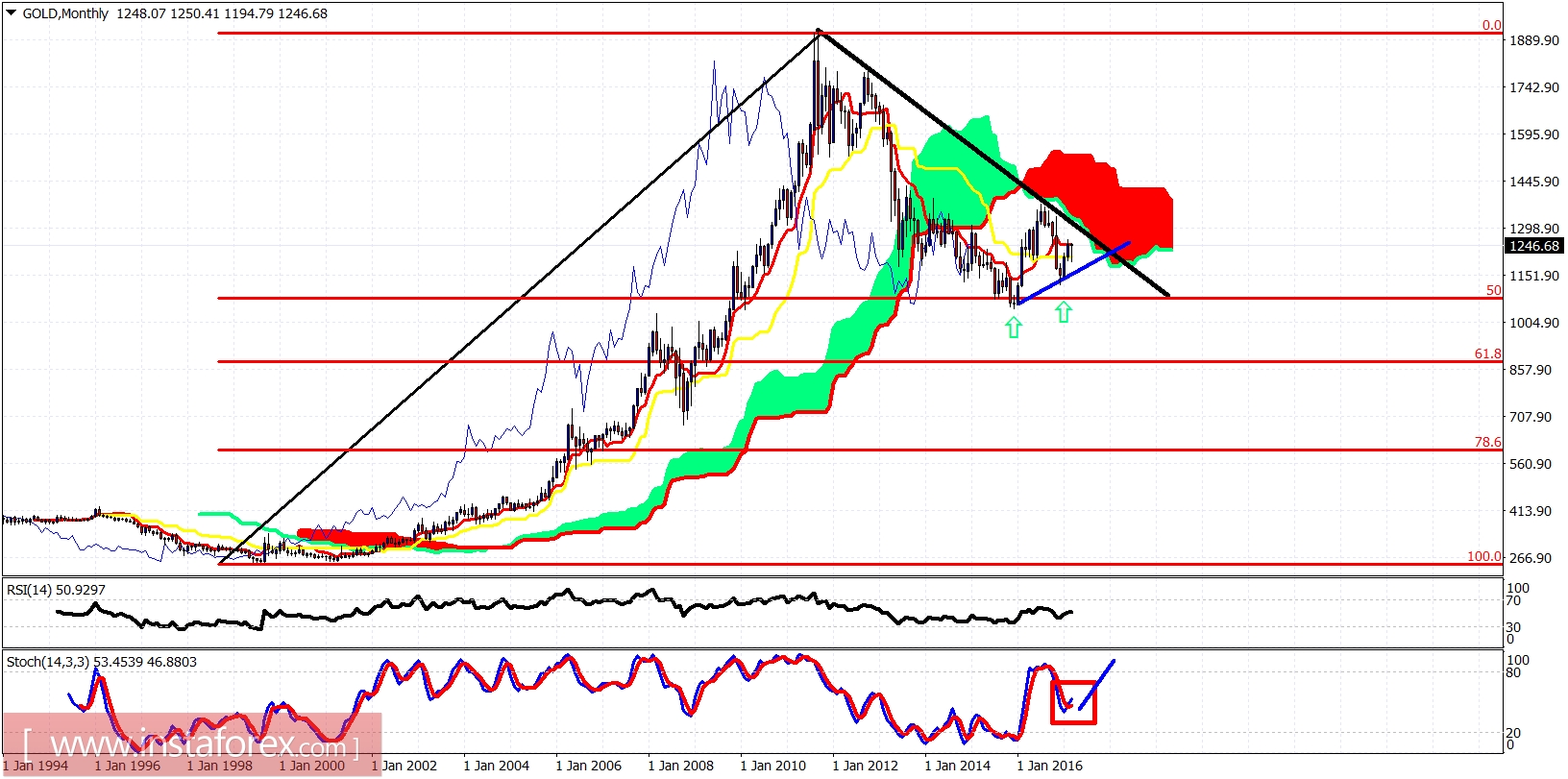

Gold is rising within an impulsive pattern. The price is in an uptrend. After making an important low at $1,194, gold is rising and is expected to move towards the key monthly resistance at $1,325. In the short term, gold prices are close or has already completed 5 waves up from $1,194.

Gold is trading above the Ichimoku cloud. The short-term trend is bullish. The price may pull back towards the Ichimoku cloud and the 38% Fibonacci retracement. Gold has made an important low at $1,194 and as long as we trade above it, we are aggressively bullish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română