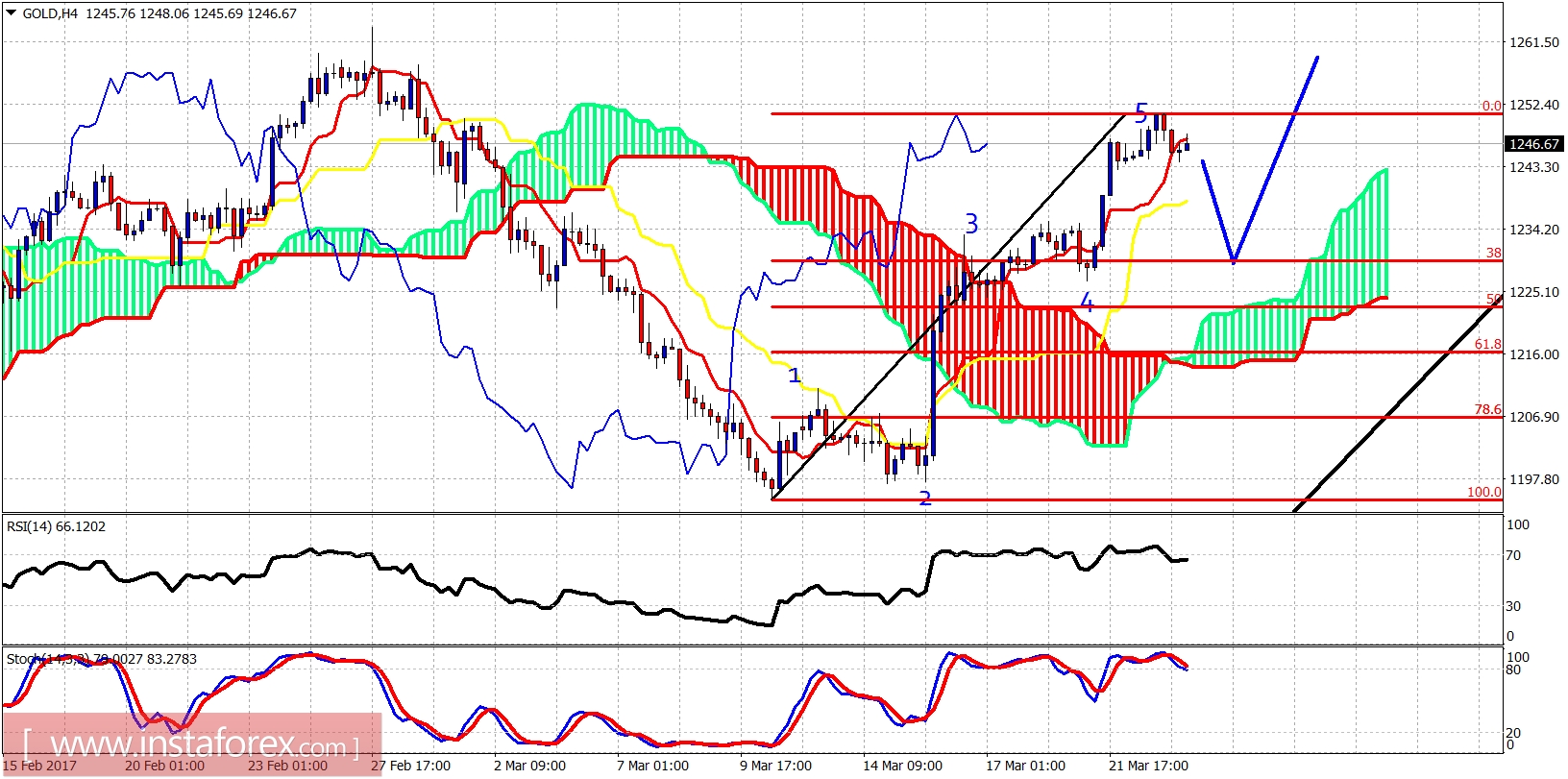

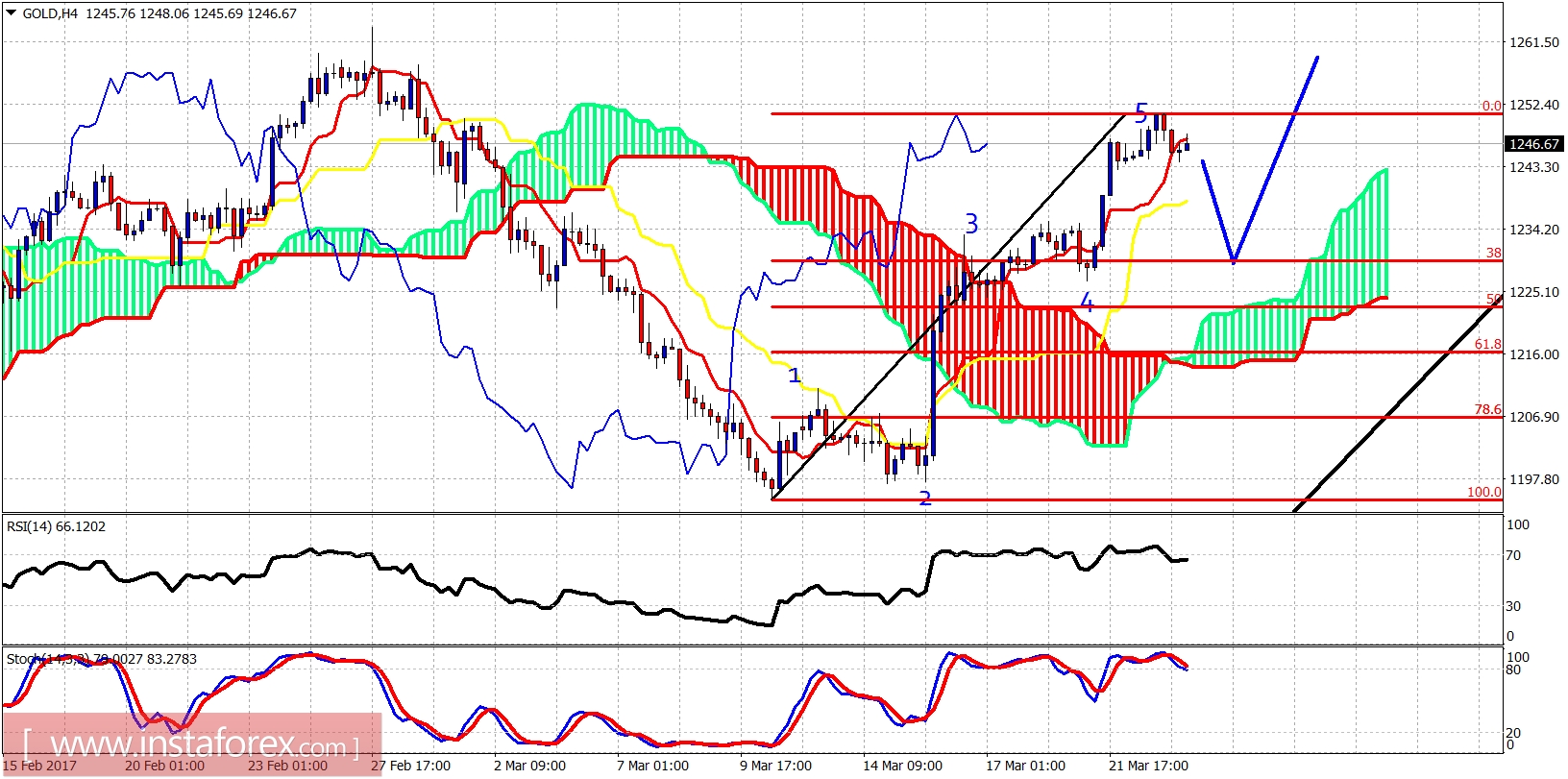

Gold price has most probably completed an impulsive wave upwards from $1,194 lows. The price is showing reversal signs. A short-term correction should unfold from current levels towards $1,220-30. Gold is in a bullish trend. I remain long-term bullish for Gold.

Gold continues to trade above the Ichimoku cloud. The price is expected to pull back towards the 4th wave area and close to the 38% Fibonacci retracement at least. Trend is bullish in the medium term. Confirmation of the bullish trend will come once the price breaks above $1,263 highs.

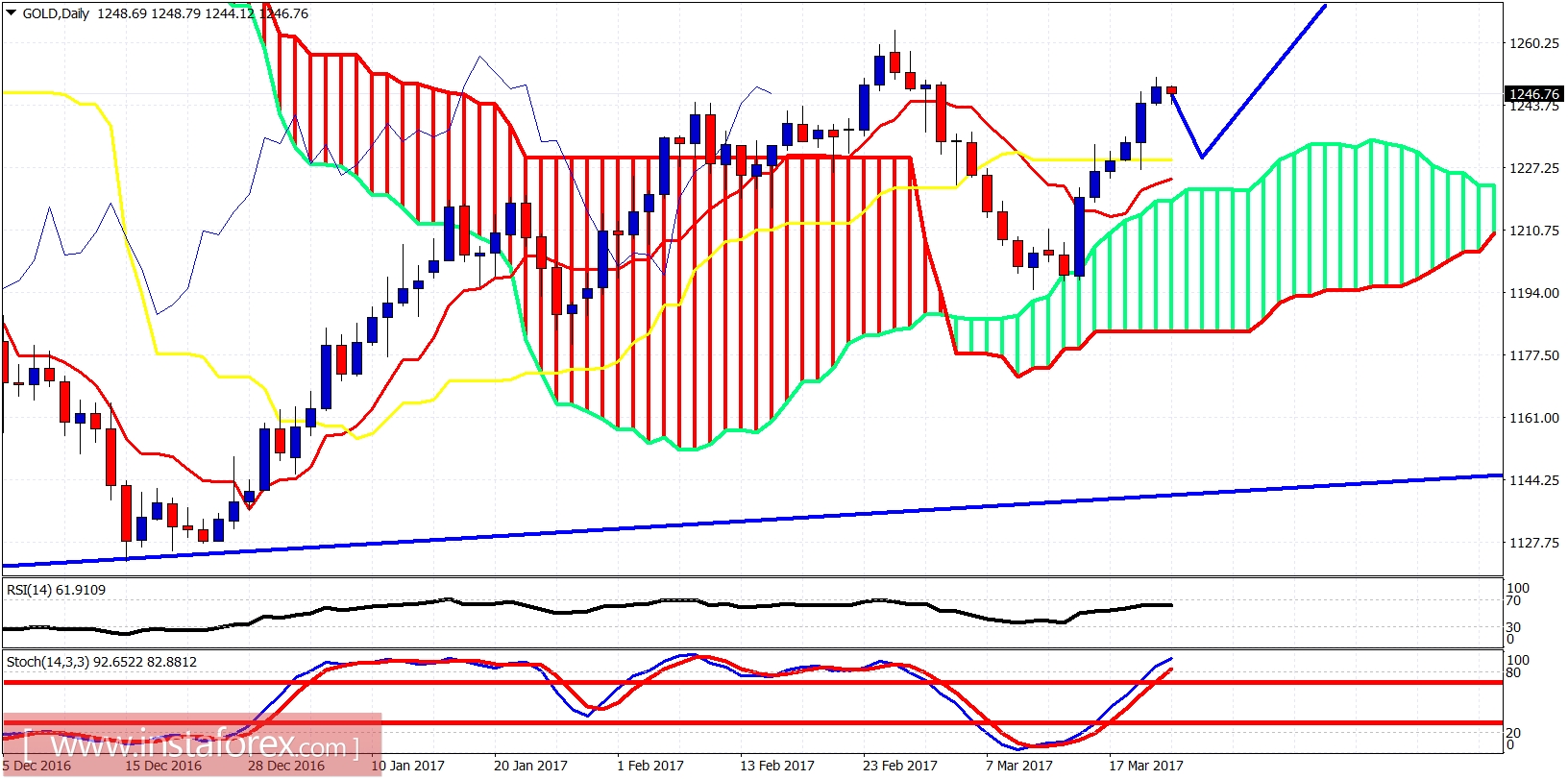

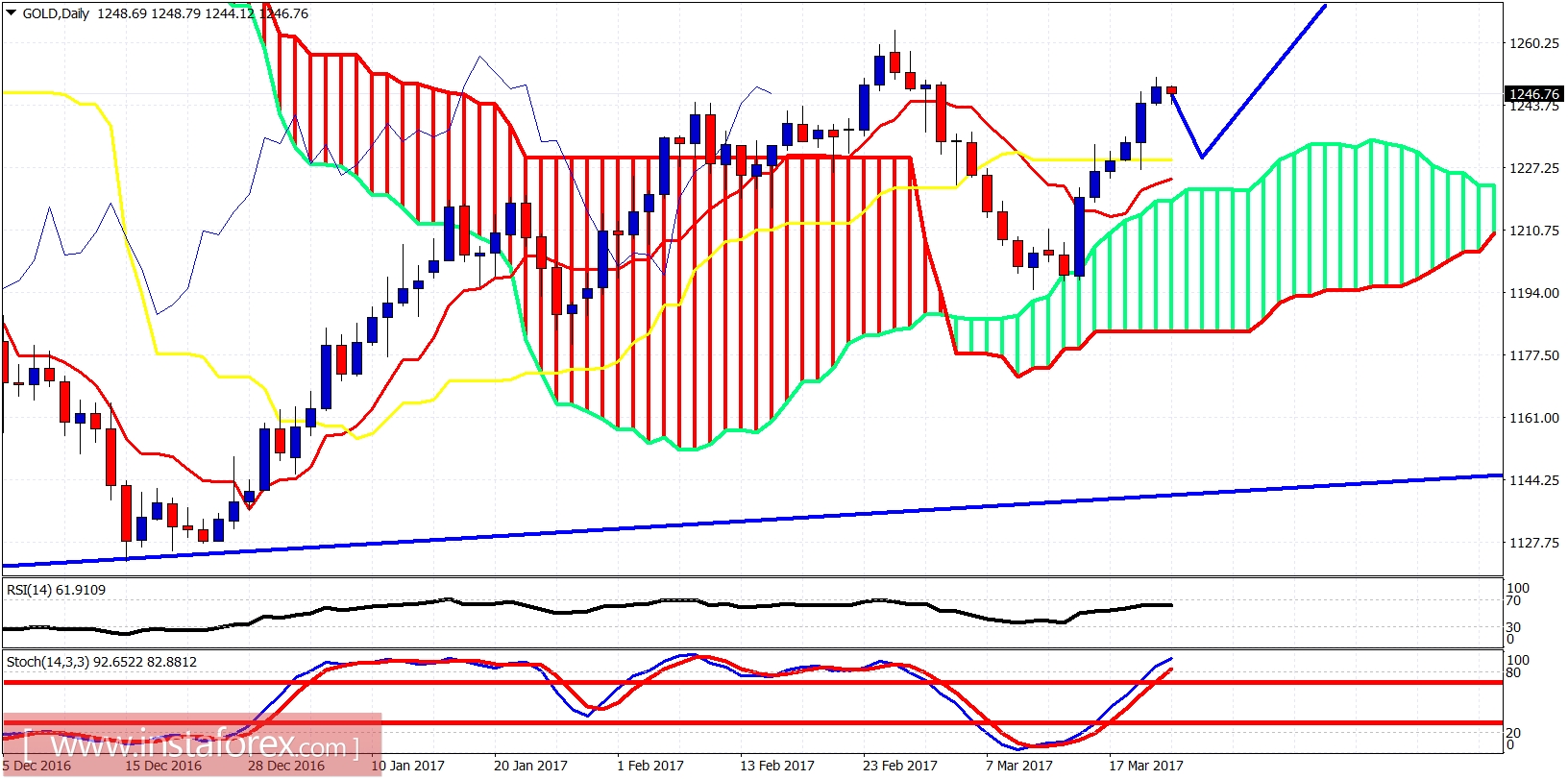

On a daily basis Gold price has broken above both the tenkan- and kijun-sen. A cross over between those two indicators with the tenkan-sen (red line indicator) above the kijun-sen (yellow line indicator) will be a very bullish signal. The price is above the Kumo (cloud support). Gold is expected to make a wave 2 pullback towards the kijun-sen and then explode to the upside for wave 3 and $1,300-$1,330. Support is at $1,194.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română