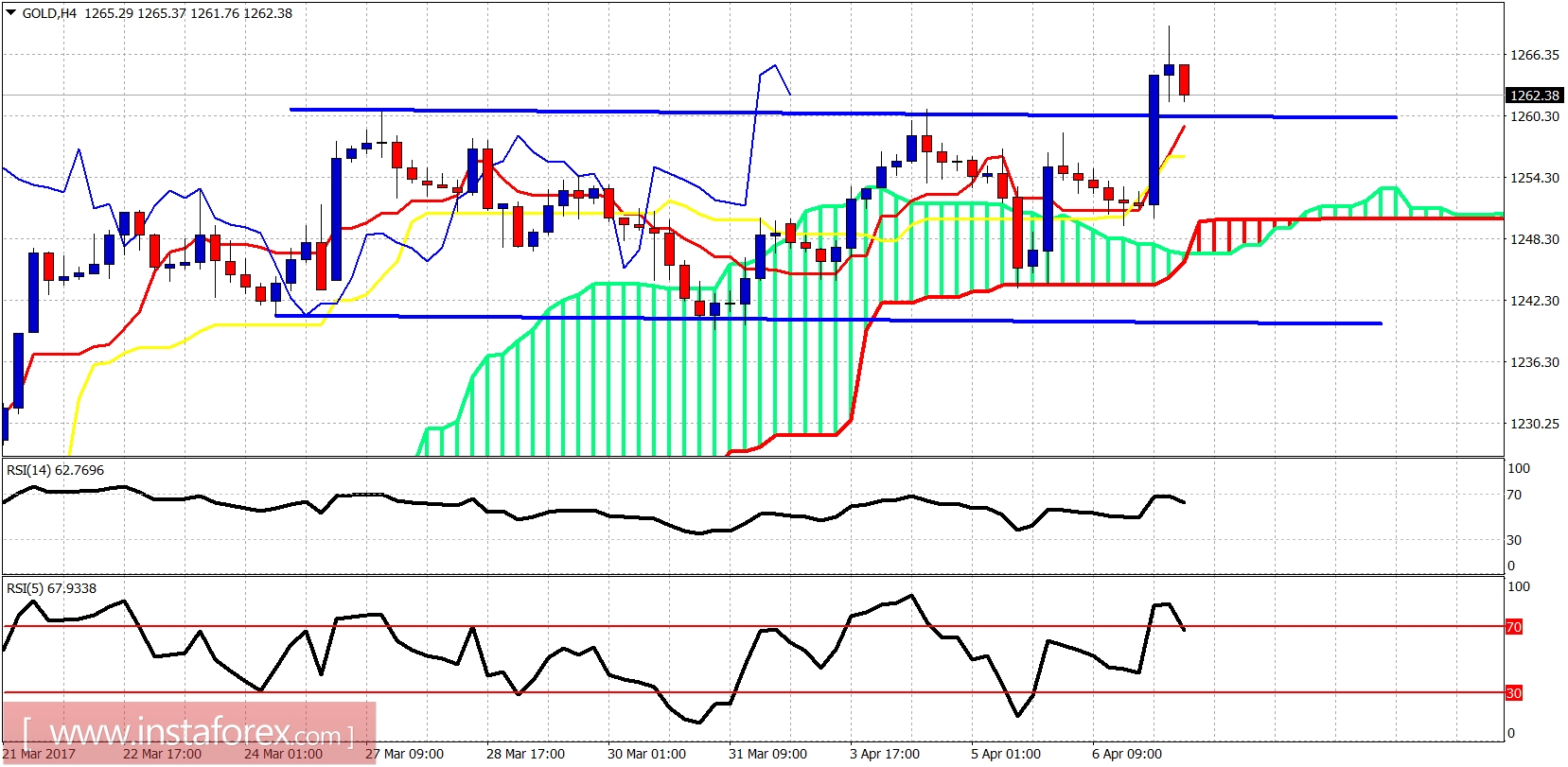

Gold broke to new highs above the 2017 highs earlier tonight after the attack in Syria by the US army forces. We should expect a pullback or a back test of the broken resistance level at $1,257-60. In the long term I remain bullish looking for $1,300-$1,310.

The price broke out of the trading range. It is above the Kumo (cloud). Trend is bullish in the 4-hour chart. Both tenkan- and kijun-sen are pointing higher. I expect more upside in price action. Support is at $1,257-60. Resistance is now at $1,280.

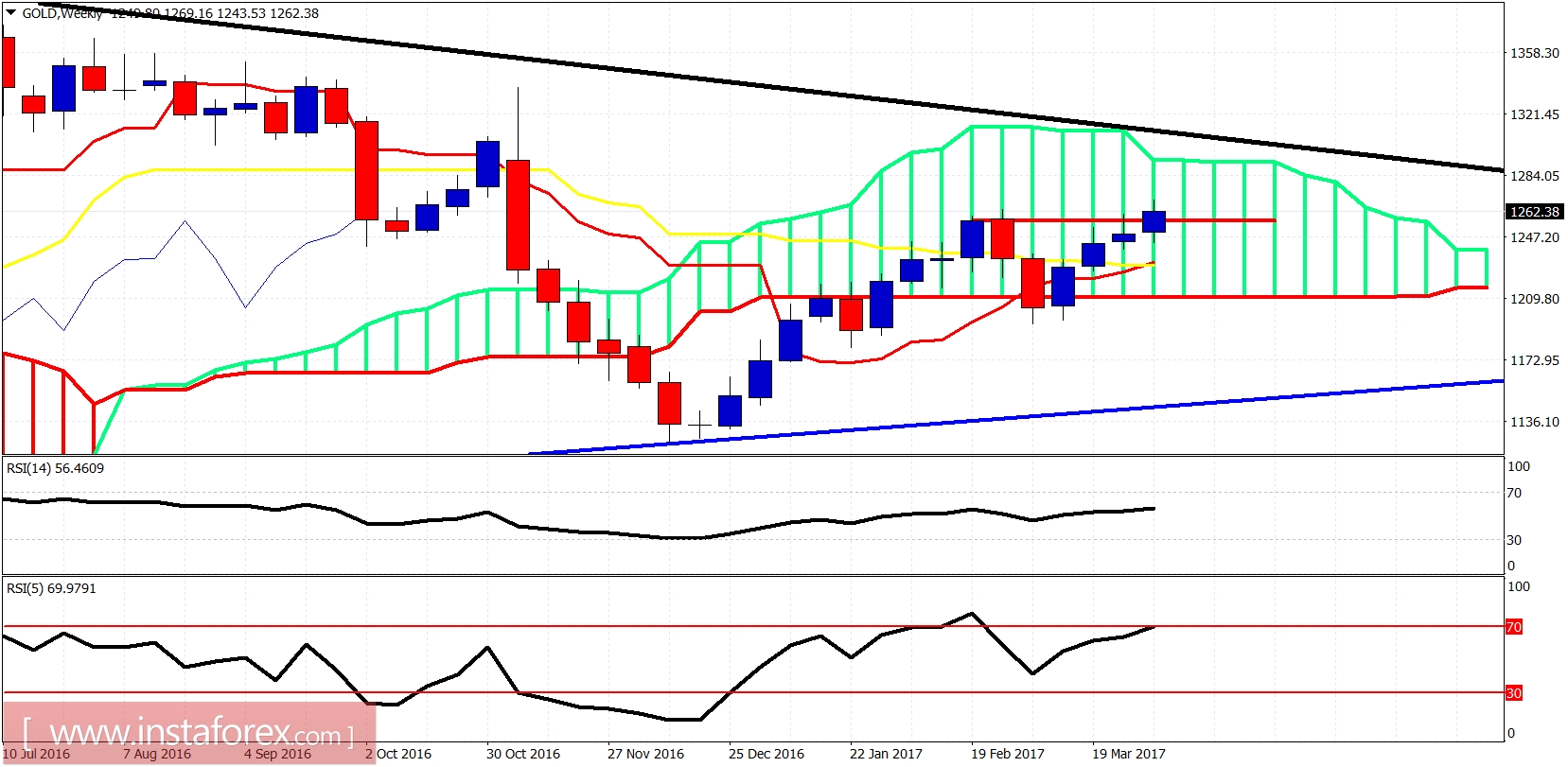

Black line - long-term resistance

Blue line - long-term support

Gold weekly candle is breaking above the short-term resistance and 2017 highs. The weekly close will be important. A weekly close above $1,263 will open the way for a push at least towards $1,285-$1,310. Trend is bullish. There are no divergence signs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română