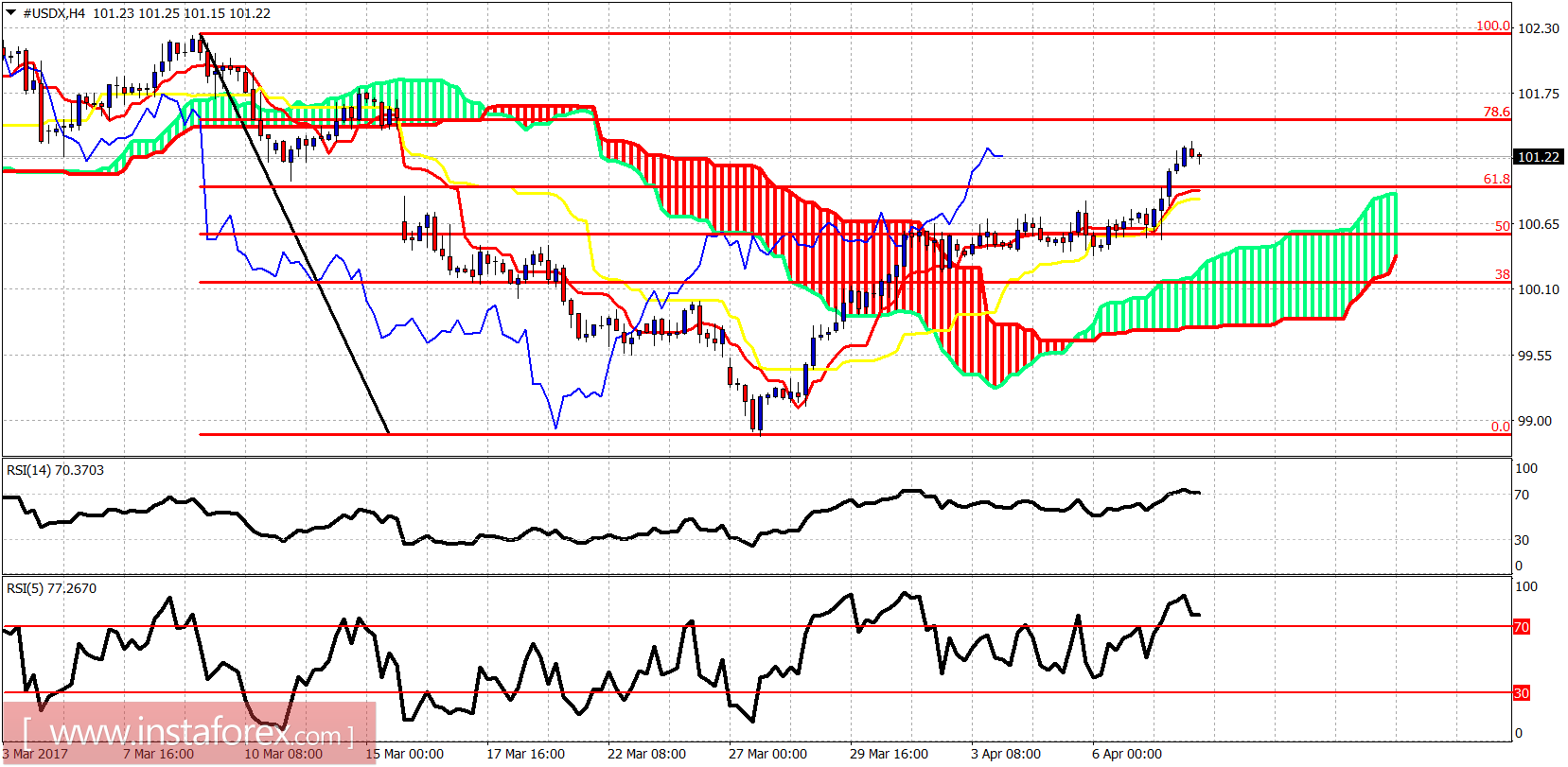

Despite the bearish divergence signs and the resistance at the 61.8% Fibonacci retracement, the Dollar index managed to fight the worse-than-expected NFP figures announced on Friday and pushed higher towards 101.50 where the next resistance is found.

Price is trading above the Ichimoku cloud and both the tenkan- and kijun-sen indicators. Trend is bullish. Oscillators are overbought. Resistance is now at 101.50 where the 78.6% Fibonacci retracement is found. Support is at 100.90.

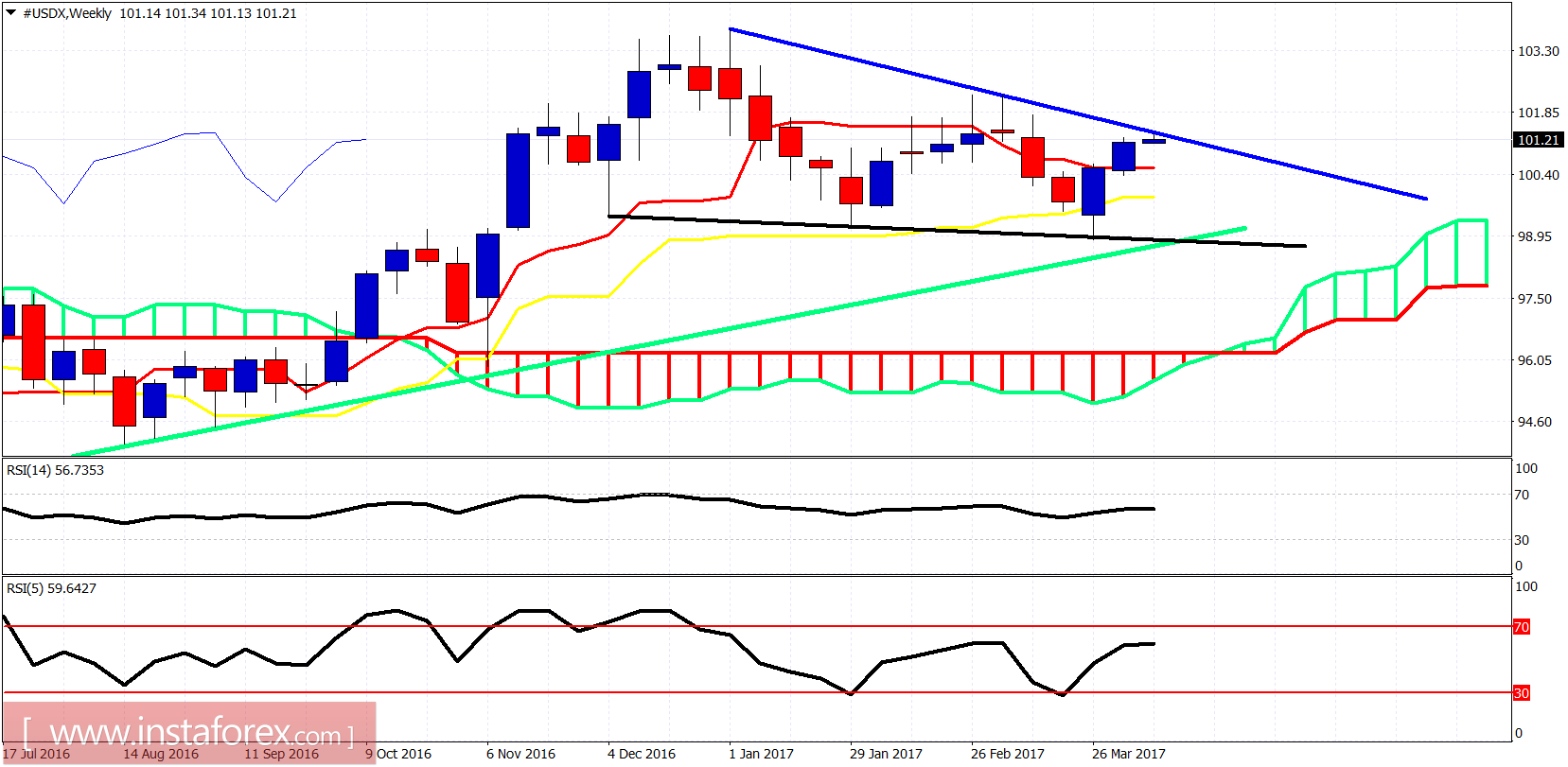

Black line -support

Green line - long-term support trend line

On the weekly chart, price is testing important weekly trend line resistance at 101.20-101.50 area. I expect this trend line is not to be broken and price to get rejected this or next week from the 101.50 level. I will focus on the bearish side of the trade as long as price is below the blue trend line and especially below 102.30.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română