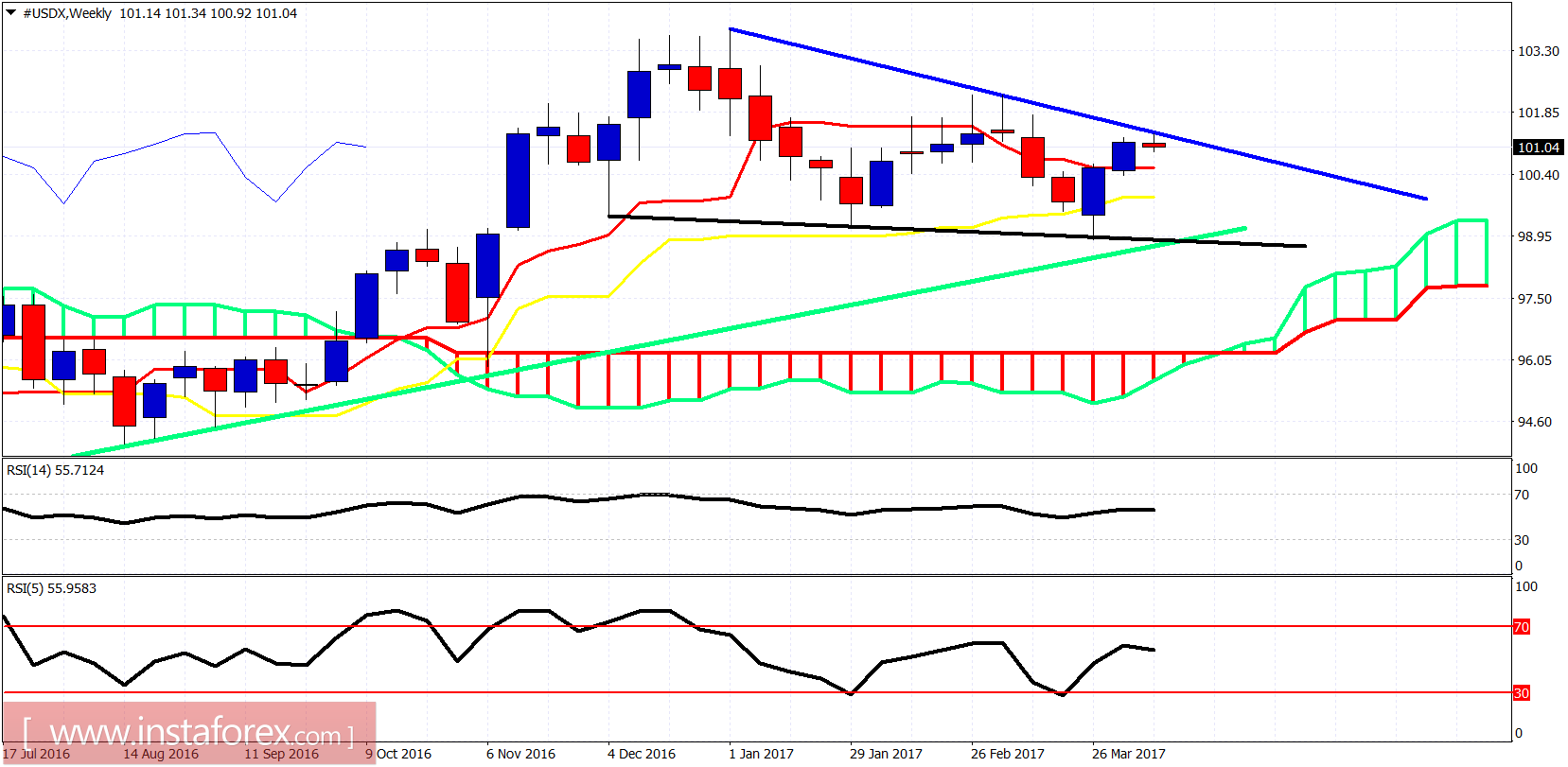

As expected the Dollar index is showing reversal signs off the critical weekly resistance at 101.50. Price managed to reach 101.35 yesterday. I believe this is not the right time to buy Dollar.

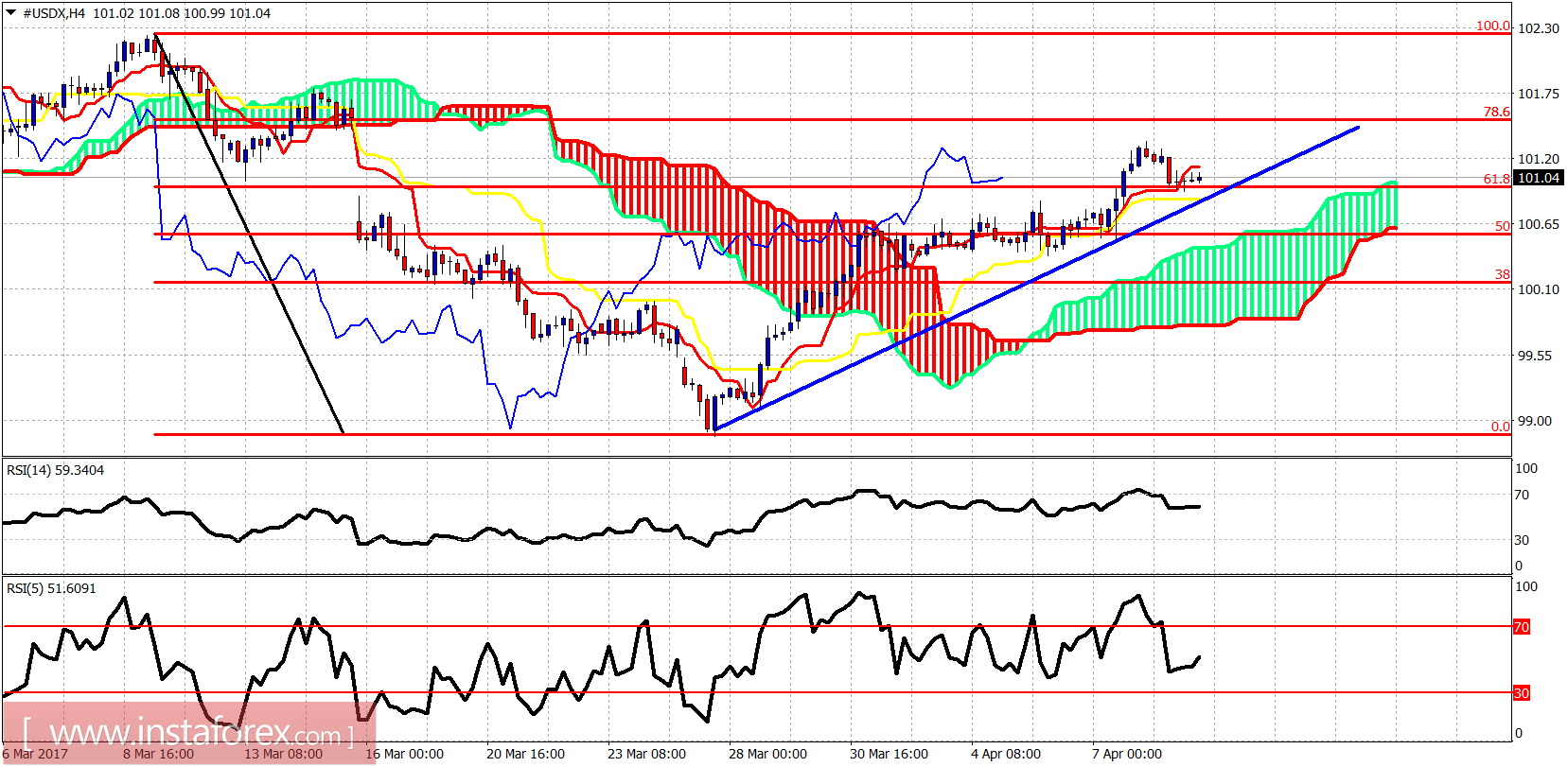

The Dollar index remains in a short-term bullish trend. Price is above the Ichimoku cloud on the 4-hour chart. Short-term support is at 100.83 by the blue trend line. Price almost reached the 78.6% Fibonacci retracement and is reversing.

Blue line - resistance

Black line - support

Green line - trend line support

The Dollar index reached the blue trend line resistance and is showing rejection signs. This is important resistance area and unless we break above 101.50, bulls should be very careful as I expect price to turn back down at least towards the black trend line suppport.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română