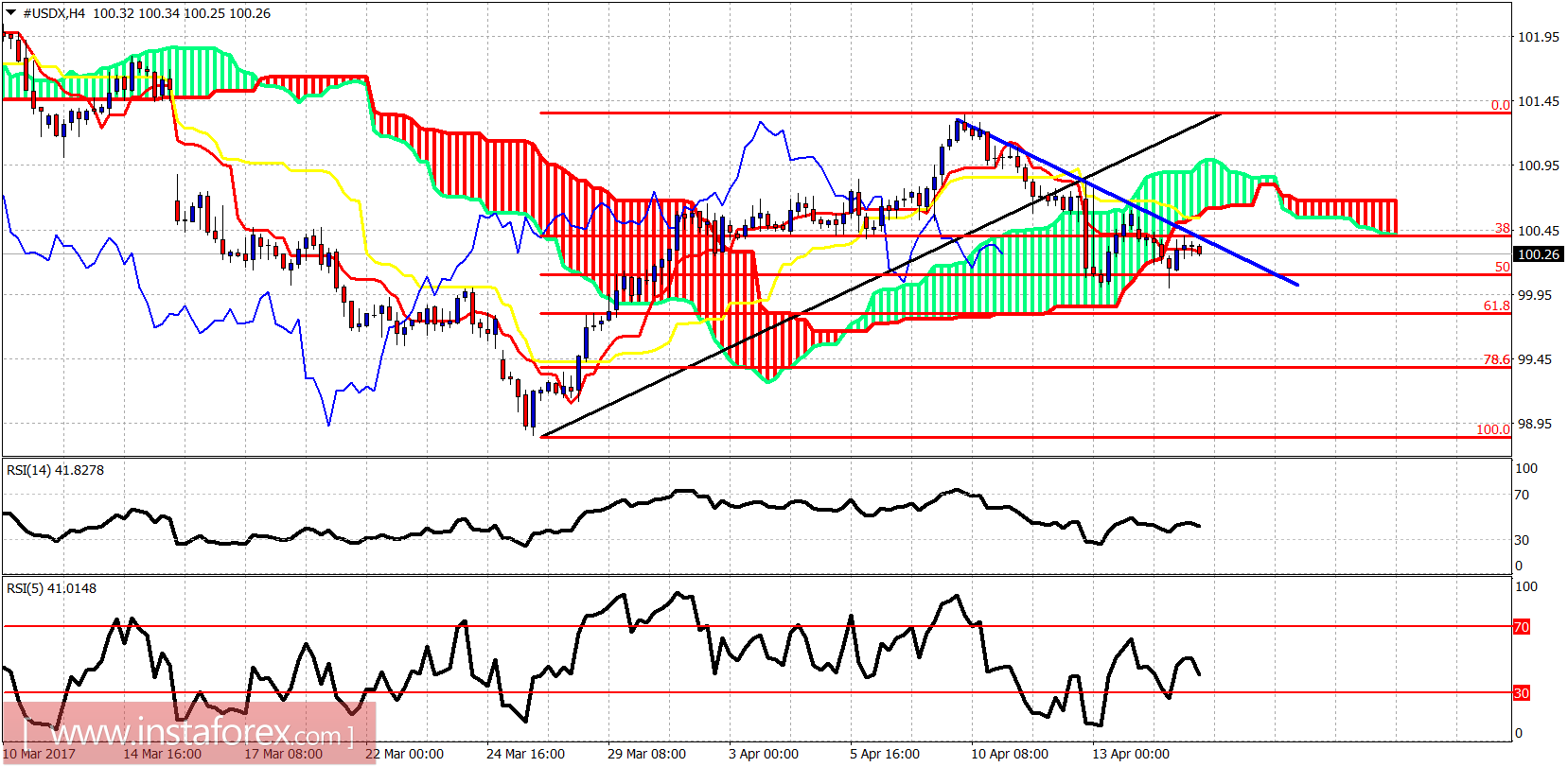

The US dollar index reversed and got rejected at 101.30 when we expected it last week. Now it is in a short-term bearish trend. The price is in the important support area where we could see another upward turnaround.

Blue line - short-term resistance trend line

The dollar index is trading below the 4 hour Kumo (cloud) and the blue trend line resistance. Resistance is found at 100.60. Support lies at 99.80 where we also find the 61.8% Fibonacci retracement of the latest upward move from the important lows at 98.80.

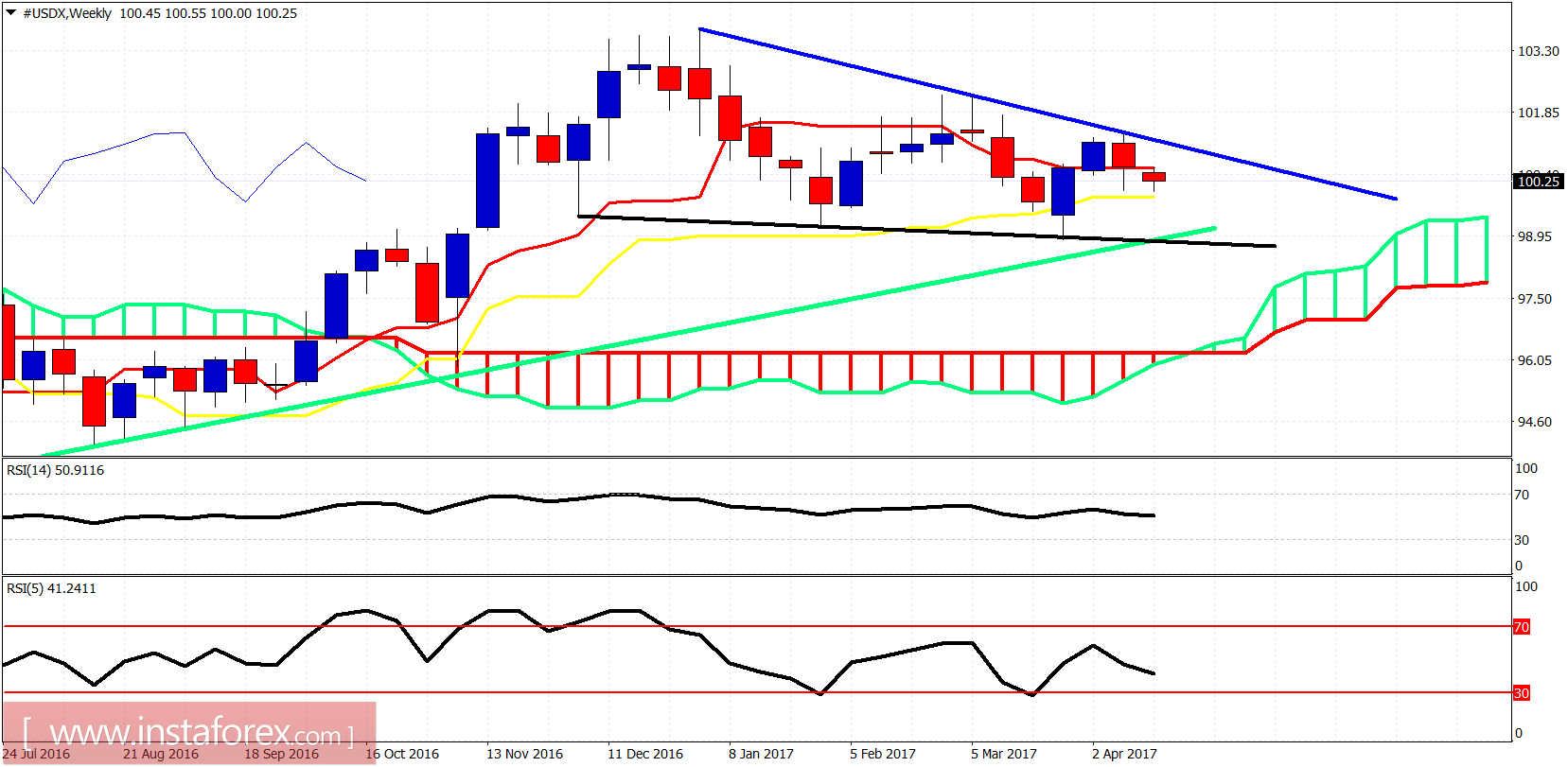

Black line - medium-term support trend line

Green line - long-term support trend line

Weekly resistance remains in the area of 101.30-101.50 by the downward sloping trend line. Weekly support is at 99-98.80 where the medium-term and long-term support trend lines meet. Long-term trend remains bullish as price the holds above the Kumo (cloud). However, there will be intense warnings if the price closes below the weekly kijun-sen at 99.80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română