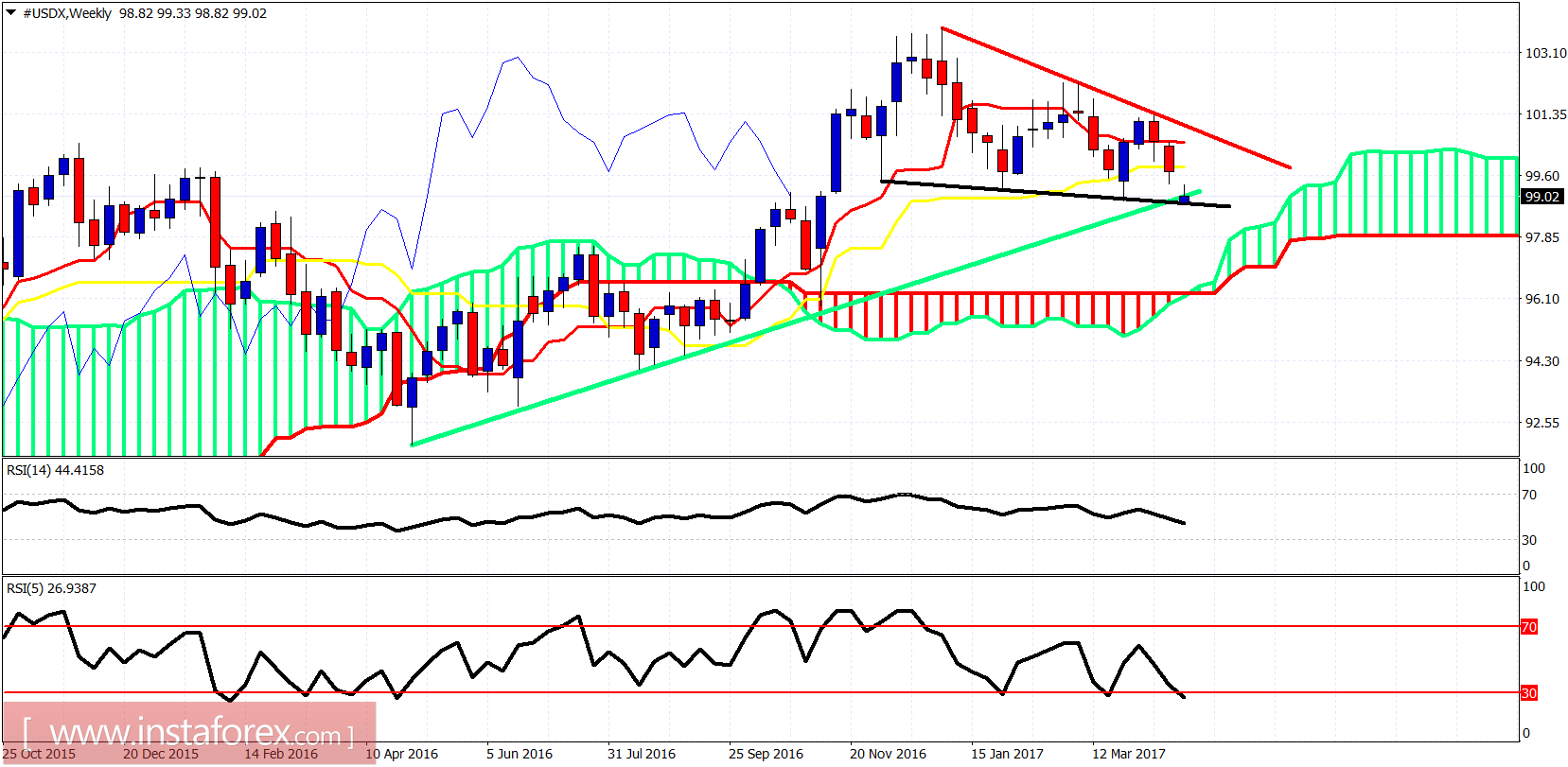

The Dollar index continues to trade above the 99-98.80 support area but the sideways consolidation in the short-term implies that more downside is expected. The downward move is not over but the risk reward does not favor bears.

Short-term support is at 98.80. Resistance is at 99.30-99.50. Price remains in a bearish trend below both the tenkan- and kijun-sen indicators. Price is expected to make new lows towards 98 before it reverses upwards. Short-term indicators are diverging.

Black line - support

Green line - long-term support trend line

The weekly candle is below both the tenkan- and kijun-sen but above the Kumo (cloud). Trend is bearish as long as price is below 101.30 and the longer-term trend is also in danger if price breaks below the Kumo. If price breaks below the green long-term trend line the chances for a bounce towards the red resistance trend line diminish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română