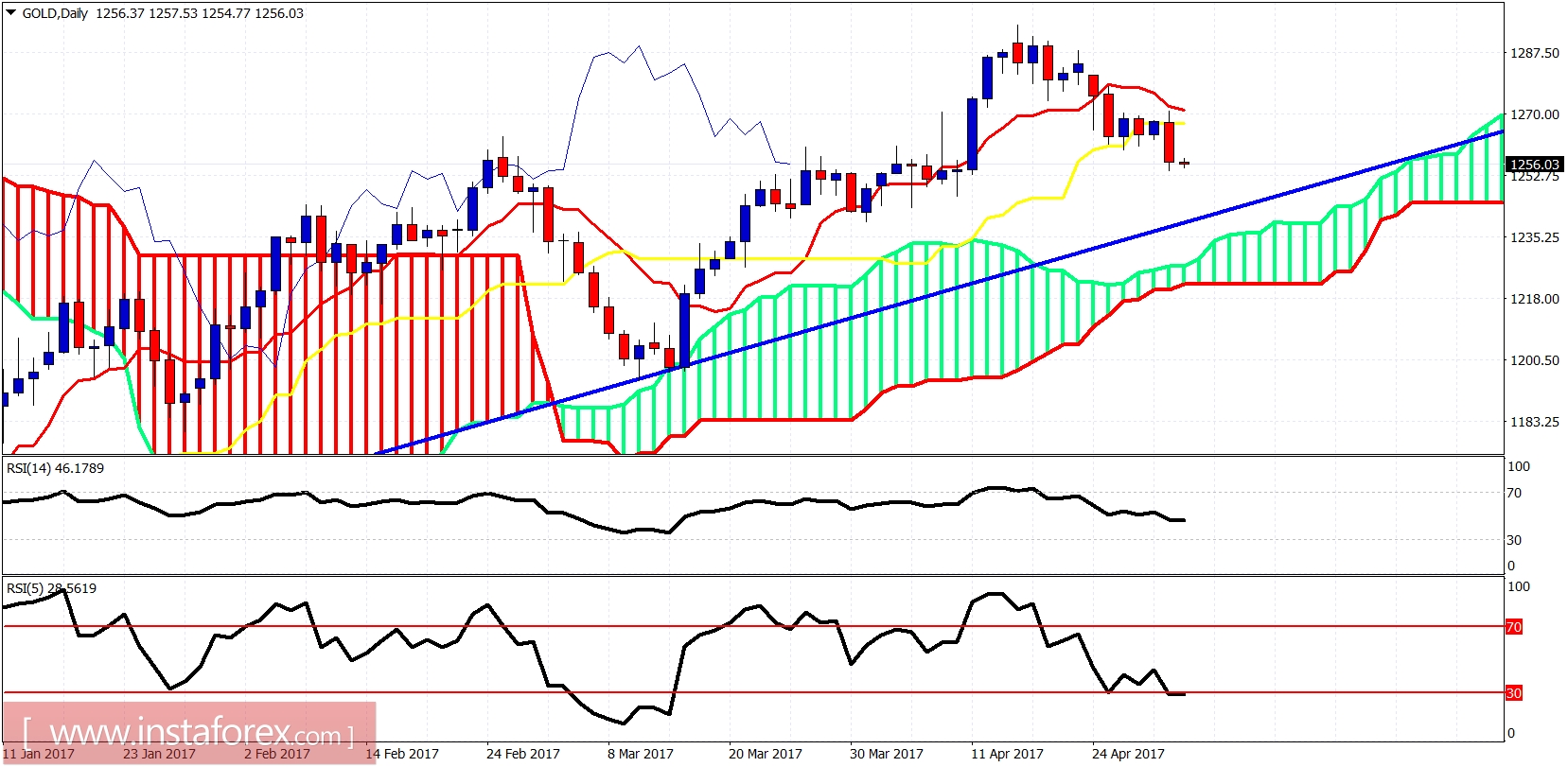

Gold price remains in a bearish short-term trend, correcting the entire rise from $1,194. The price has reached the important Fibonacci support levels although the possibility of a move by $10-15 lower is still possible. Overall, my longer-term bullish view remains intact.

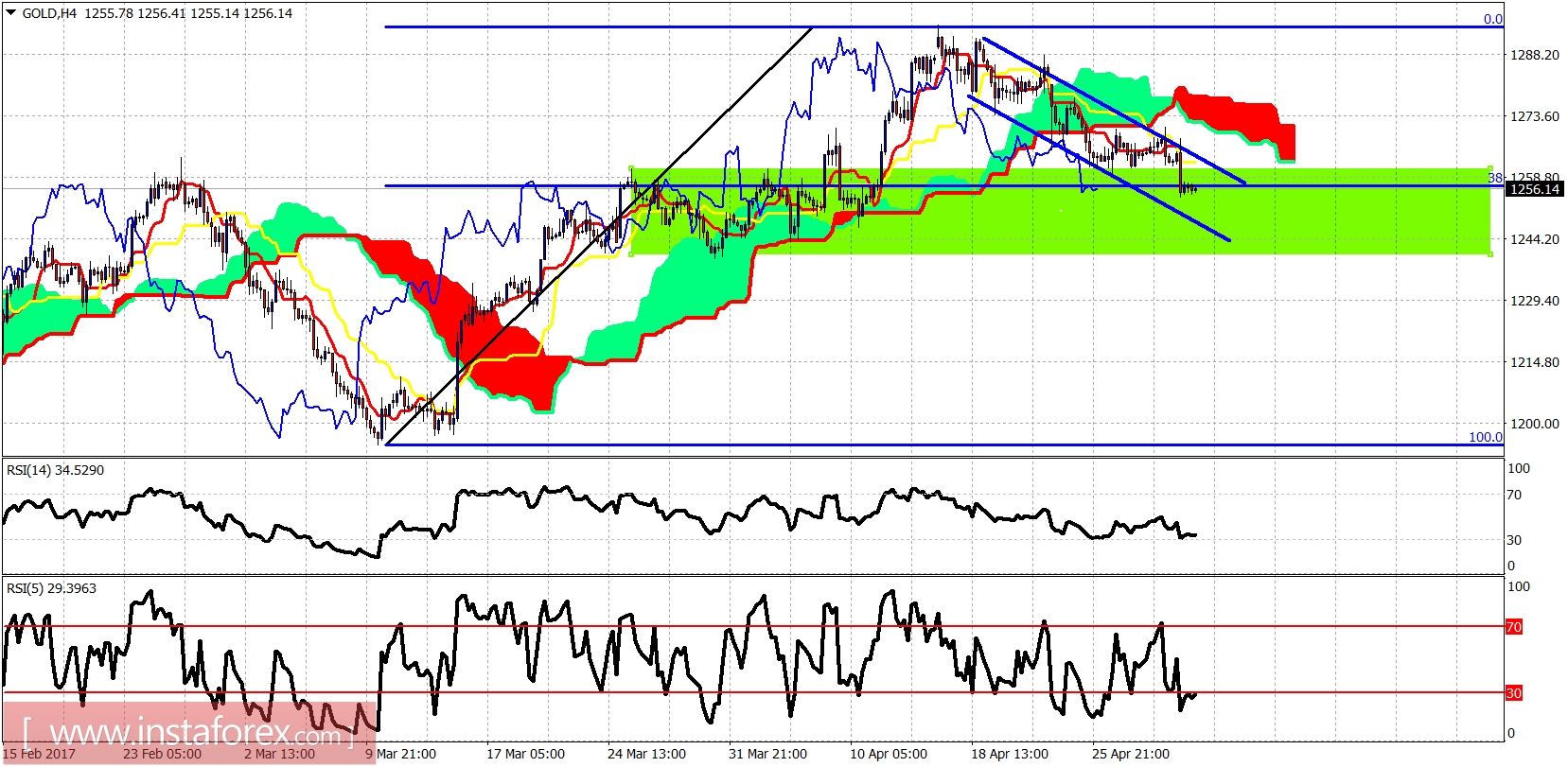

Blue lines - bearish channel

Gold price has just entered the important long-term support area. The price is trading below the 4 hour Kumo (cloud) confirming the bearish short-term trend. Moreover, the price is still inside the bearish blue channel. A break above $1,272 will open the way for a reversal. Support lies at $1,250-45 area now.

Gold price has broken below both the tenkan- and kijun-sen indicators on the daily chart. The price is heading towards the trend line and cloud support at $1,240-45. The short-term trend is bearish. However, I expect gold price to reverse from current or lower levels for a move towards $1,320-40.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română