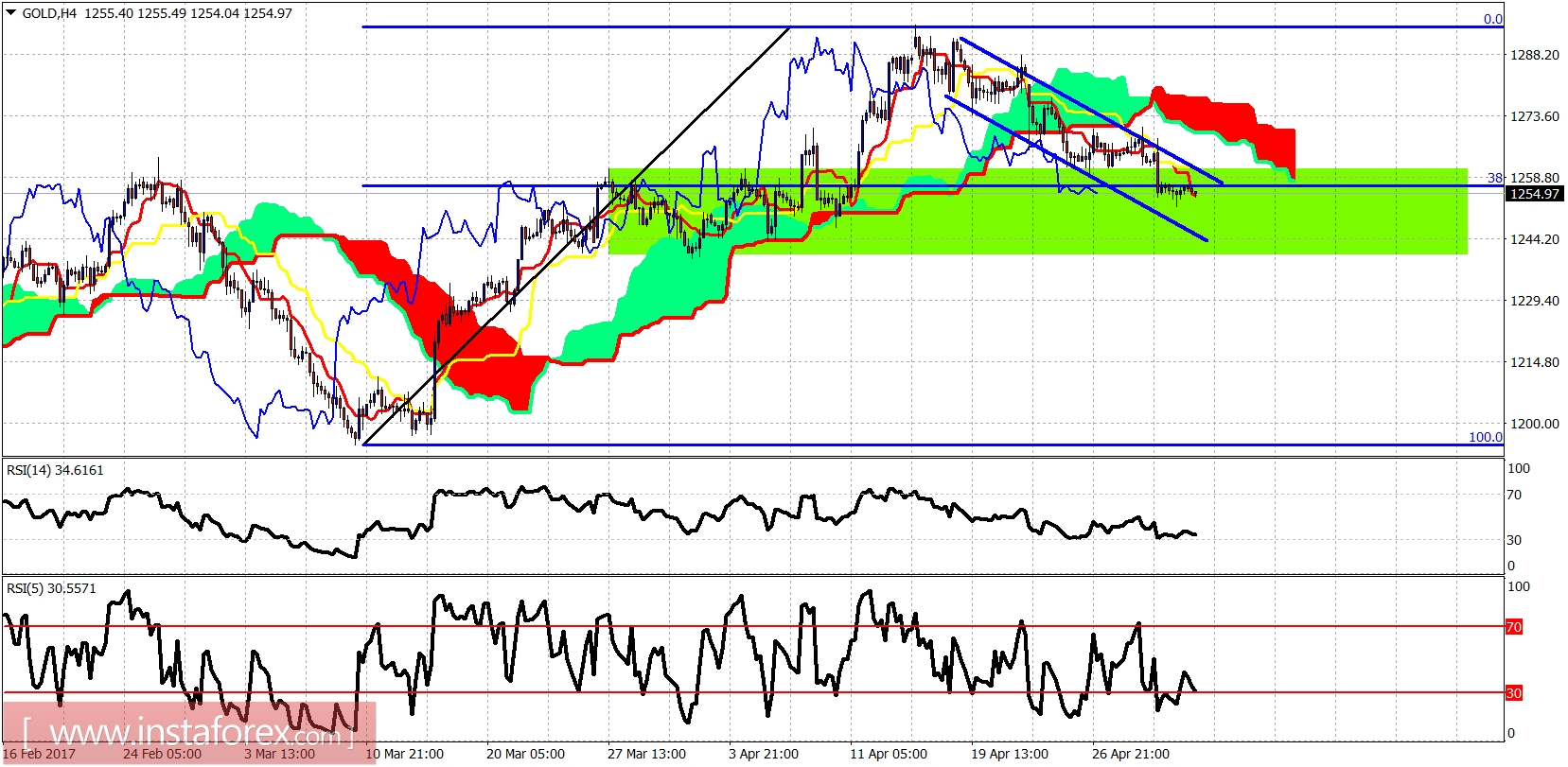

Gold price is close to bottoming. Gold price has limited downside potential and could go as low as $1,245. I cannot see it lower than that area. Gold is expected to bounce strongly towards $1,300 and higher after the coming reversal.

Green rectangle - support area

Gold price is inside the green rectangle support area. Price is below both the tenkan- and kijun-sen indicators. Trend is bearish for the short term. Short-term resistance is at $1,262. Next important resistance is at $1,272. Bulls need to break these levels to confirm a reversal.

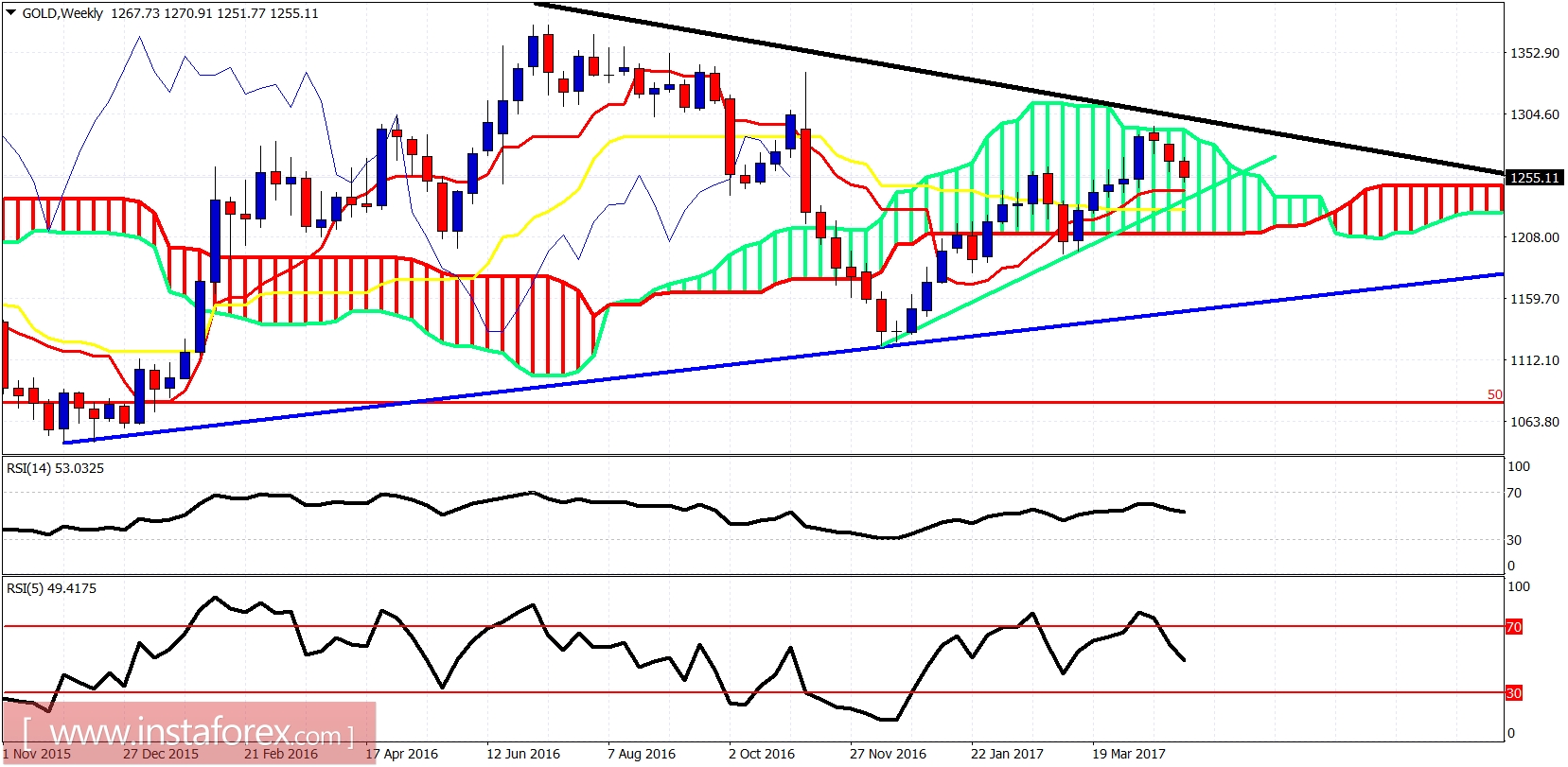

Blue line - long-term support trend line

Green line - medium term support trend line

Gold price is trading inside the Kumo. Trend is neutral. Price is above both the tenkan- and kijun-sen. Price is also above the green medium-term support trend line. I expect this trend line to hold and price bounce upwards strongly above the long-term trend line resistance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română