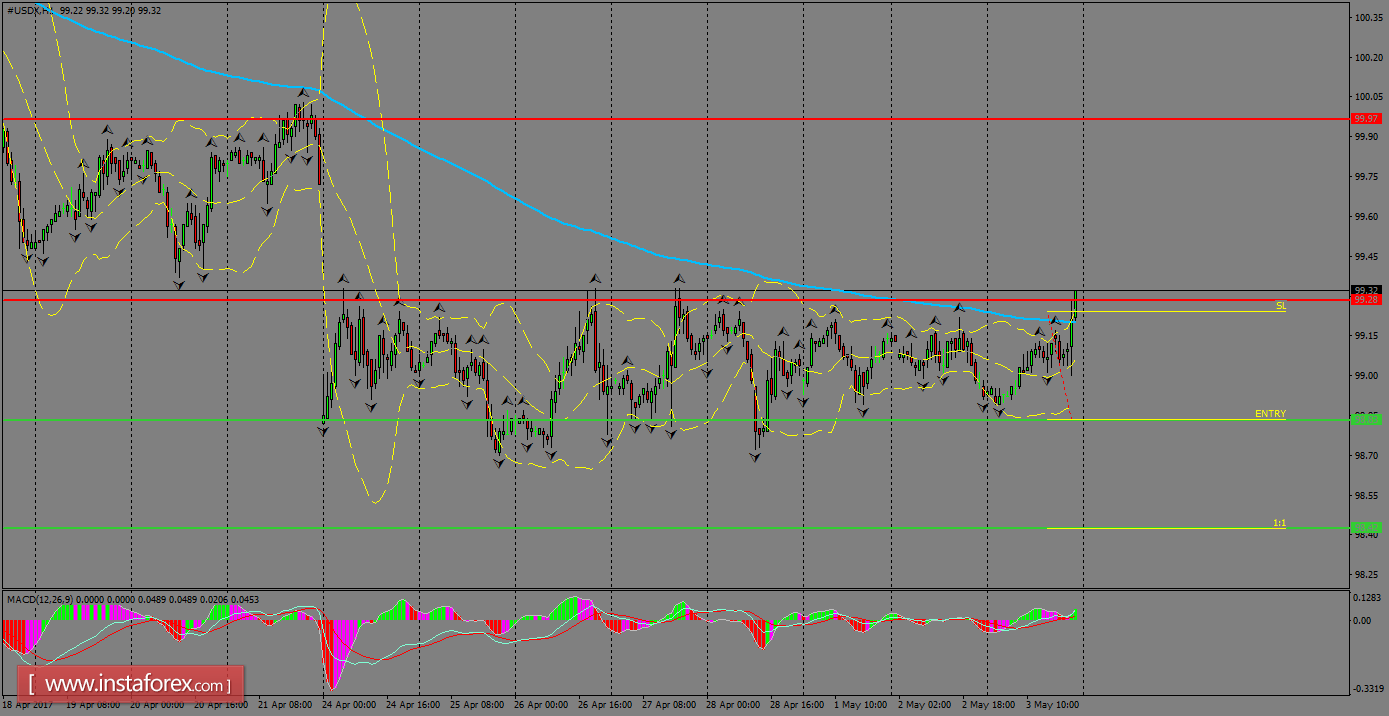

The index received fresh bullish momentum after Fed's interest rate decision, as they kept rates unchanged. Now, we're seeing an attempt of consolidation above the 200 SMA at H1 chart, targeting the resistance level of 99.97 or 100.00, to finally fill the French elections' gap. However, if USDX performs a pullback, it can re-test the 99.00 handle.

H1 chart's resistance levels: 99.28 / 99.97

H1 chart's support levels: 98.83 / 98.42

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 98.83, take profit is at 98.42 and stop loss is at 99.24.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română