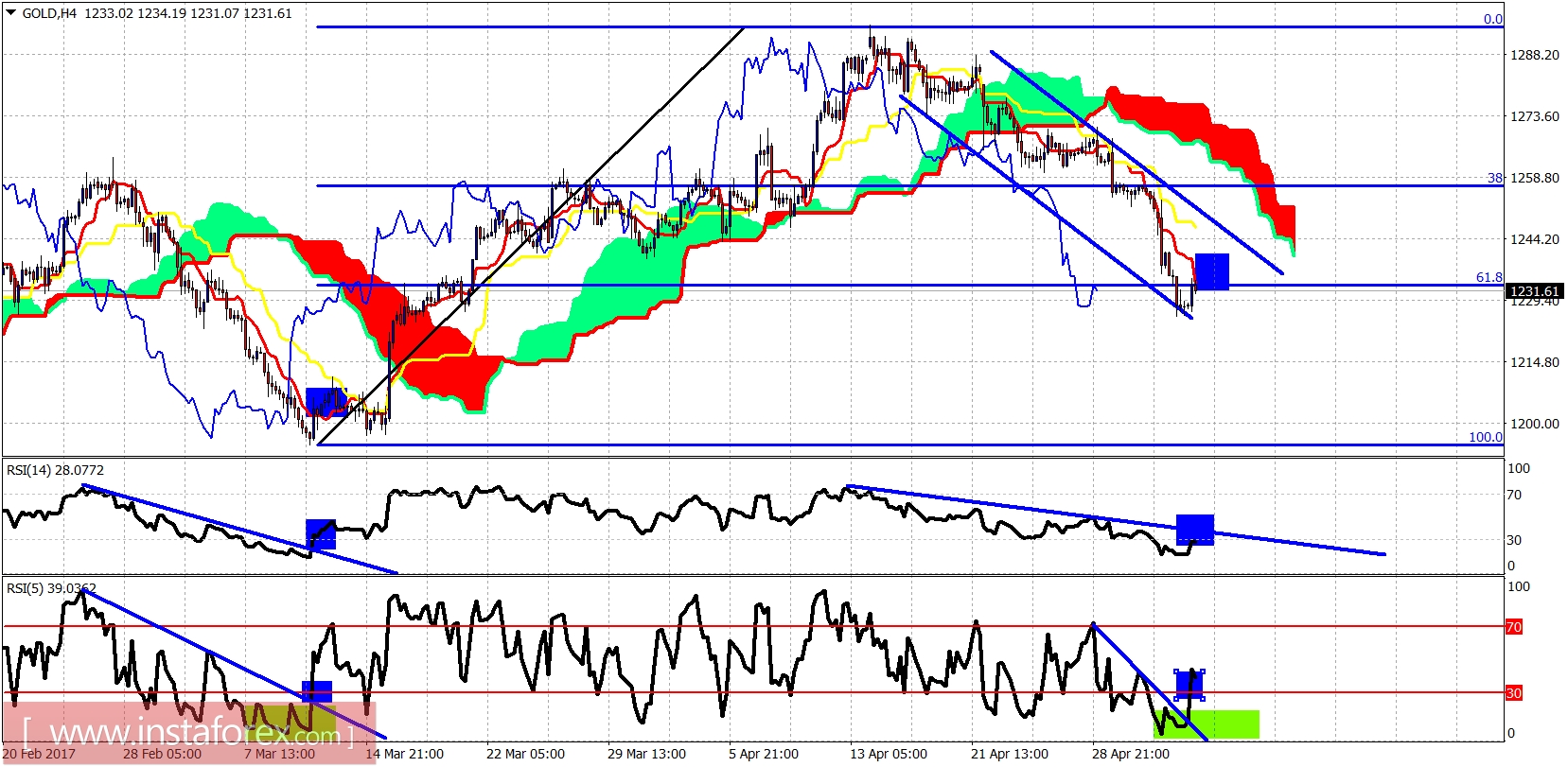

Gold price has broken to new lows yesterday but is very close to making an important bottom reversal if it has not already bottomed. Gold price should bounce at least towards $1,260-70. There are many signs of bullish divergence and similar to when Gold was at $1,194.

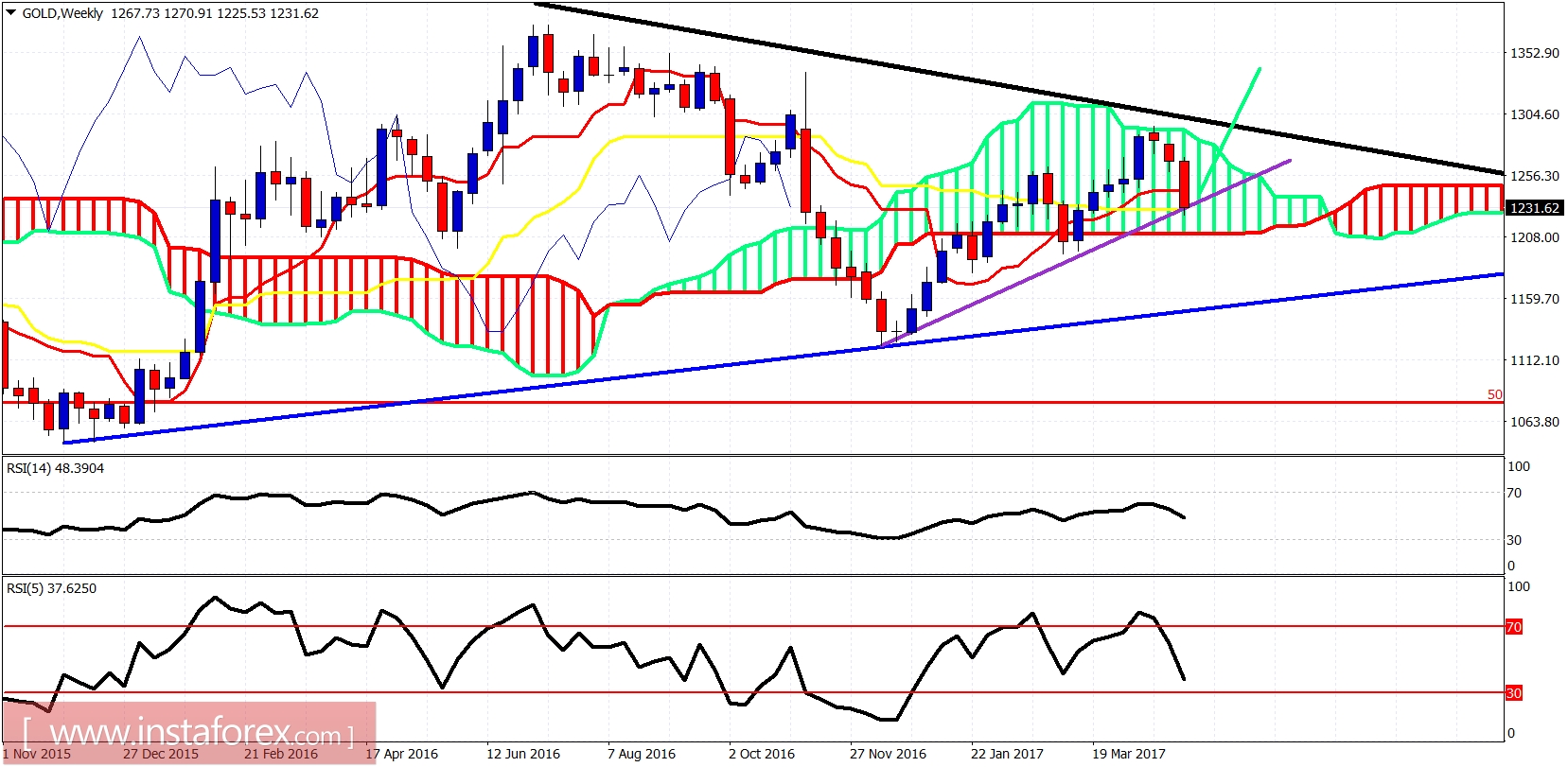

Purple line - support

Blue line -long-term support

Black line - long-term resistance

Gold price was rejected a couple weeks ago at the long-term resistance trend line and the upper cloud boundary. Price is now testing the purple trend line support and the weekly kijun-sen (yellow line indicator). A bounce is expected from current levels. However, a break below $1,220-$1,210 on a weekly basis will imply that Gold should move even lower towards $1,160. My long-term view remains bullish expecting Gold towards $1,500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română