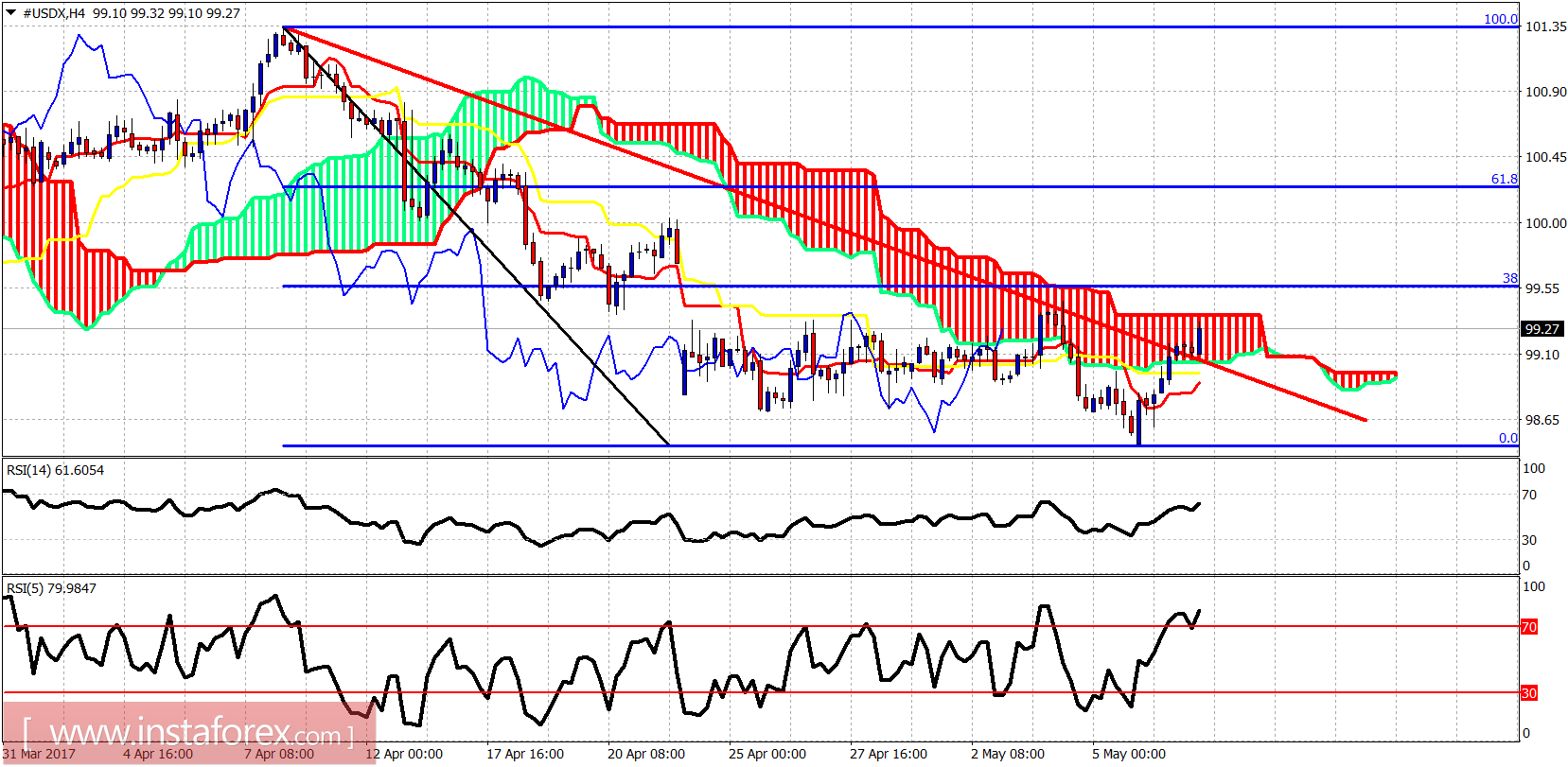

The Dollar index is bouncing as we expected from our last post. Price is now trying to break above the 4-hour Kumo resistance and move towards the first Fibonacci retracement level of importance at 99.60.

Red line - resistance

The Dollar index has broken above the red trend line resistance. Trend is neutral in the 4-hour chart as price is inside the 4-hour Kumo. Important short-term resistance is at 99.37 and 99.60. The upper cloud boundary and the 38% Fibonacci retracement are the levels to watch.

Green line - support

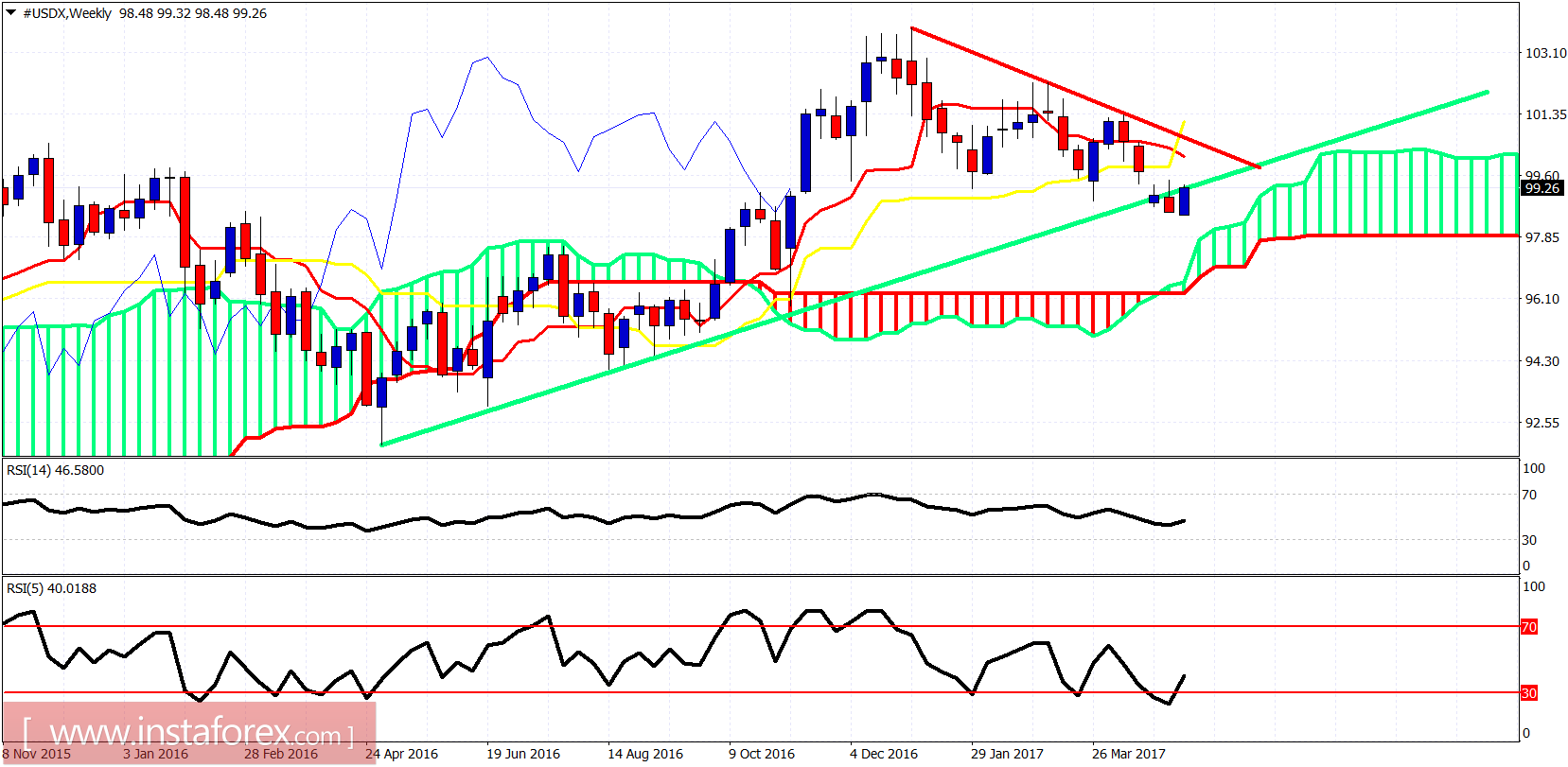

The Dollar index has broken below the green long-term trend line support and is now trying to get back inside. The bounce was justified and awaited since last week. Resistance is at 100.20 (tenkan-sen) and at 100.60 (red trend line). Support is at 97.50 at the weekly upper Kumo boundary.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română