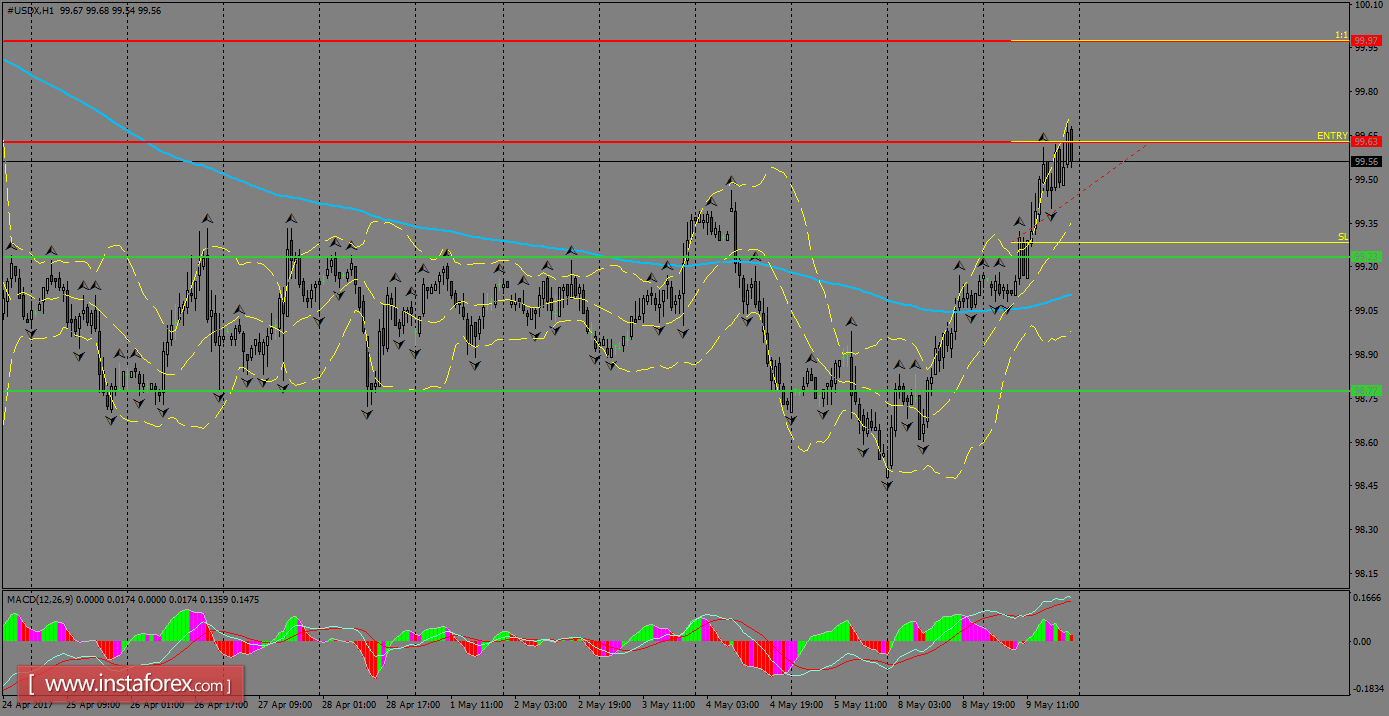

USDX continues to strengthen in the short term and it's approaching the 100.00 handle. With a consolidation above the 200 SMA at H1 chart, we can expect further rallies to reach that psychological zone. As the current move was done within an impulse, a pullback can happen towards the support zone of 99.23. MACD indicator is turning flat, calling for sideways in the index.

H1 chart's resistance levels: 99.63 / 99.97

H1 chart's support levels: 99.23 / 98.77

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD index breaks a bullish candlestick; the resistance level is at 99.63, take profit lies at 99.97 and stop loss is at 99.28.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română