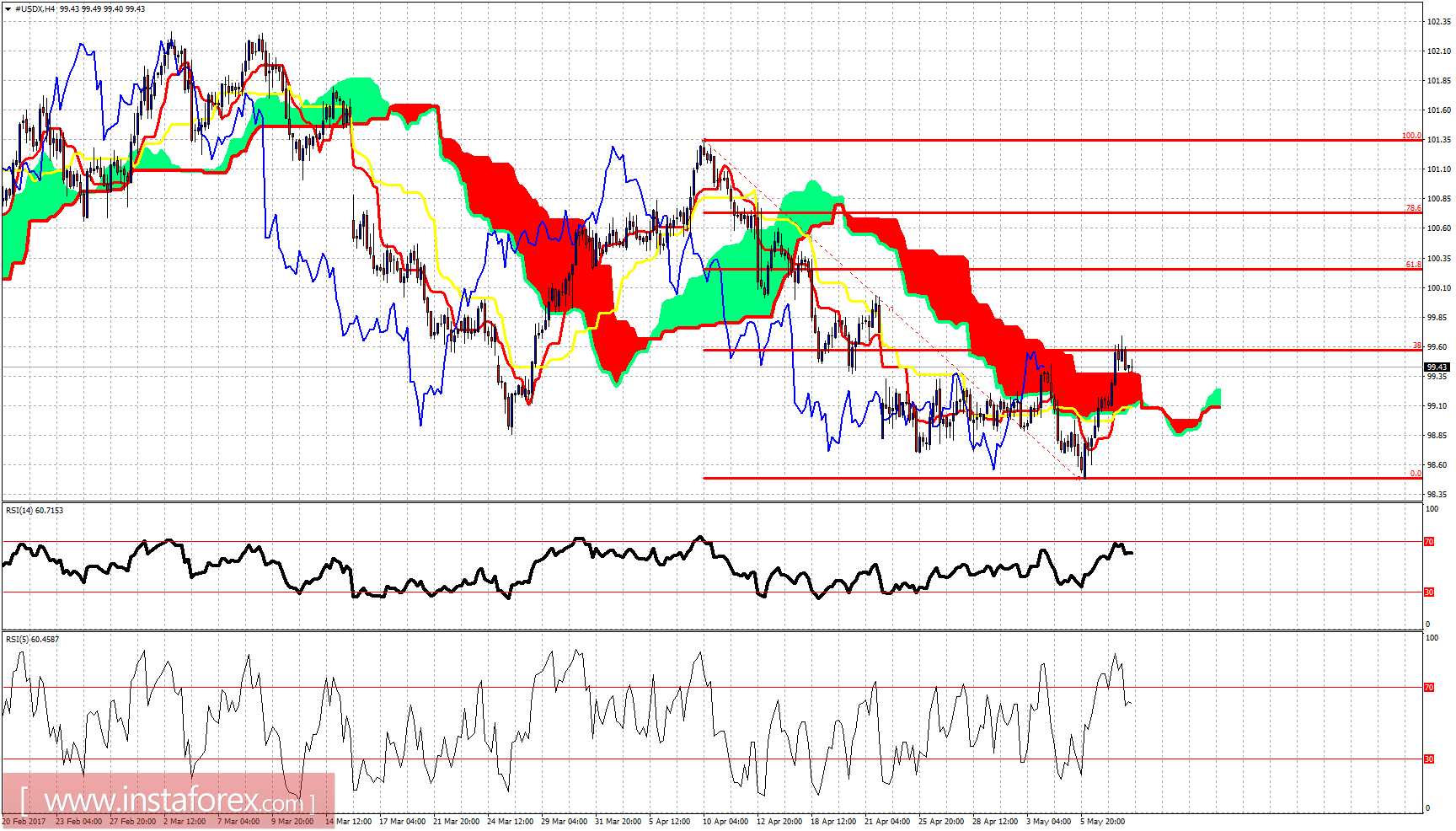

The US dollar index bounced yesterday, as expected, and reached our first target at 99.50 where the 38% Fibonacci retracement resistance is found. A clear daily break above 99.60 will open the way towards 100.20 as the price has broken above the 4 hour cloud resistance.

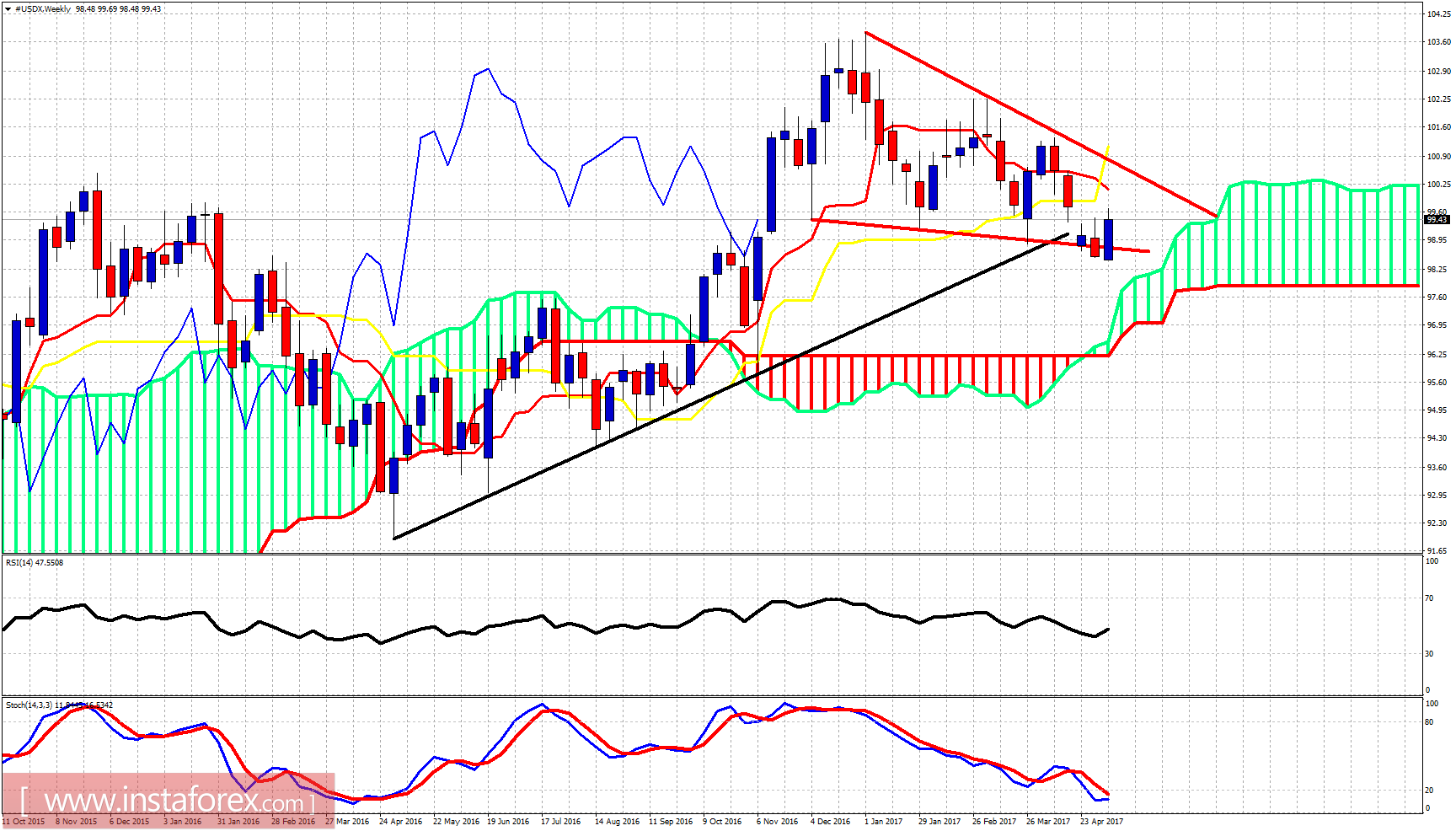

Black line - long-term trend line support

USDX remains inside the triangle pattern and above the weekly Kumo. The price is bouncing as expected and could even reach the upper triangle boundary resistance at 100.30. Only a break above the 100.30 and 101.30 will confirm that an important low is forming and that a new up trend has started.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română