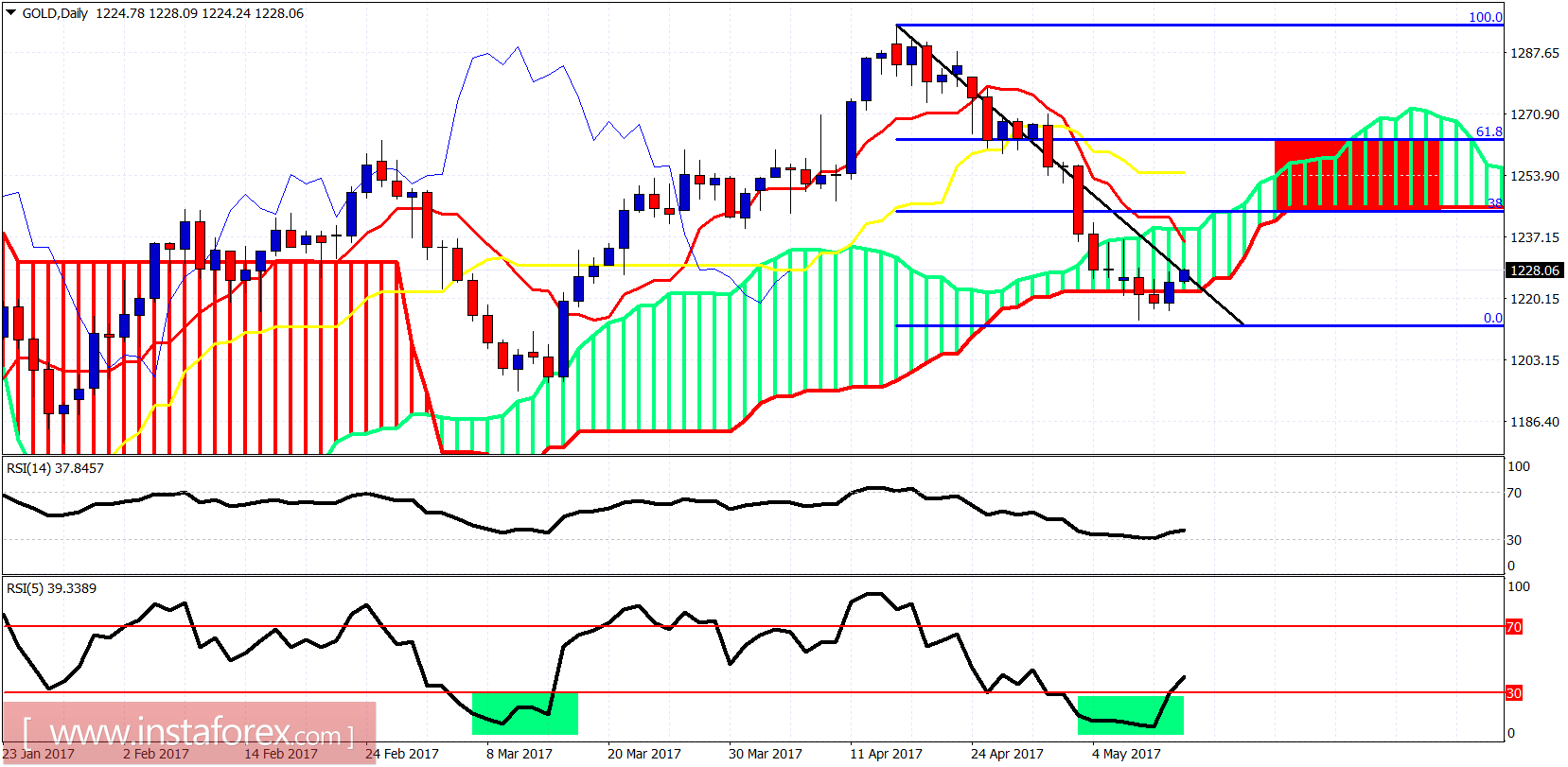

Gold price is bouncing and trying to break out of the bearish channel. Trend remains bearish as price is below the 4-hour Kumo. Important resistance levels ahead at $1,245 and at $1,260 must be broken so that the bullish scenario of $1,300-$1,400 is realized.

Gold price is breaking above the tenkan- and kijun-sen indicators on the 4-hour chart. Price remains below the Kumo and is still inside the bearish channel. Trend remains bearish. Short-term resistance is at $1,230 but the most important level is at $1,245 and at $1,260.

target is between $1,240 and $1,260. Breaking above it will open the way for a bullish move above $1,300.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română