Gold price as expected is pulling back from the important weekly resistance at $1,260. Bulls now we need to see a higher low relative to the May lows at $1,214. A corrective pullback that will not hurt the bullish scenario should hold above $1,234.

Gold price is trading above the 4-hour cloud. Trend is bullish. Gold price could bounce from current levels as price has found support at the 38% Fibonacci retracement of the rise from $1,214. Next important support is at $1,234 where the 61.8% and the cloud supports are found. Bulls should not lose that level. On the other hand bears stopped the rise right at the important resistance of $1,260. Now they need to break back below the cloud for the move towards $1,150-60 to start.

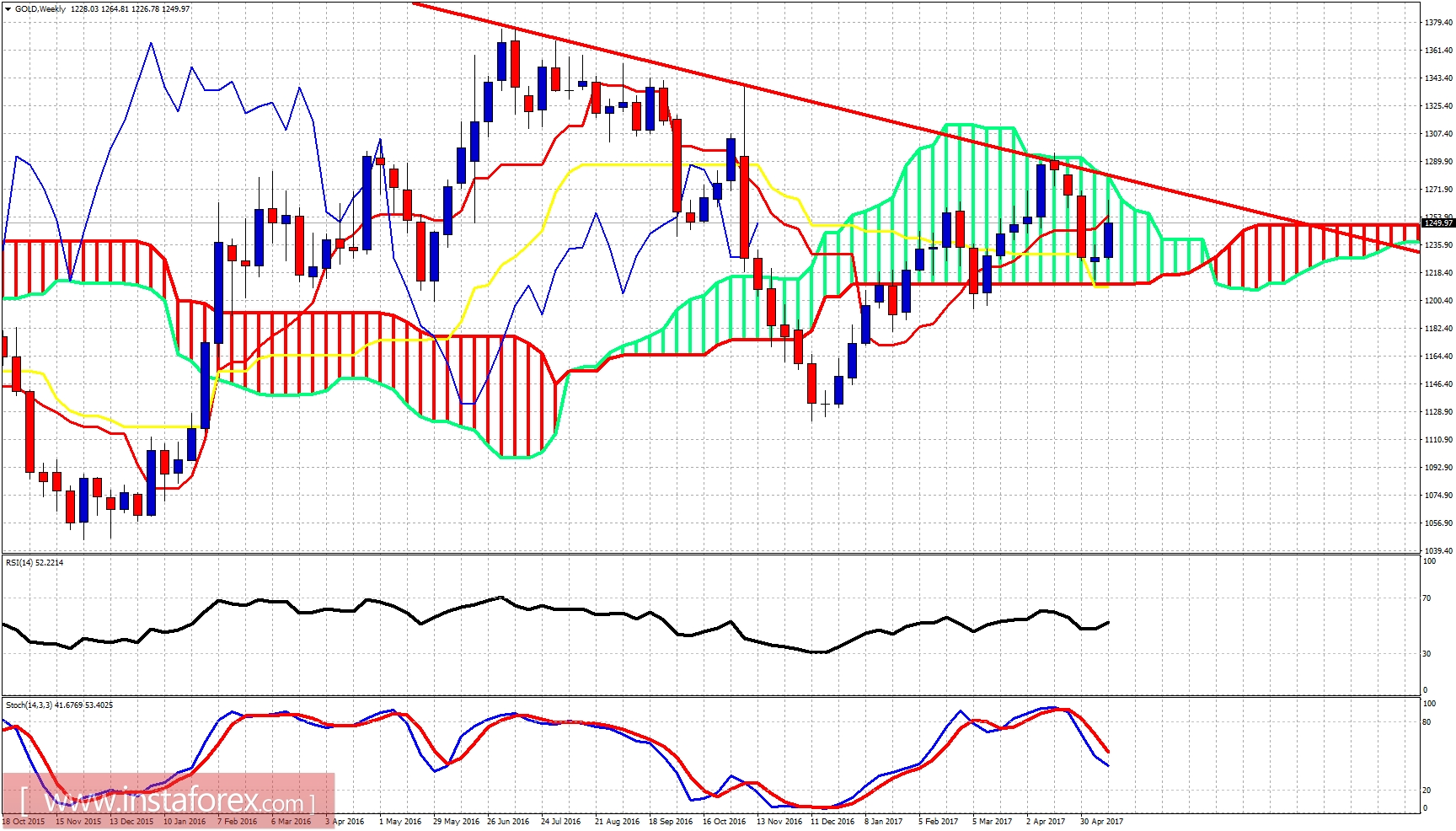

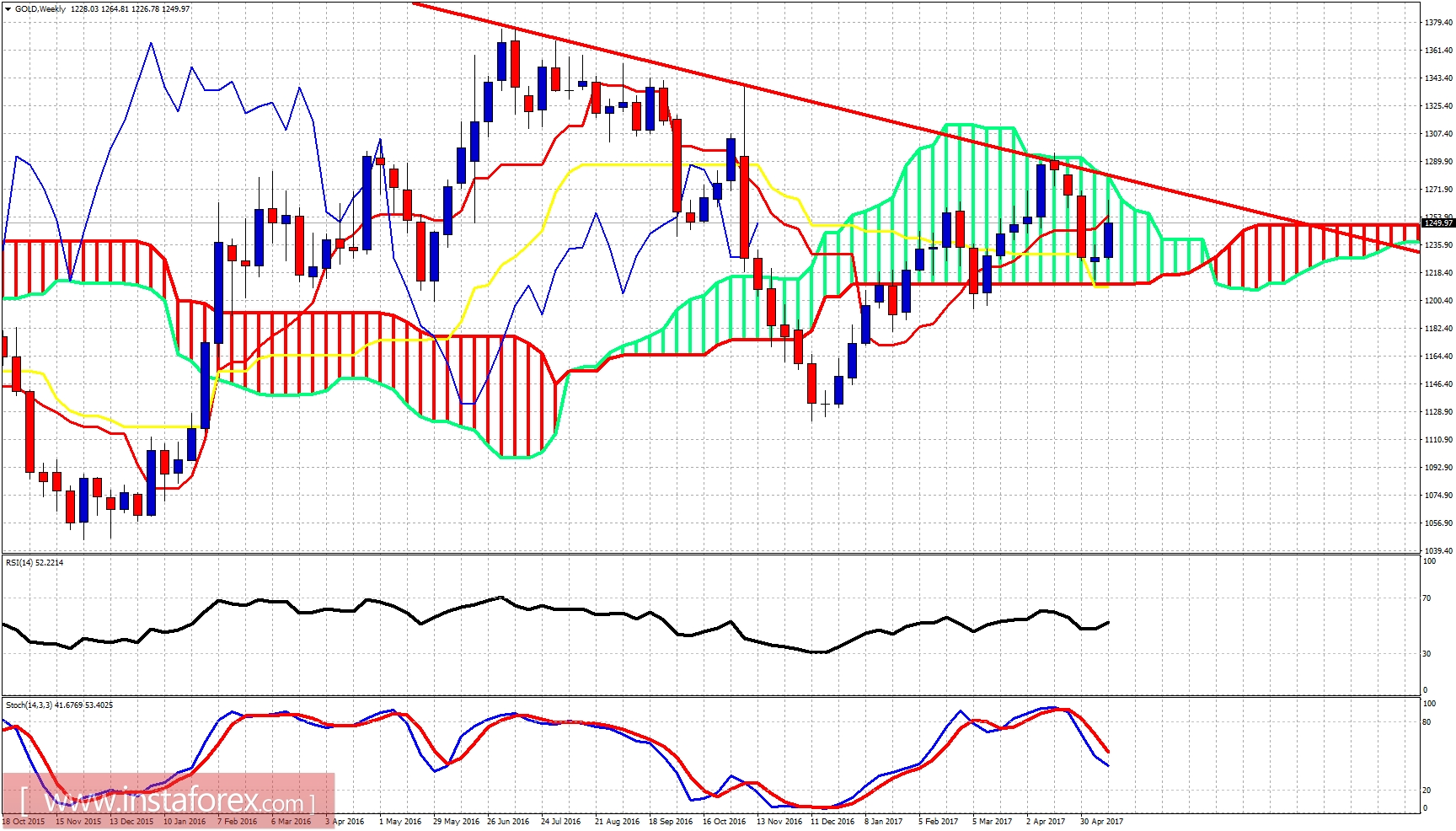

Red line -long-term resistance

Gold remains inside the weekly Kumo (cloud). Weekly trend remains neutral. Price remains below the weekly trend line resistance. However the bounce off the lower cloud boundary was a bullish sign. Bulls however need to break above the weekly cloud at $1,280 for the bull trend to be confirmed.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română