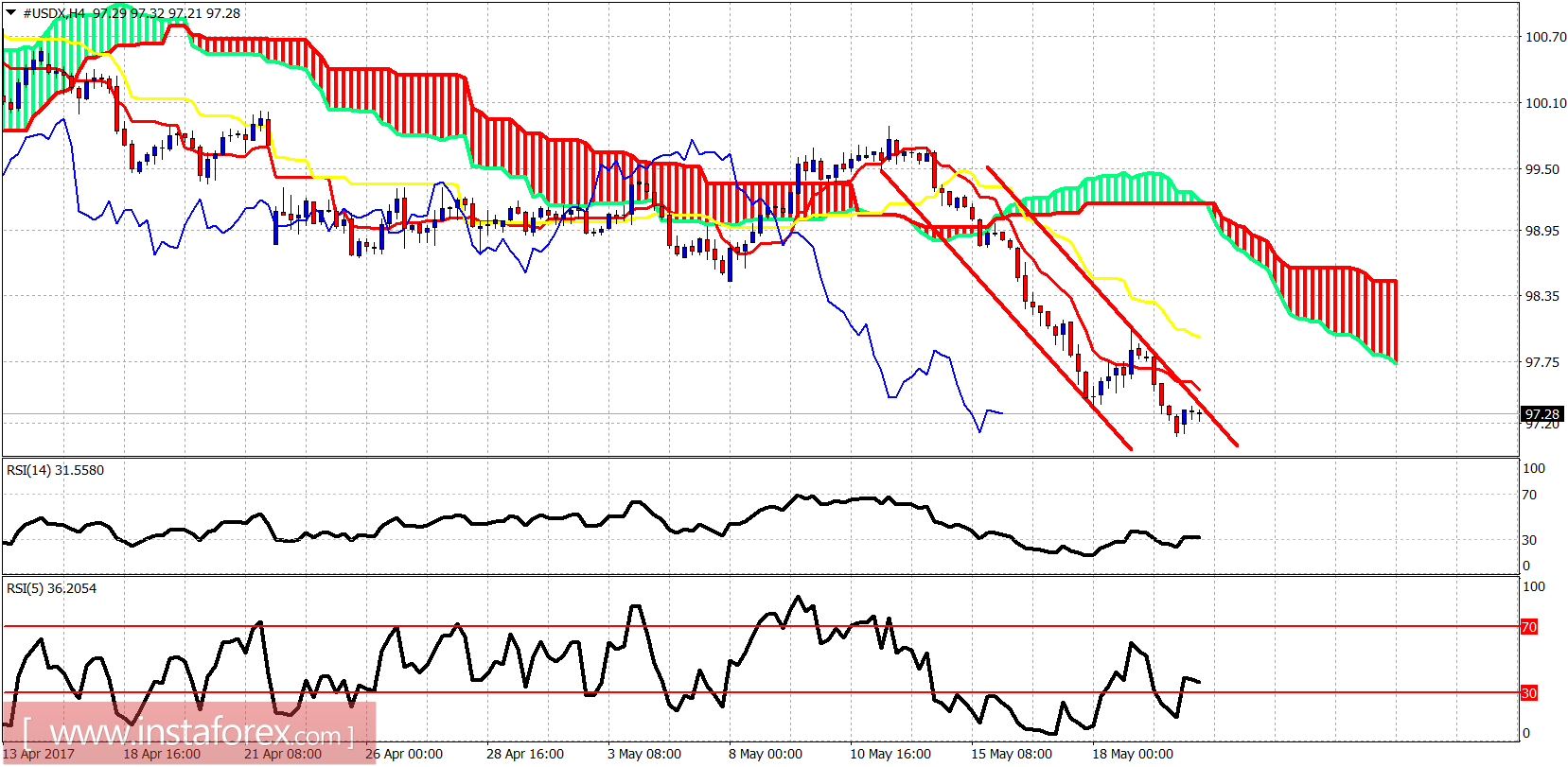

The Dollar index is oversold, diverging and is expected to move higher this week towards at least 99 - 99.50. Price is expected to reverse upwards this week so I prefer to be Dollar bullish. Price is at important weekly support.

The short-term trend remains bearish as price is inside the bearish red channel and price below both the tenkan- and kijun-sen. I expect the Dollar index to bounce at least towards the Kumo (cloud) at 99.

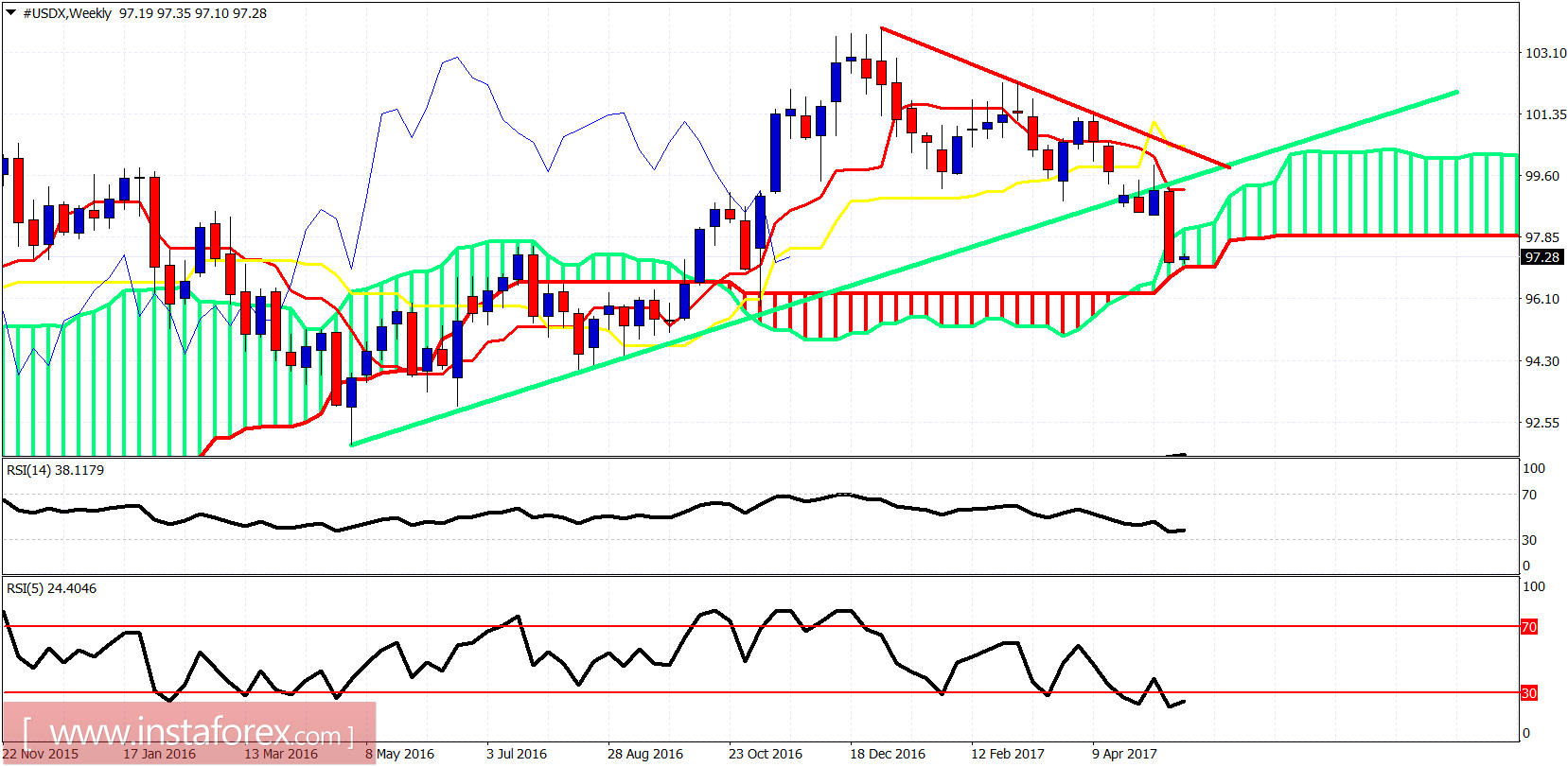

Green line - long-term trend line support (broken)

The Dollar index is at the weekly Kumo. Trend is about to turn bearish with price having broken the long-term trend line support. In the short-term, I expect a strong bullish reversal as the RSI (5) is oversold and about to turn higher. Price at the weekly Kumo should at least make a technical reflex bounce to 99. So I would wait for a bounce higher before re-entering short Dollar positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română