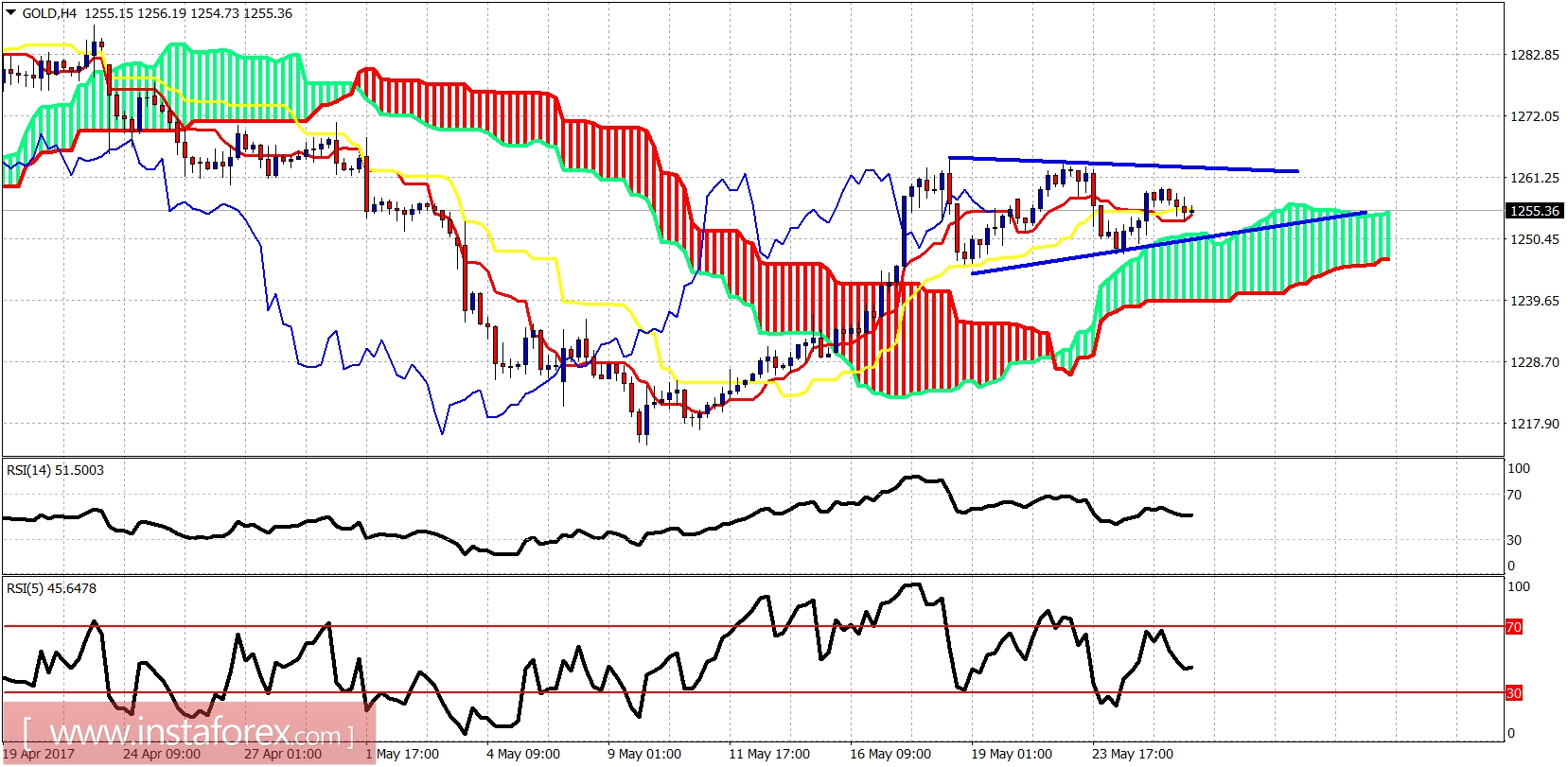

Gold price is forming a sideways triangle price action. This tightening range will soon provide a break out and a clear signal. I believe that it is more probable the breakout to be to the upside.

Gold price is trading around the tenkan- and kijun-sen indicators above the 4-hour Ichimoku cloud. Trend is neutral in the short term. Resistance is at $1,263. Support is at $1,250.

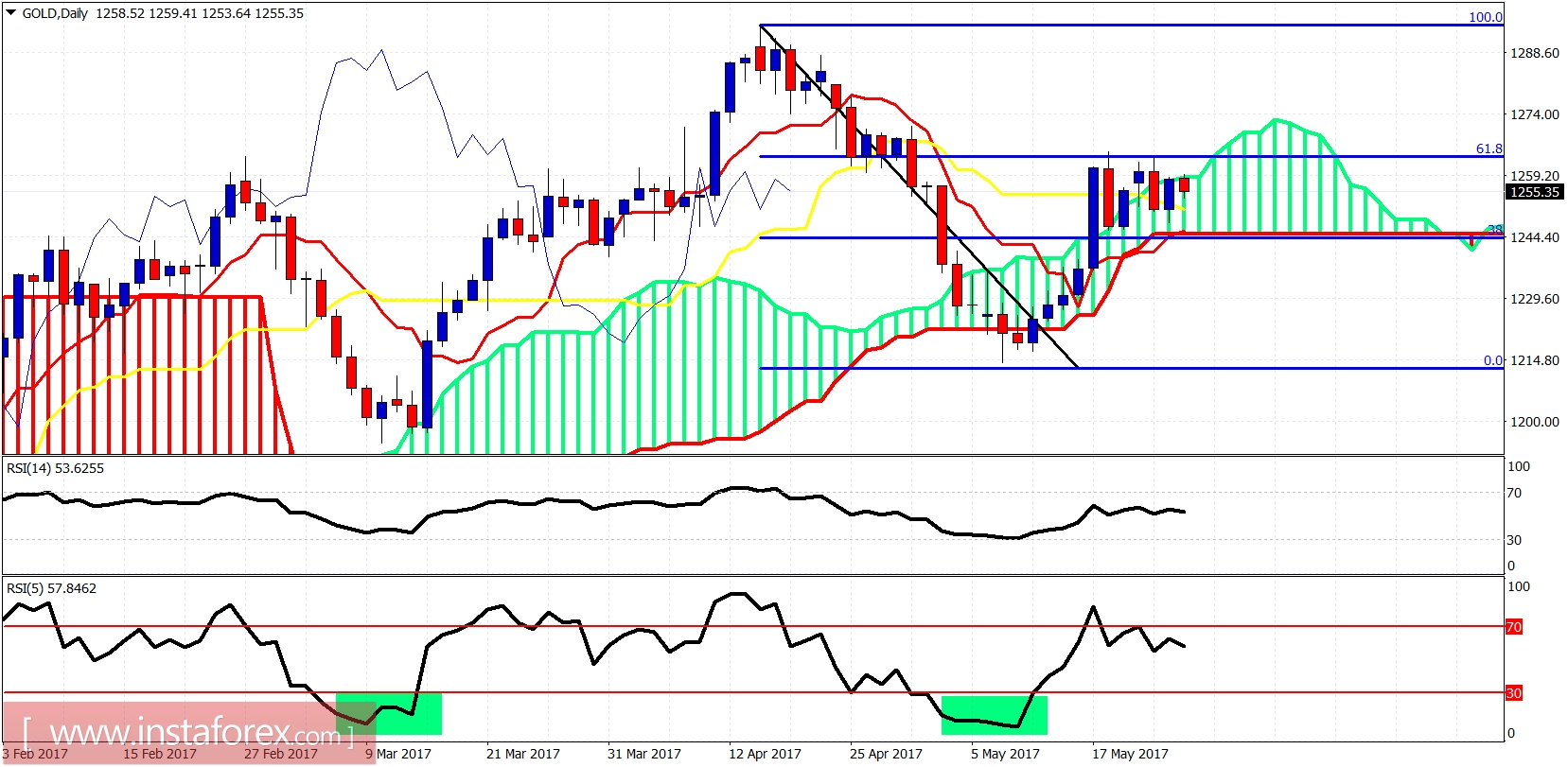

in a row. Price is near the upper cloud boundary and a daily close above it will be a bullish sign that will push price towards $1,280-$1,300. A close below $1,245 will be a bearish sign as price will be below the daily cloud.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română