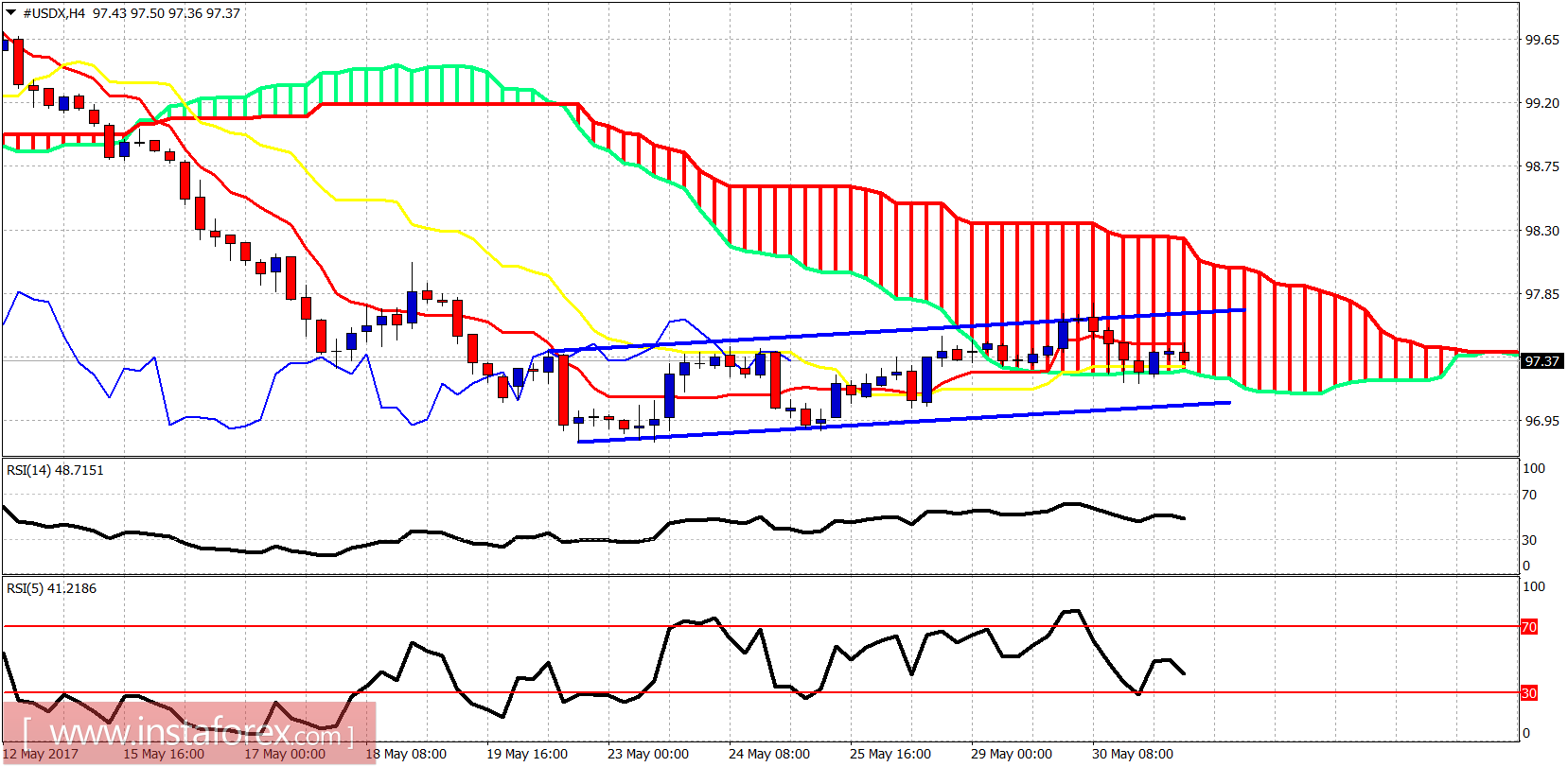

The Dollar index strength was short lived as price fell back towards short-term support at 97.25 area. Price remains inside a sideways channel and trading range. We need a clear break above 97.75 or below 97 to see a clear trending move.

The Dollar index is trading inside the 4-hour Kumo. Trend is neutral as we also mentioned yesterday. Unless the trading range boundaries are broken, we will remain in the range until Friday and the announcement of the NFP data.

Green line - support (broken)

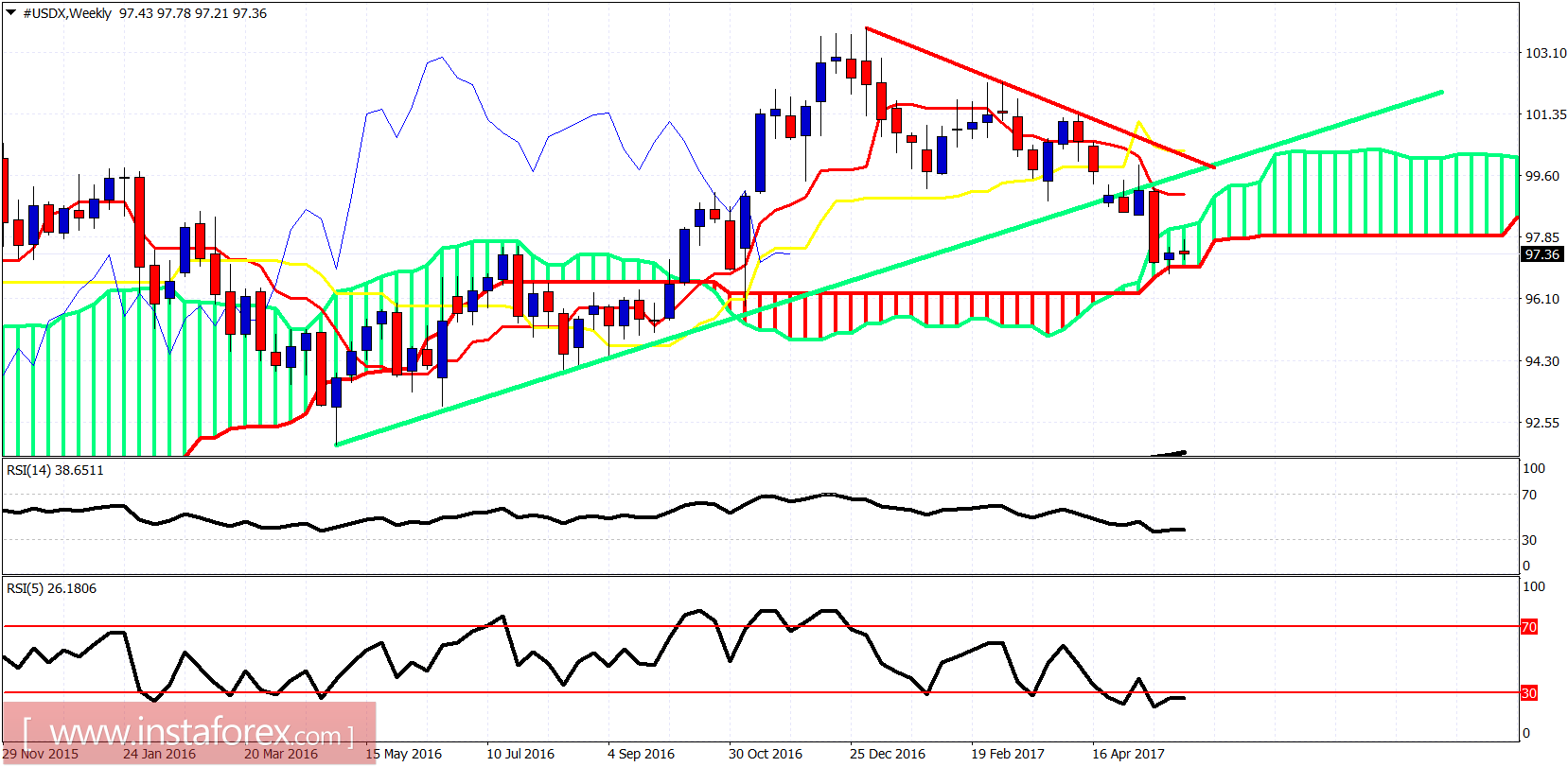

The weekly candles are at important Kumo (cloud) support. I expect a bounce from the 97 area and the Friday NFP data could be the trigger behind the expected Dollar bounce. I would not be bearish at current levels.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română