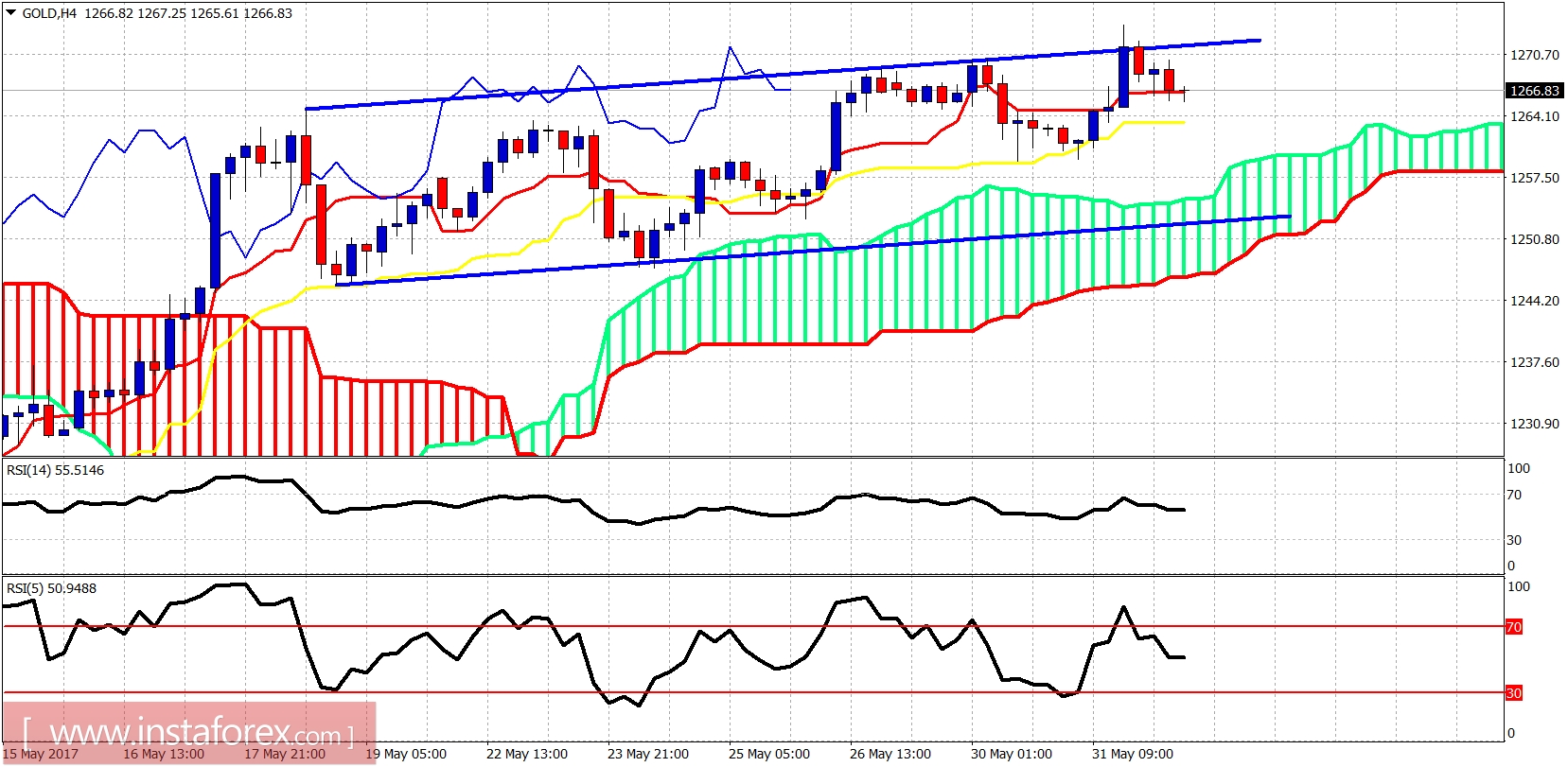

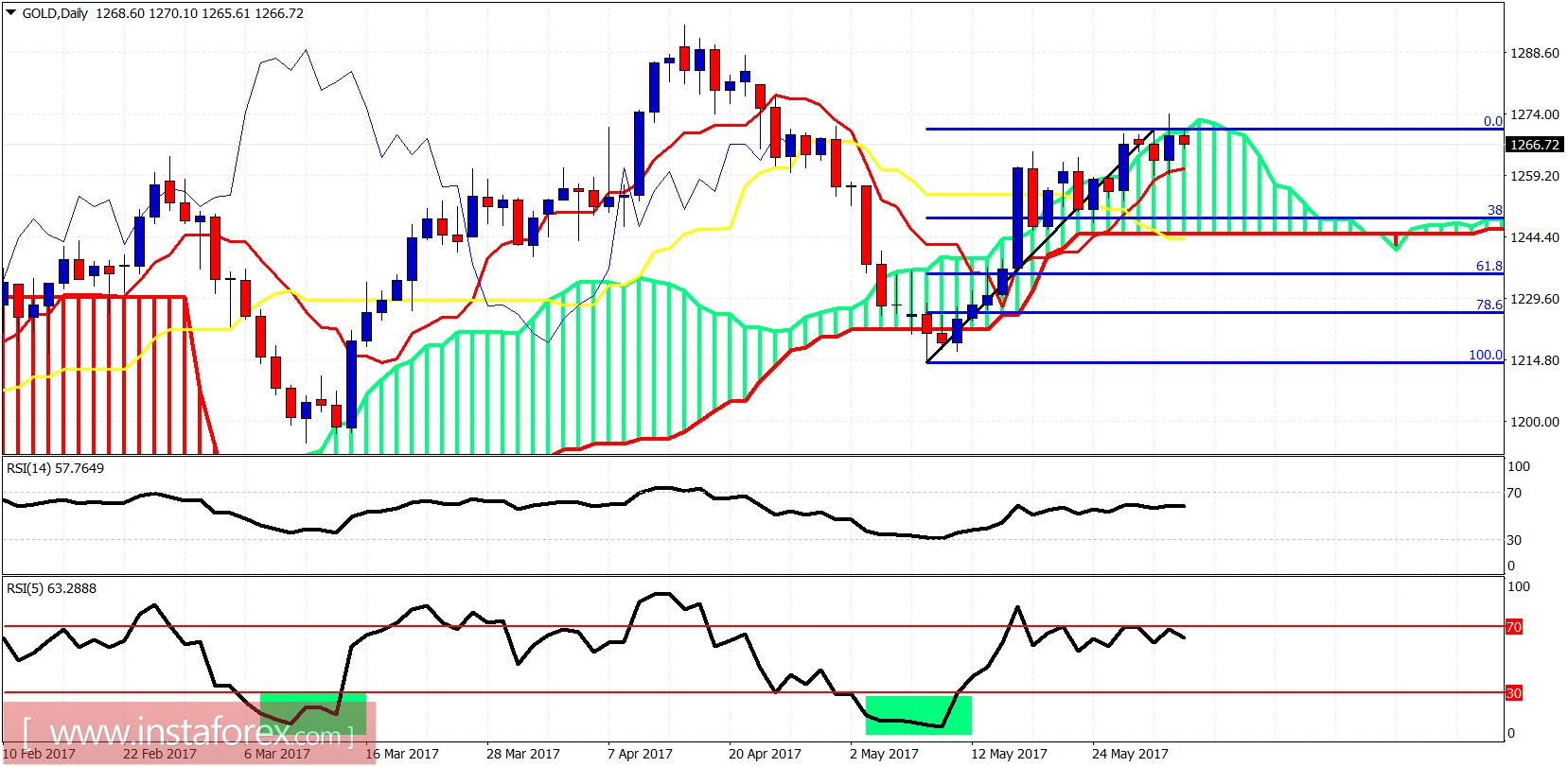

Gold price has reached the upper trading range boundary resistance and is pulling back down. Short-term traders could try and profit from short positions with tight stops at $1,275 as a pullback towards the lower boundary level is justified.

Gold price got rejected at the upper blue trading range boundary. Price remains above both the tenkan- and kijun-sen indicators. Trend remains bullish. As said in previous posts, we could see a slow grind higher but overall I expect price to pull back towards $1,255.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română