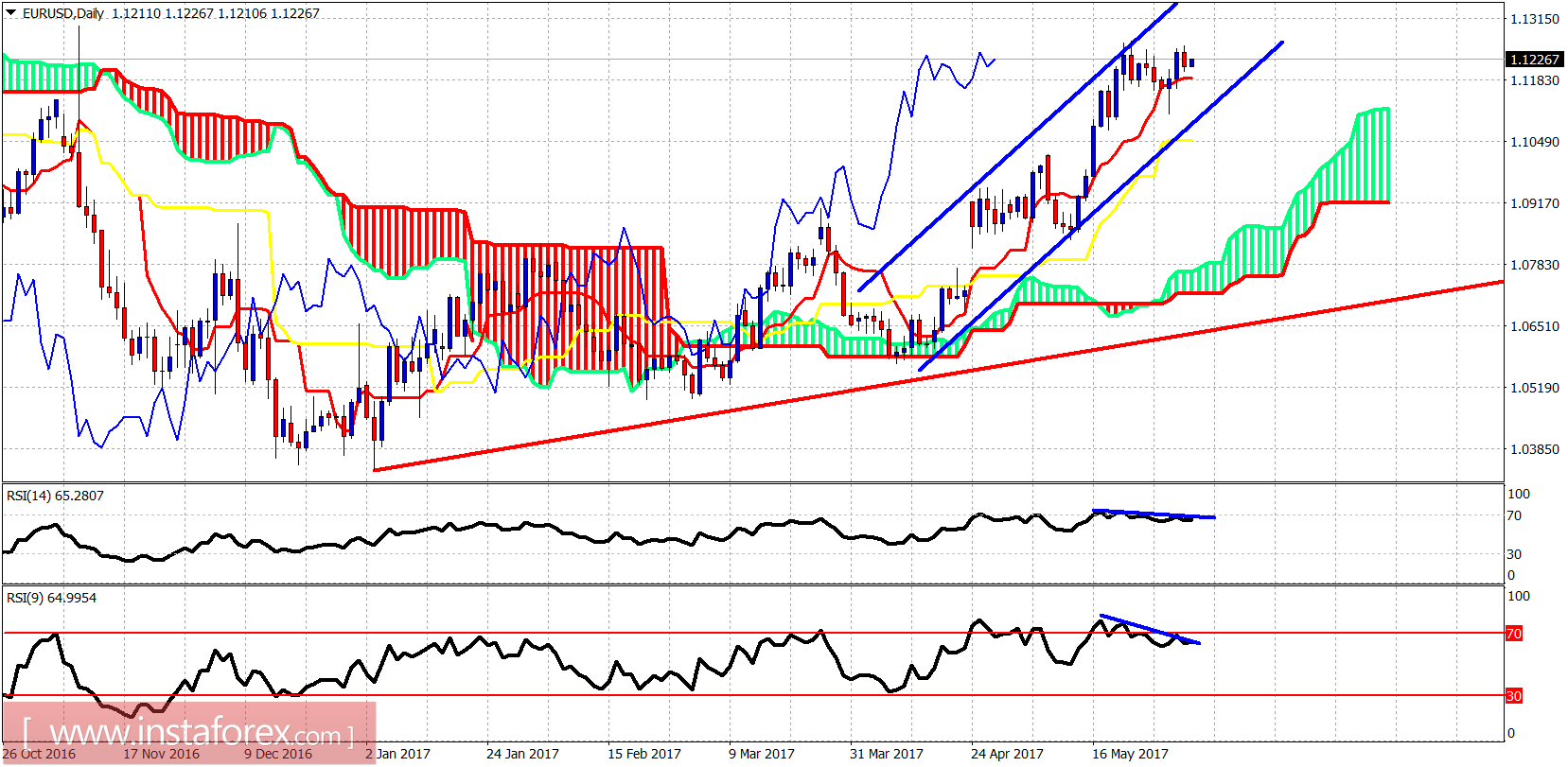

EUR/USD is making higher highs and higher lows but there are several warning signs in both the 4-hour and daily charts implying a pullback is imminent towards 1.1050 at least.

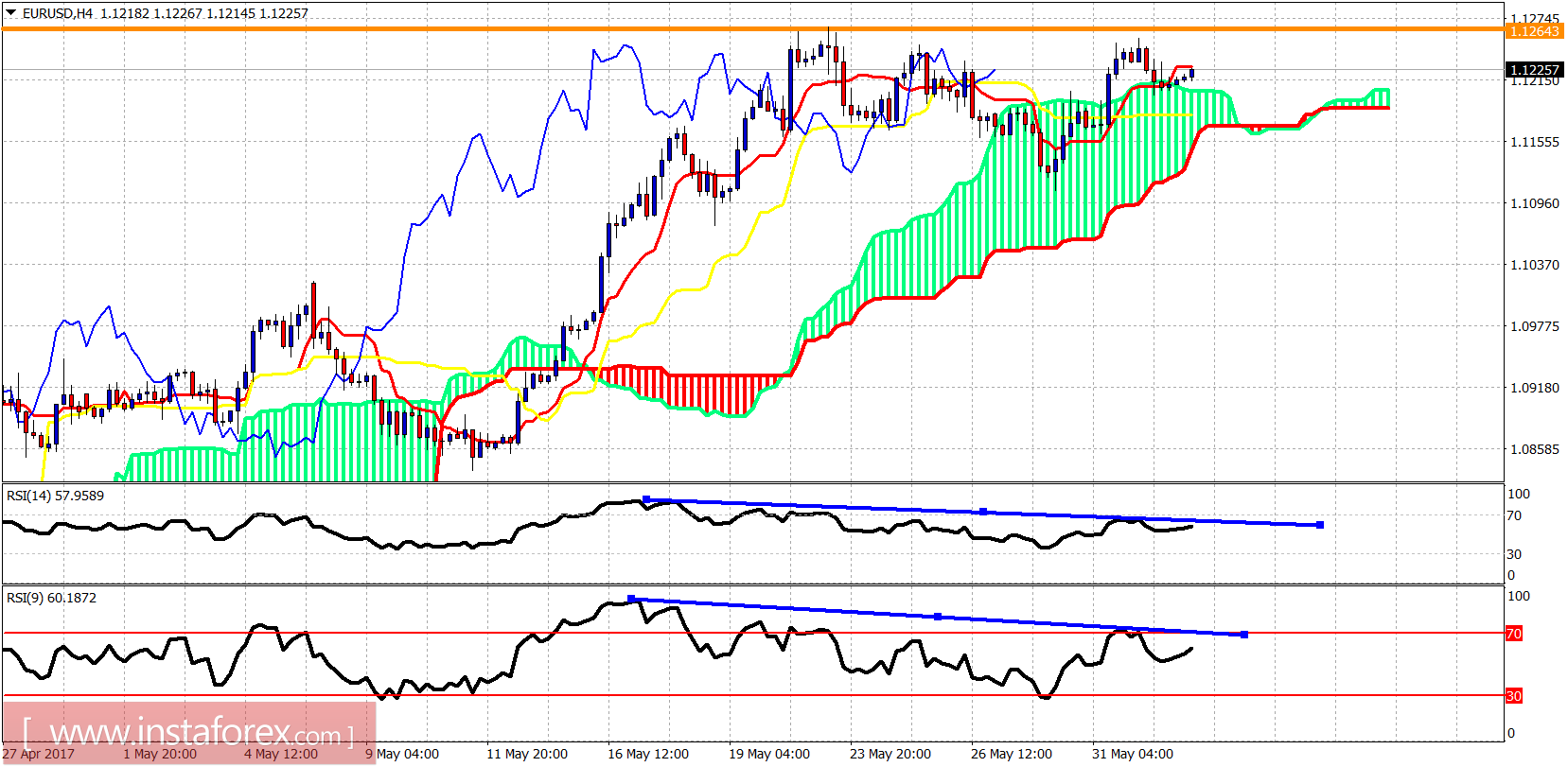

EUR/USD is trading above the 4-hour Kumo but has made a double top rejection so far at the 1.1260 area. The RSI provides negative divergence. We could see a new higher high but overall I expect EUR/USD to give a sell signal by breaking back inside the Kumo at 1.12 and moving lower.

Red line - long-term trend line support

On a daily basis, EUR/USD is trading inside a bullish channel. Trend is bullish. However, short-term indicators point to a pullback towards at least the lower channel boundary above 1.1050 before the resumption of the uptrend. There are daily divergence signs supporting this view.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română