Monthly Outlook

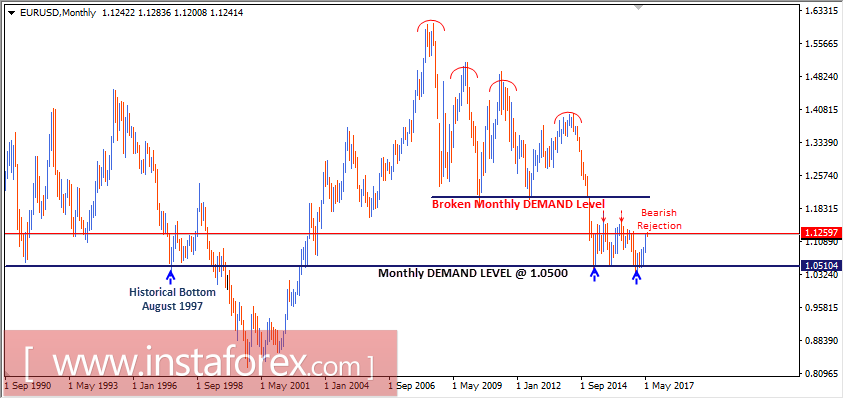

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2100 (Multiple previous bottoms set in July 2012 and June 2010). Hence, a long-term bearish target is projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

Otherwise, the EUR/USD pair remains trapped within the depicted consolidation range (1.0500-1.1260).

Daily Outlook

In January 2017, the previous downtrend was reversed when a Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

The next daily supply level to meet the EUR/USD pair is located between (1.1400-1.1520) where price action should be watched for possible bearish rejection.

Trade recommendations:

The EUR/USD pair remains bullish initially towards 1.1400 unless evident signs of bearish rejection is expressed earlier on the chart.

A valid SELL Entry can be considered at the depicted supply zone (1.1400 up to 1.1520) especially if signs of bearish rejection are expressed.

S/L should be placed above 1.1550 while T/P levels should be placed at 1.1100, 1.1020 and 1.0850.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română