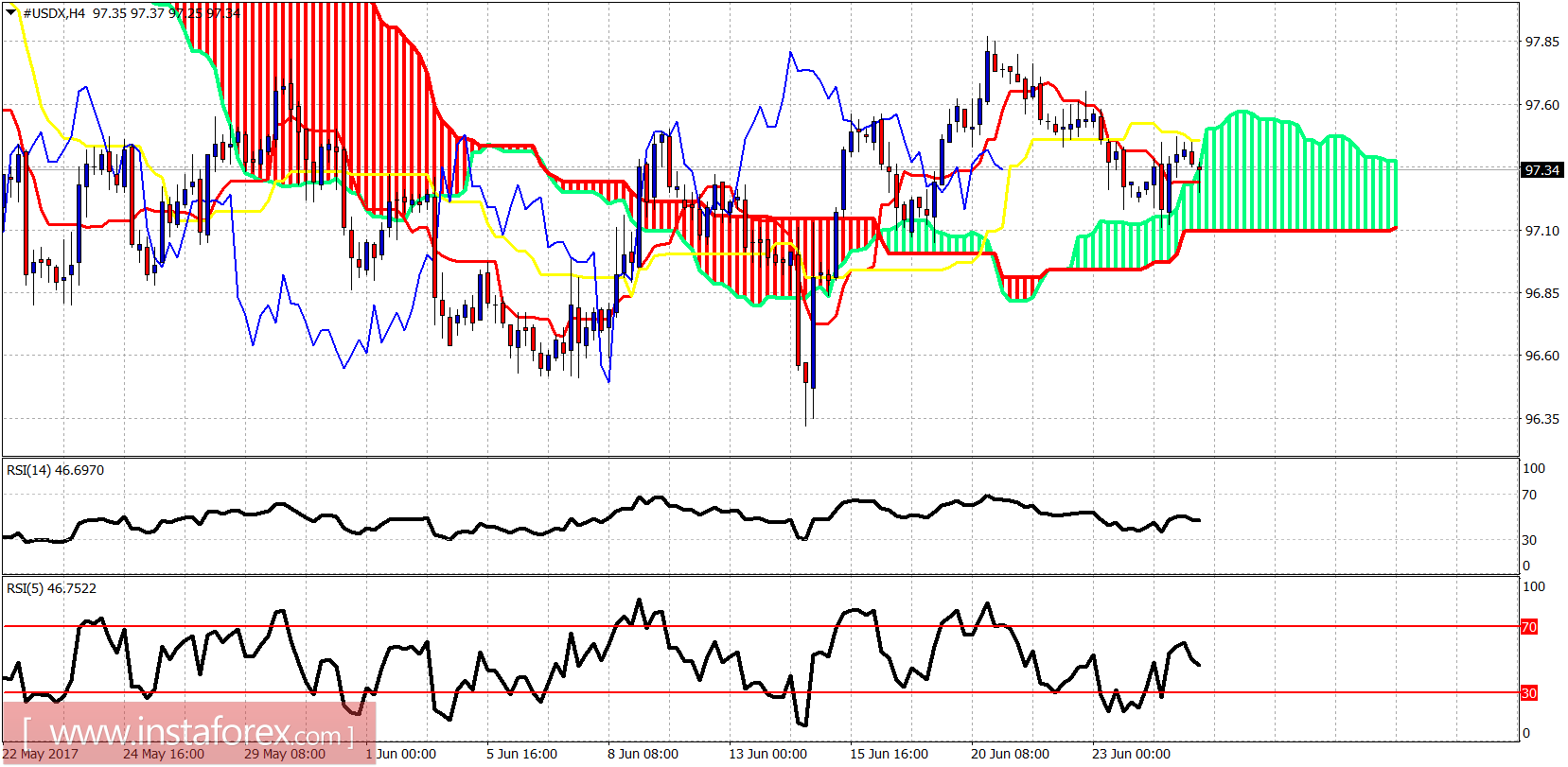

The Dollar index is holding short-term support. We might eventually see the bounce towards 98.50-99 we were expecting after all. This is not the time to be bearish on the Dollar.

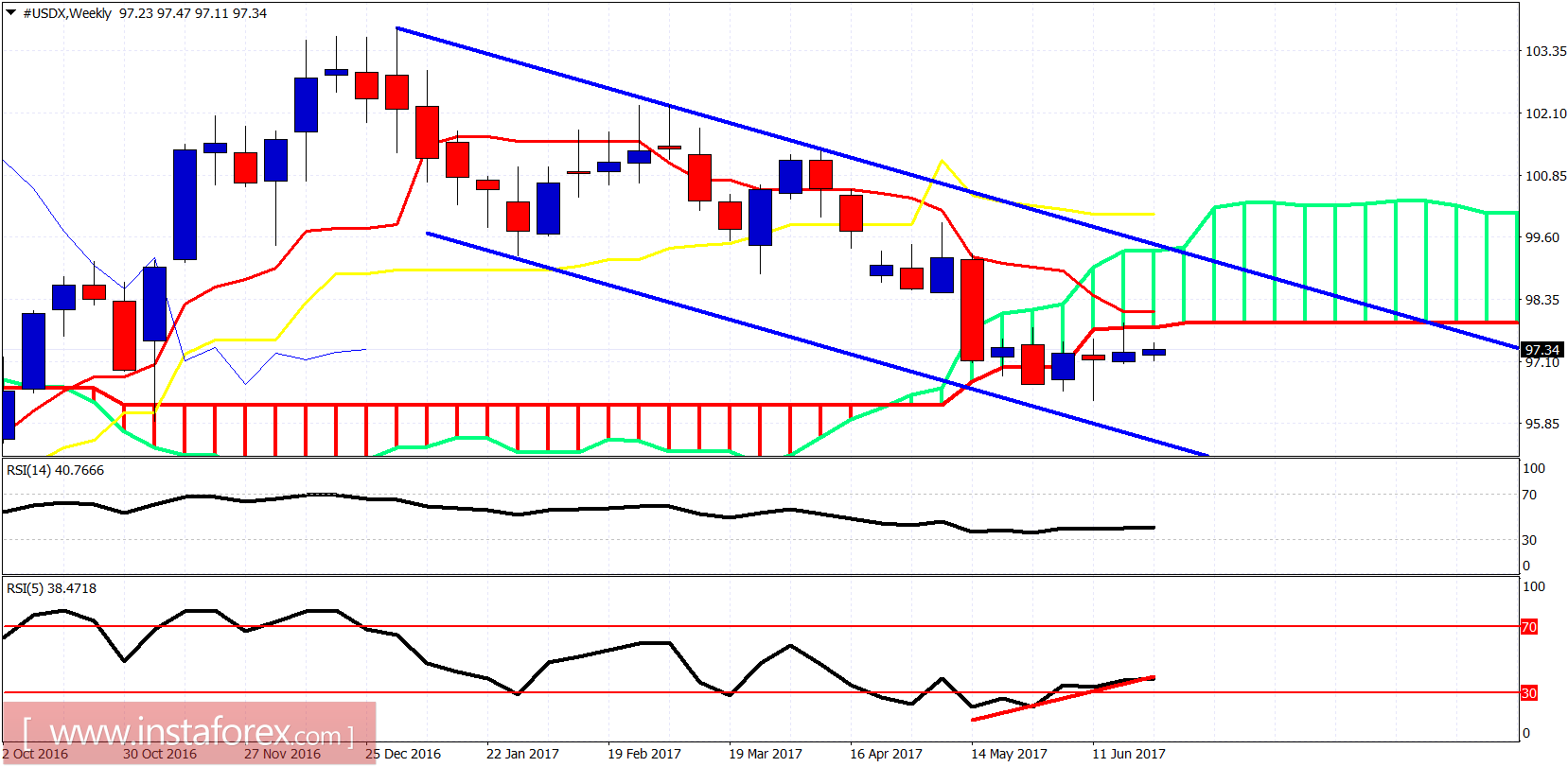

We continue to expect the Dollar index to move upwards and sideways towards the upper channel boundary. The bullish divergence signs in the weekly chart imply that next couple of weeks should continue and favor the Dollar. Despite the weekly Kumo below, there are no selling strength...and this is depicted in the divergence. That is why I expect a bounce first.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română