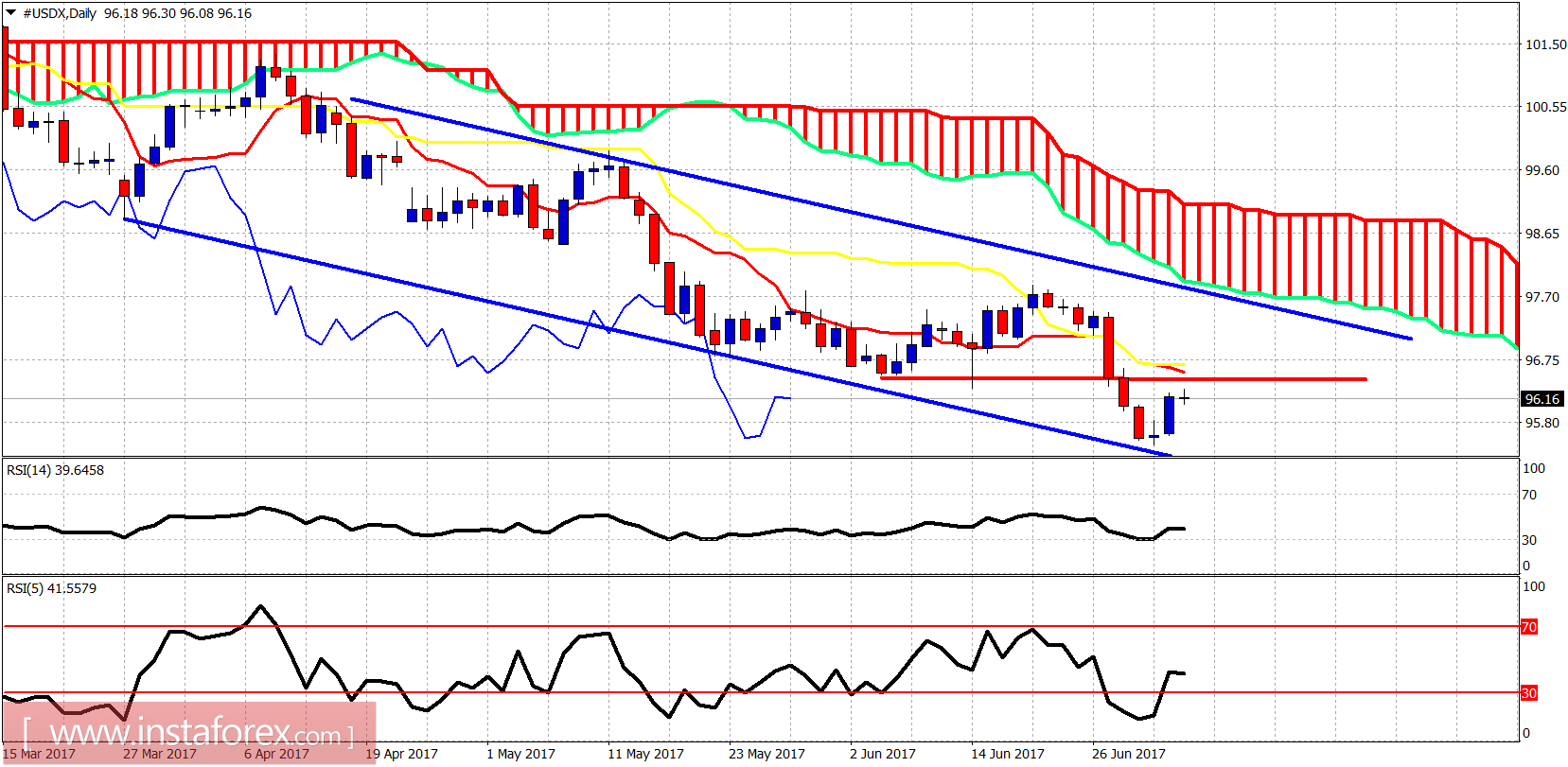

The Dollar index is bouncing as expected. The price is now making the minimum bounce requirements towards short-term resistance and previous support at 96.50. Overall I expect a bigger Dollar index bounce towards 98.

Blue lines - bearish channel

The Dollar Index is testing short-term resistance at 96.50 where we also find the 4-hour tenkan- and kijun-sen indicators. Oscillators bounce off oversold levels. I expect this bounce to continue higher.

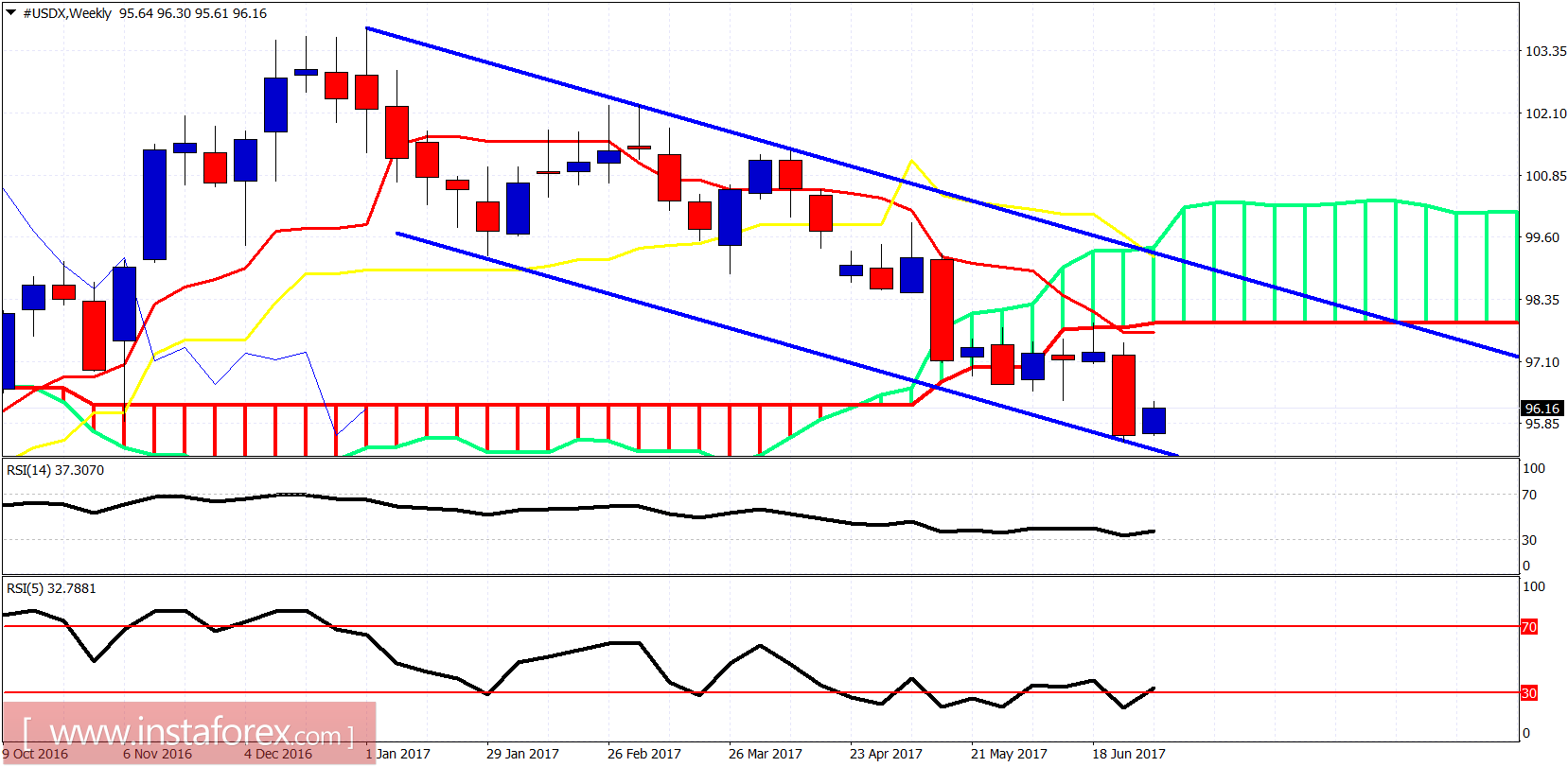

Blue lines - bearish channel

On a weekly basis, although the trend is bearish and the price is below the weekly Kumo (cloud), I expect a short-term bounce for a week or two towards 98-98.50. The RSI is diverging and oversold. I expect at least a move towards the lower Kumo boundary.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română