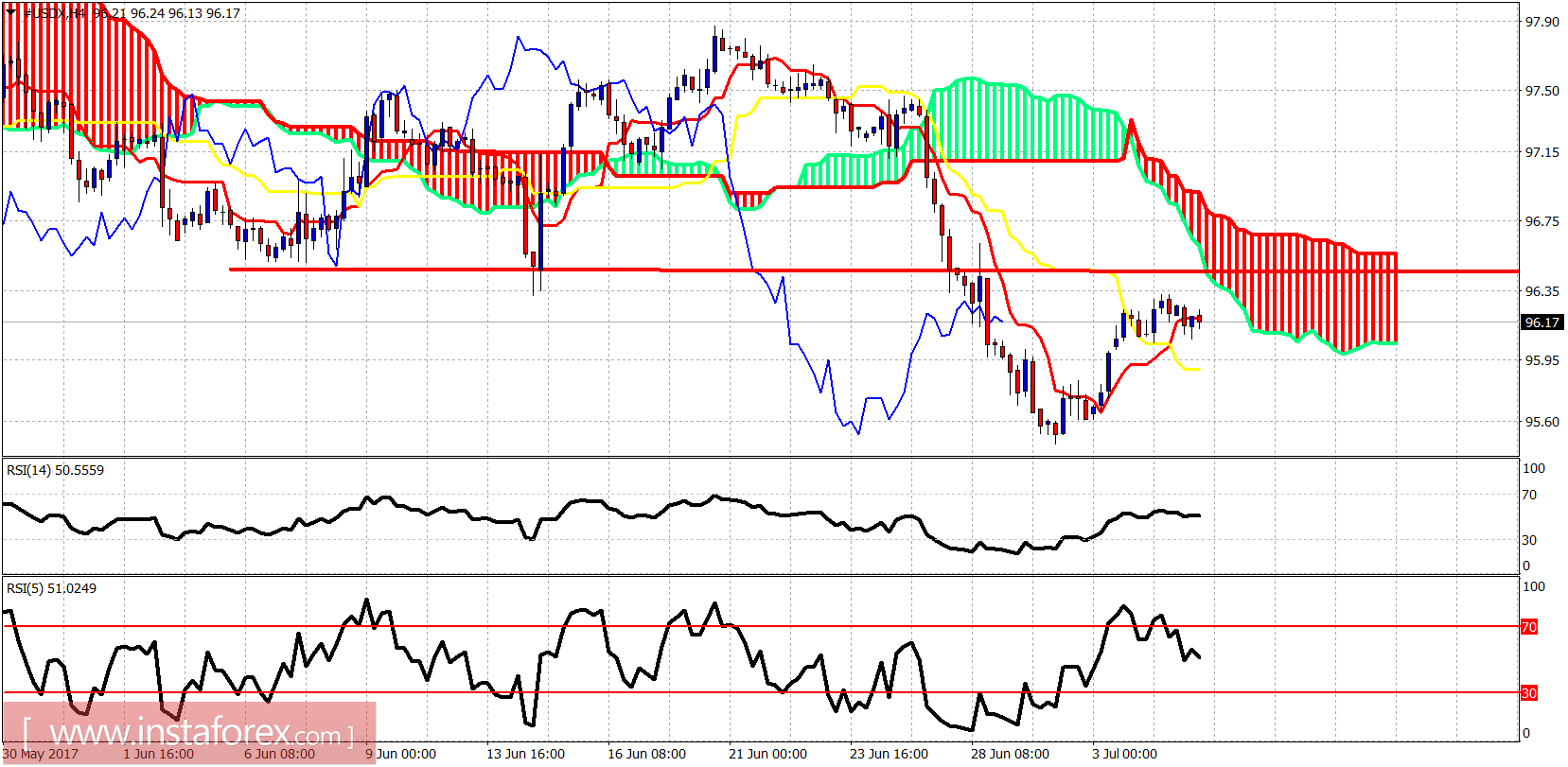

The Dollar index bounced as expected but found resistance at 96.50 and did not manage to break it. A rejection at current levels will imply a move lower below 95.

Price is below the 4-hour Kumo and trying to hold above the tenkan- and kijun-sen indicators. Support is at 96 and resistance at 96.50. A break above 96.50 could push the index towards 98. A break below 96 will open the way for new lows towards 94.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română