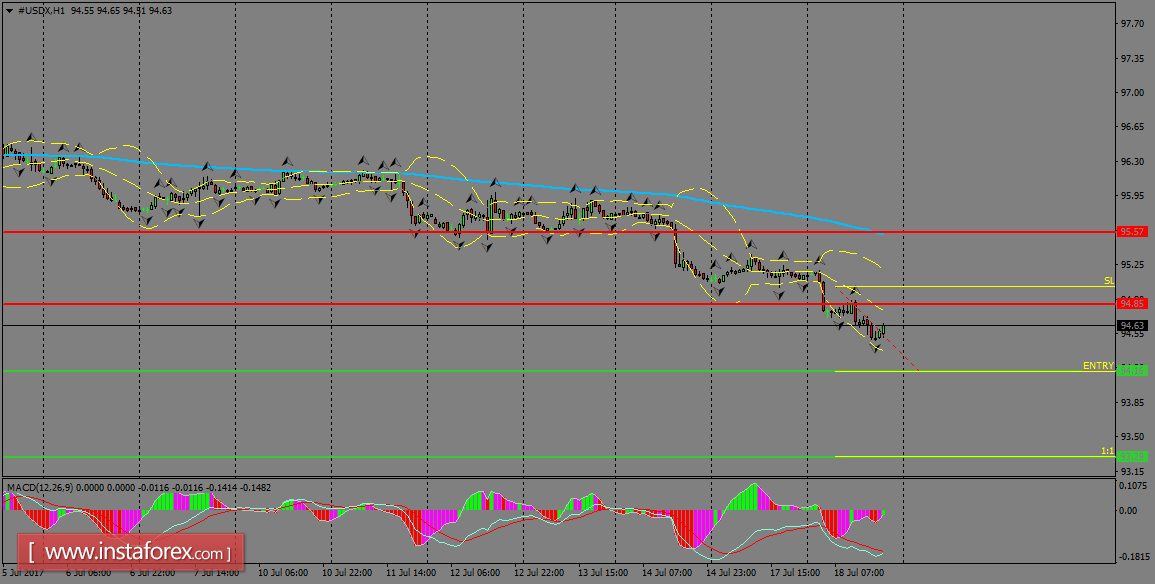

USDX extended the decline during Monday's session on Healthcare headlines that two Republicans rejected to vote for it. Currently, the index could be targeting the support zone of 94.16, where a break below that level should help to accelerate the downside towards 93.29. MACD indicator is turning neutral and we can expect some consolidation moves to happen.

H1 chart's resistance levels: 94.85 / 95.57

H1 chart's support levels: 94.16 / 93.29

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 94.16, take profit is at 93.29 and stop loss is at 95.02.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română