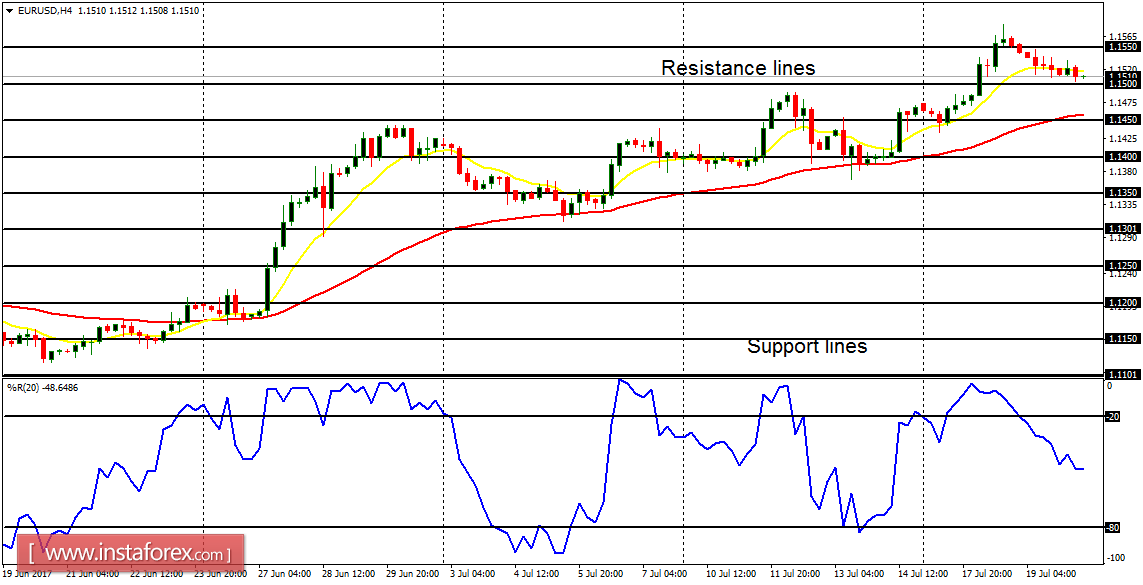

EUR/USD: What is happening on this pair can best be described as a short-term sale in the context of an uptrend. The bias on the market is bullish and the price could go upwards from here, reaching the resistance line at 1.1550 (which had been previously exceeded), and going above it once again to target another resistance line at 1.1600. That target is attainable this week.

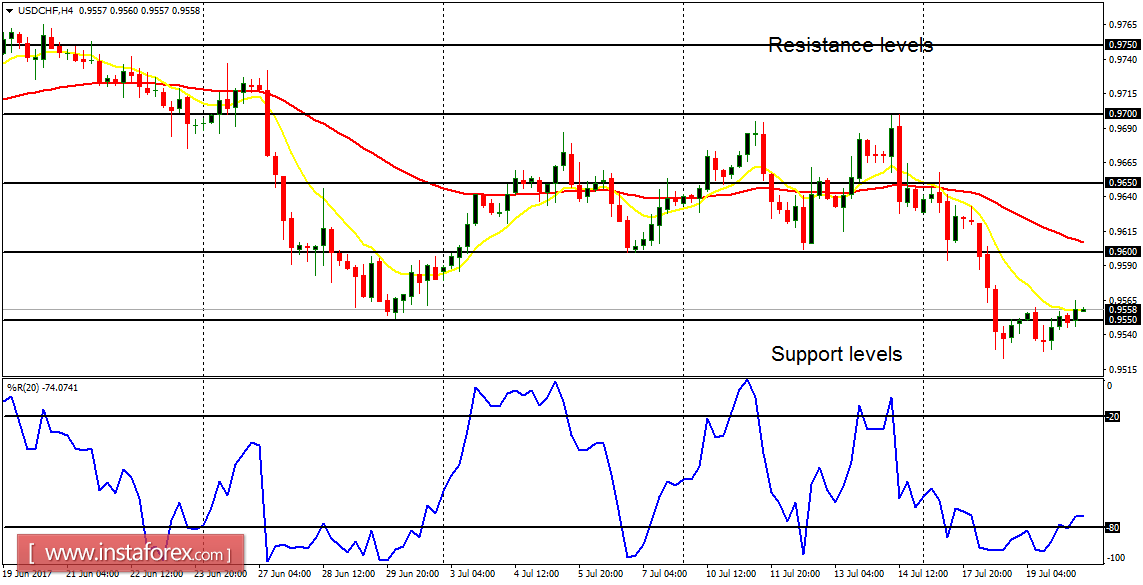

USD/CHF: The USD/CHF has become a bear market. The EMA 11 is below the EMA 56, while the Williams' Percentage Range period 20 is in the oversold region. There is a clear Bearish Confirmation Pattern in the market, and the support levels at 0.9550 and 0.9500 could be reached before the end of the week.

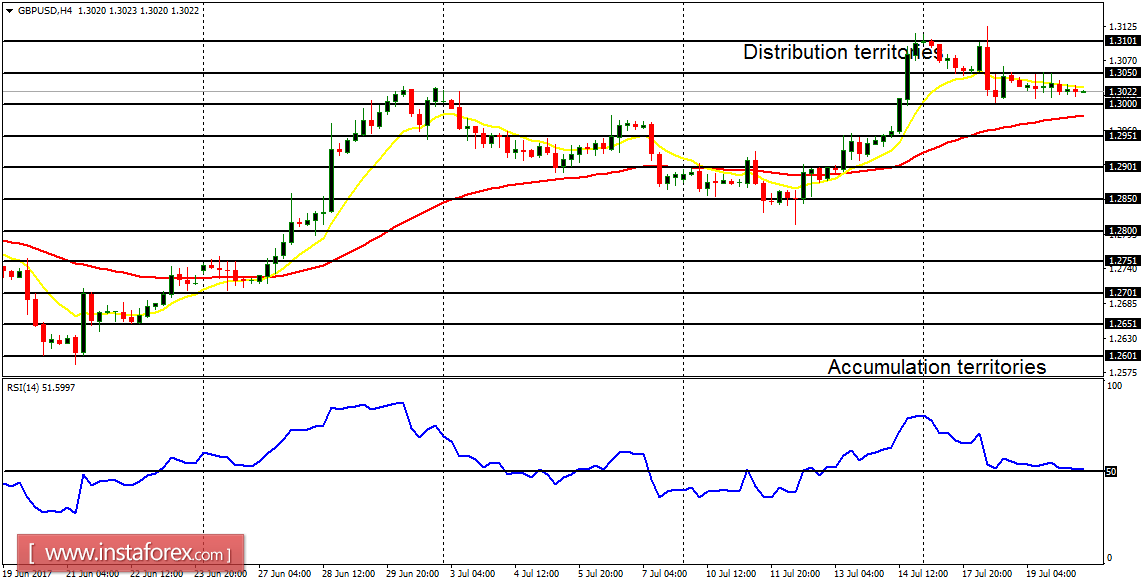

GBP/USD: The Cable is currently consolidating – something that could be ended any moment. The bias remains bullish unless price loses about 150 – 200 pips. Any movement above the distribution territory 1.3100 would, on the contrary, help restore the bullish confidence. Some fundamental figures are expected today and they can have an impact on the market.

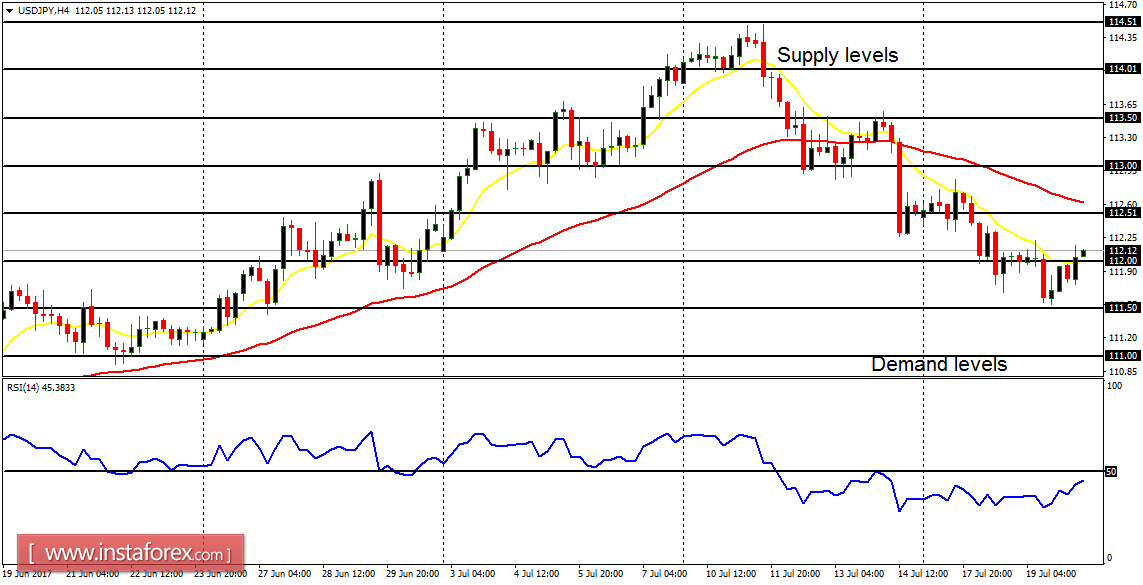

USD/JPY: There is a Bearish Confirmation Pattern in the USD/JPY 4-hour chart. Owing to the weakness of USD, the EMA 11 has crossed the EMA 56 to the downside. About 230 pips have been given up since last week, and it is expected that the market would continue to go more and more bearish, reaching the demand levels at 112.00, 111.50 and 111.00.

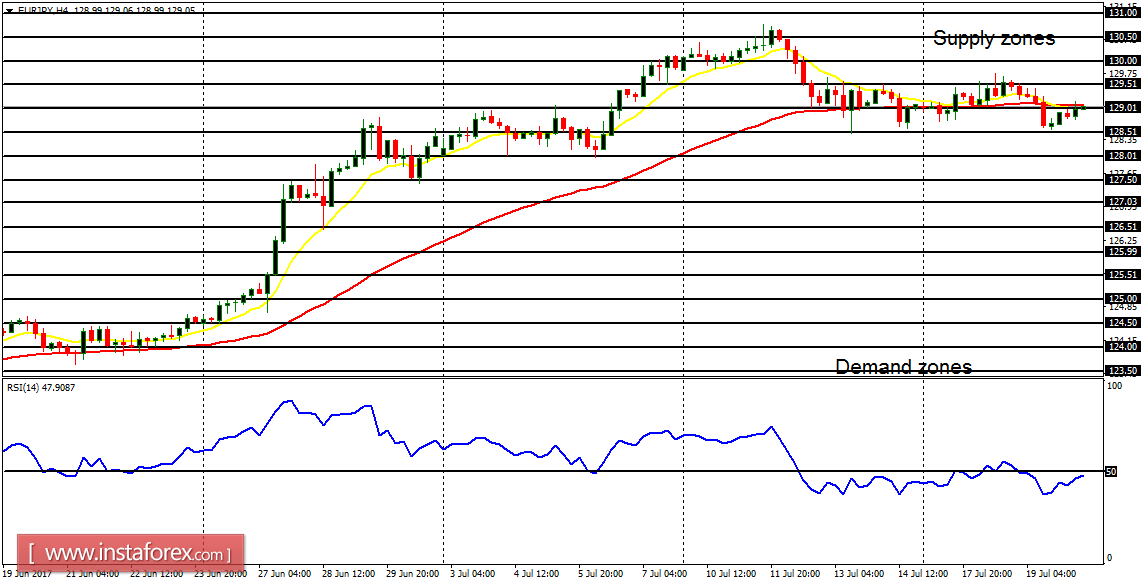

EUR/JPY: This is a flat market. The cross has not done anything significant so far this week, and it may be OK to stay away until there is a directional movement. There is a supply zone at 130.50 and there is a demand zone at 128.00. Either of this must be breached to the upside or the downside before there can be a directional bias.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română