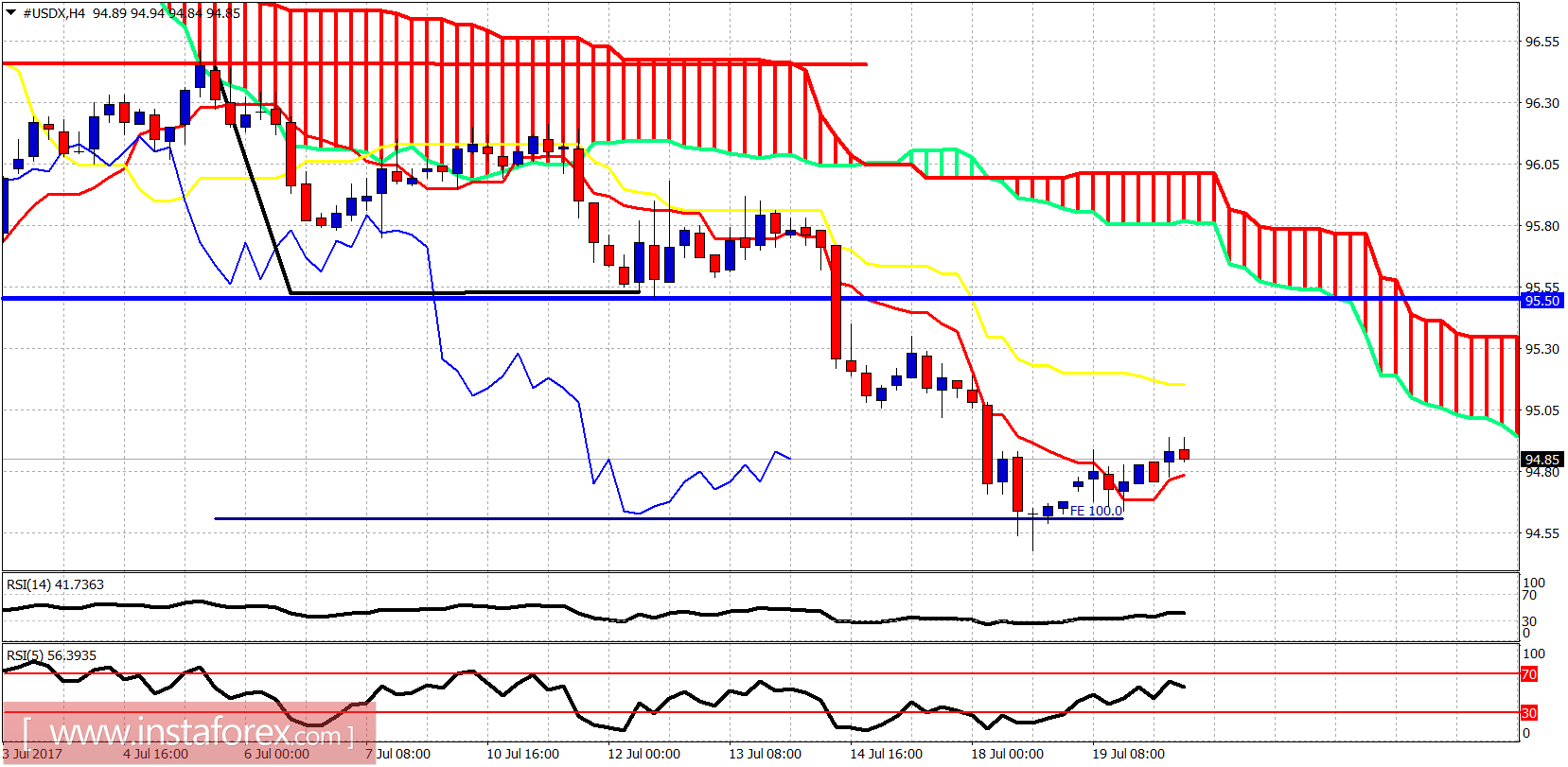

The Dollar index is bouncing off the 94.50 area towards 95 where we find the previous lows and the kijun-sen indicator as resistance. Trend remains bearish as long as price is below 95.80.

Red line - resistance

Blue line - resistance (former broken support)

The Dollar index is in a bearish trend. Price is above the tenkan-sen (Red line indicator) and this implies we could see price move towards the kijun-sen (yellow line indicator) at 95.15. Cloud resistance is at 95.50-95.80. Price continues to make lower lows and lower highs. No trend reversal signal yet.

The Dollar index remains inside the bearish channel and below both the tenkan- and kijun-sen indicators. Price is also below the 200 Day MA. Daily resistance is at 95.50-96.20 area. As long as we trade below these levels, we are in a bearish daily trend looking for a move towards 92.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română