The GBP/USD pair naturally found a resistance level within the psychological coordinate 1.3000, where a slowdown occurred, followed by a rebound in the downward direction. The detailed market cycles confirm the synchronicity of fluctuations in the periods of September 16 and October 6, which suggests that the correction move from the local low of 1.2674 will soon be completed.

The basis of this assumption is the pattern in the prices and market participants behavior relative to the psychological level of 1.3000. The concentration of trading forces below it can lead to an increase in the volume of short positions and restore the downward course in the future.

A violation of the market cycle can only be a price consolidation above 1.3050 on the daily TF.

Analyzing yesterday's fifteen minute, we can see that there was a concentration of trading forces within the psychological level of 1.3000 during the Asian session, but the main surge in short positions occurred in the intervals 9:45 - 10:45 and 15:00 - 18:45 - 20:45 UTC+00. The local low is 1.2864, which coincides with the Fibo 23.6 area, as well as the slowdown in the previous period.

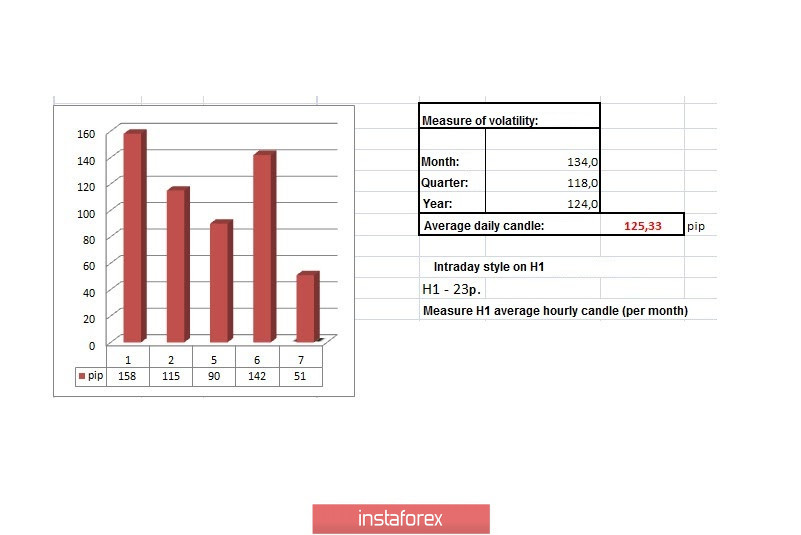

In terms of yesterday's daily dynamics, an indicator of 142 points was recorded, which is 13% higher than the average level. The growth in activity was expected, due to a sharp decline in volatility last October 5, where they recorded the lowest indicator in seven trading days.

As discussed in the previous analytical review, traders have been considering the psychological level of 1.3000 as resistance since Monday, which, as a result, made it possible to enter sell positions at the best price.

Looking at the trading chart in general terms (daily period), we can see an attempt to recover relative to the corrective move, where the level of 1.3000 may act as a resistance, which will lead to a consistent decline in the pound's price. It is worth considering that if you refer to the regular basis on September 16 and October 6, it will be seen that the quote can temporarily form an amplitude of 1.2865/1.3000 and only a price consolidation below 1.2860 will indicate a full-fledged recovery signal.

For the news background, an index of UK business activity in the construction sector for September was released yesterday, where they recorded an increase from 54.6 to 56.8. The market reacted locally with the growth of the pound sterling. However, this is insignificant within the framework of accumulation around the level of 1.3000.

In the afternoon, US data on open vacancies for August was published, where they recorded a decline by 204 thousand compared to the previous month (6 697 thousand ---> 6 493 thousand).

In terms of the information background, they continue to discuss the difficult situation with the Brexit divorce process, where there is not much time to discuss controversial issues. Therefore, Maros Sefcovic, Deputy Head of the European Commission, sees a high risk of failure of the negotiations and in this regard, he activates the preparation of institutions and EU countries for the implementation of Brexit without an agreement

In turn, the EU has no plans to make compromises with Boris Johnson before the Brexit deadline next week, betting that the Prime Minister will not cross the line of threatening to abandon trade negotiations if he doesn't get what he wants. According to a senior EU diplomat, the bloc is ready to extend negotiations until November or December and even risk that Johnson will refuse to discuss, rather than compromise.

On the other hand, business in Britain is already going through a bad year, and the nearing "X" day is even worse. So car manufacturers – Toyota and Nissan intend to demand from the UK government compensation for additional costs for customs clearance of cars imported into the European Union, if London fails to agree with Brussels on special customs conditions in Brexit. It is worth recalling that cars imported from Britain to the EU will undergo customs clearance, including payment of 10% starting from 2021.

In terms of the economic calendar, FOMC's minutes from the last meeting will be released, which is definitely worth familiarizing with. But if there is a market reaction, it will be during the Asian session.

18:00 Universal time - FOMC minutes

Further development

Analyzing the current trading chart, we can see a pullback from the level of 1.2865, after a rapid decline yesterday. In order to continue the downward interest, the quote must consolidate below 1.2860 in the H4 time frame. Otherwise, there will be a repetition of price fluctuations within 1.2865/1.3000, as it happened last September 16-18.

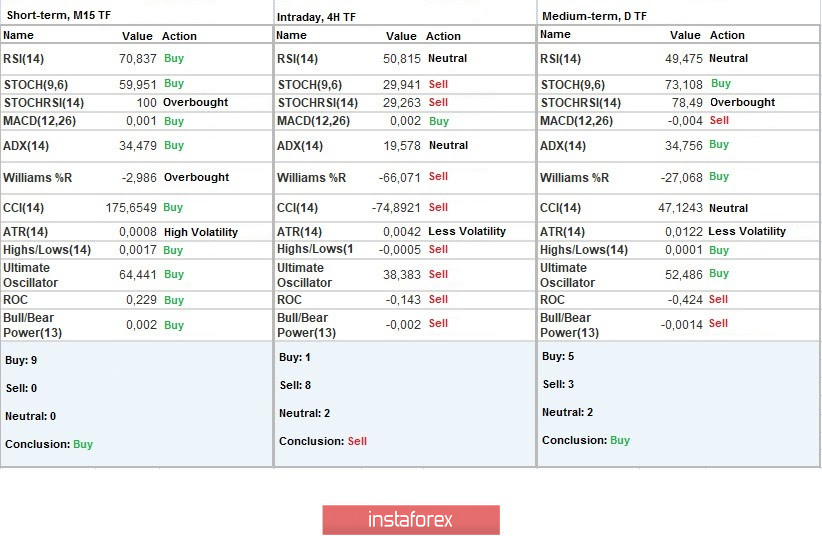

Indicator analysis

Analyzing the different sectors of timeframes (TF), we see that the indicators of technical instruments on minute intervals signal a buy due to the pullback process. In turn, the daily period reflects the rebound stage from the level of 1.3000, which is practically at the stage of a neutral signal.

Weekly volatility / Volatility measurement: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year.

(It was built considering the publication time of the article)

The dynamics of the current time is 51 pips, which is 59% below the average. We can assume that speculative interest is still taking place in the market, which can create local surge of activity.

Key levels

Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411).

* Periodic level

** Range level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română