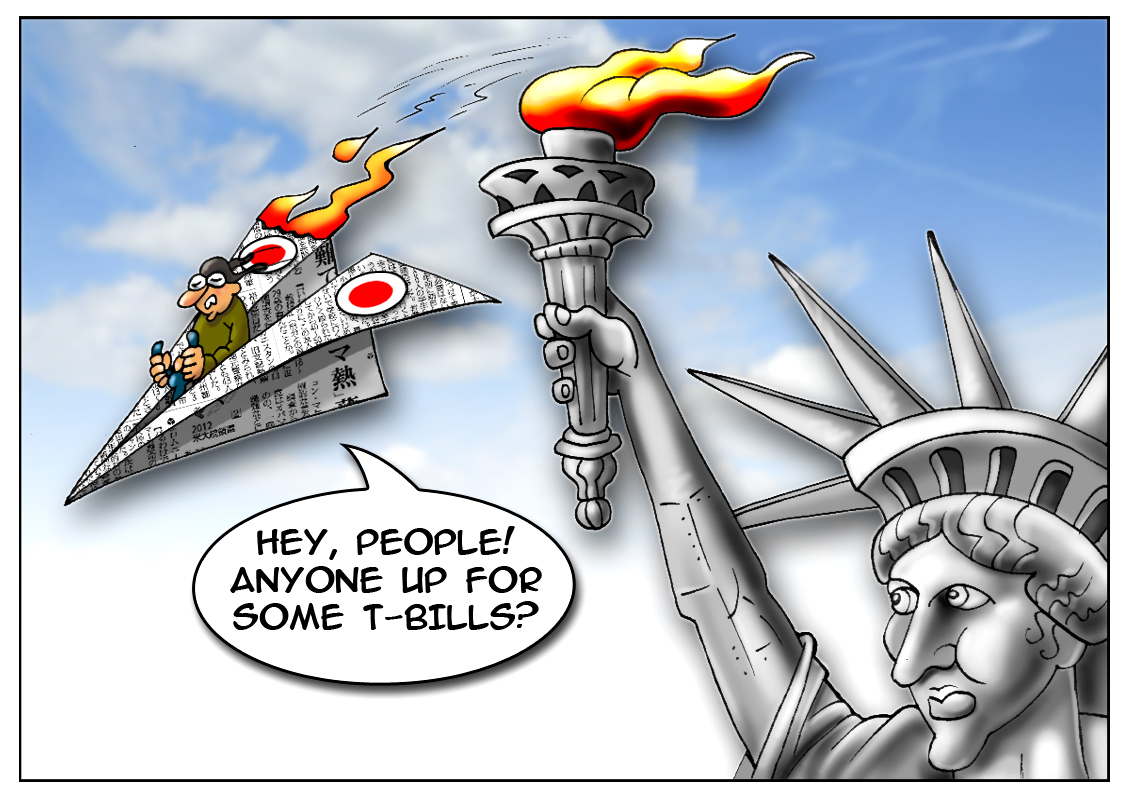

The U.S. markets are waving goodbye to Asian capital. According to the US Commerce Department, Japan and China cut their holdings of U.S. Treasuries. Such a tendency started in early summer and sparked worries among private investors who decided to follow the example of Asian governments. The total net outflow of long-term U.S. securities and short-term funds such as bank transfers was $153.5 billion, after an inflow of $33.1 billion in May. The June figure and $40.8 billion in net selling of Treasury bonds are record high, the Treasury said.

“Right at the beginning of June, you had a very strong sell-off of Treasuries and that’s what frightened a lot of private investors,” Gennadiy Goldberg, U.S. strategist at TD Securities USA LLC in New York, said.

China’s holdings of U.S. Treasuries declined by $2.5 billion to $1.27 trillion, while Japanese holdings decreased $600 million to $1.22 trillion, a Treasury report showed.

Thus, China and Japan’s combined share of total foreign holdings of Treasuries dropped to 41.4% in June from 50.9% in August 2004.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română