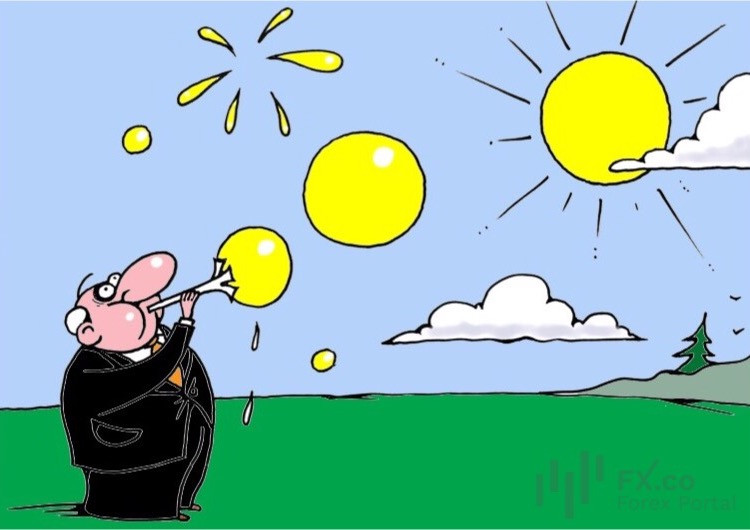

ARK Invest CEO Cathie Wood warned of a bubble risk in the gold market, pointing to the metal’s rapid rally and its outperformance relative to the US money supply.

She noted that the recent spike pushed gold above $5,600 per ounce and drove its aggregate market capitalization close to $40 trillion. The price then fell more than 3% to about $5,230 per ounce.

Wood believes the current rally reflects a disproportionate increase in gold’s value relative to the money supply during periods of macroeconomic instability. She drew attention to the ratio of gold’s market capitalization to the US M2 aggregate, which has approached historical highs.

The last time this measure reached such levels was during the Great Depression in the early 1930s, when the ratio hit 171%. By 2025, it had once again approached comparable territory. A second historical peak — around 125% — occurred in the early 1980s amid high inflation and tight monetary policy.

Cathie Wood stressed that current macroeconomic conditions differ significantly from both the 1930s and the inflationary 1970s. As evidence, she pointed to the 10‑year US Treasury yield, now at about 4.2%, down from peaks of about 5% at the end of 2023.

Market reaction to her comments was mixed. Some participants argue that the rise in gold market quotes is driven by ongoing monetary expansion and geopolitical uncertainty rather than speculative overheating. Others, however, questioned the relevance of M2 as a key metric in an increasingly digitalized financial system.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română